Russia supply shock forces rethink for chemicals and fertiliser groups

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The war in Ukraine is wreaking havoc on global supply chains. Western sanctions in response to the invasion, price shocks resulting from Russia’s weaponisation of energy, and disruptions to goods shipments have punctured normal procurement practices. The reverberations are being felt across the span of global industries — but the effects on the chemicals and agribusiness sectors have been particularly severe.

“Energy-intensive industrials and European fertiliser producers are the two groups that have been hit the most,” says Sebastian Bray, lead chemicals analyst at German investment bank Berenberg. “Any chemical company that is power or gas intense has generally not had a good past few months.”

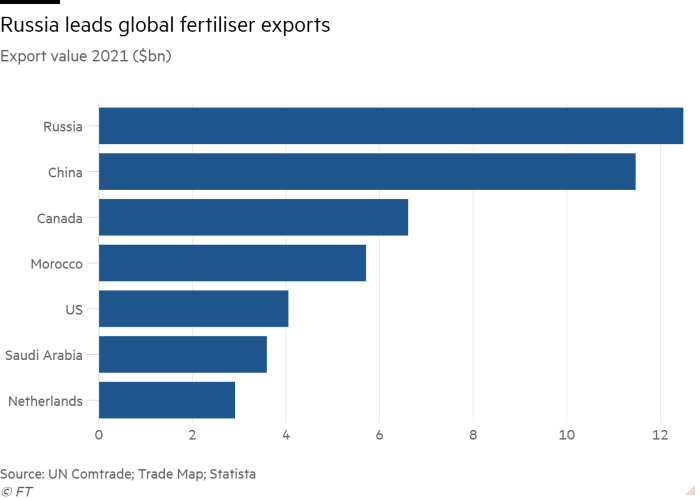

The world had come to rely on Russia for much of the energy and raw materials that power the food chain and global industries. Though accounting for less than 3 per cent of global gross domestic product, Russia, Ukraine and neighbouring Belarus play an outsized role as producers and exporters of agricultural commodities, minerals, fertilisers and energy.

Russia is the world’s principal supplier of fertilisers and their core components. It accounts for roughly 45 per cent of the global ammonia nitrate market, 18 per cent of the potash market, and 14 per cent of global phosphate fertiliser exports.

Svein Tore Holsether, chief executive of Norwegian chemicals group Yara International, one of the world’s largest producers of nitrogen-based mineral fertilisers, says the disruption following the invasion of Ukraine was rapid and profound — piling pressure on already tight market conditions. Even before the war, global fertiliser supplies had been stretched by Covid shutdowns, labour shortages, and general volatility.

“The value chains were incredibly integrated,” he says. “When you look at the map — where Europe is, where Russia is, where the locations for natural resources are — these chains have been created over decades. Even during the coldest parts of the cold war, these products kept flowing so business was running. And that all changed radically in the course of a few days.”

Though no direct bans have been levied on food and fertiliser products from Russia, western nations say the war has cut off Ukraine’s food exports and Moscow is blaming sanctions for restricting its shipments.

The invasion and those western sanctions swiftly blocked access to suppliers, while Russia’s suspension of gas flows to Europe has caused energy costs to soar. Producing fertiliser components such as nitrogen and ammonia requires vast quantities of natural gas: it accounts for some 80 per cent of production costs. But gas prices have surged 200 per cent in Europe this year, hitting record highs in August (although wholesale gas prices have since dipped, as nations build stockpiles).

Many of Europe’s chemical companies — including sector behemoths Grupa Azoty, Achema and CF Industries — have responded to the turmoil with shutdowns and cutbacks. In September just 33 per cent of European ammonia capacity was operational, but this has since improved to 70 per cent on a reduction in gas prices, according to industry researcher CRU Group.

Yara had to cut 65 per cent of its ammonia production on economic grounds. Roughly 30mn British thermal units (mmbtu) of gas are used to produce 1 tonne of ammonia. So, if Russia pays $2 for gas, Holsether says, the variable cost to produce ammonia in Russia is about $60. But the contrast with the rest of Europe is stark. In August, the respective prices were $80 and $3,000. “It was not a marginal few dollars negative that made this decision,” Holsether says. “It was hugely unprofitable.”

A fall in gas prices has enabled Yara to restart some production, but Holsether says the future remains uncertain: “We have to be very careful not to allow this to evolve to the extent that we destroy significant parts of the European fertiliser industry.”

Dwindling fertiliser supplies are adding inflationary pressure to already elevated consumer prices and stoking concerns that the inevitable fall in crop yields will worsen the global food crisis. Talks to extend a UN brokered deal with Russia to allow the flow of foodstuffs and fertilisers from Ukraine beyond this month are under way.

Holsether hopes the supply shock will be a reckoning for the world’s reliance on Russia. “[Moscow is] using energy and food as weapons of war,” he says. “That’s a huge wake-up call to all of us that we need to create a new food system, one that is less dependent on Russia.”

Germany is often cited as an example of Europe’s precarious relationship with Russia. Before the invasion of Ukraine, 55 per cent of Germany’s gas came from Russia and, last year, Germany was the third greatest chemical exporter by value, after China and the US. Now, the industry is struggling to compete in the global market.

European sellers have been among the worst affected, says Bray, as products are often priced on a global basis. “This limits the ability to pass on higher costs to end consumers for chemicals produced in Europe, because the customers can source the product for cheaper elsewhere, or simply can’t afford it.”

Germany’s BASF, the world’s largest chemicals company by revenue, was hit both by surging gas prices and the limited availability and higher costs of naphtha, made from crude oil and used for resins and plastics. For the first nine months of 2022, the company’s natural gas costs in Europe were €2.2bn higher than the previous year. In response, BASF is to downsize in the region.

Then, this week, the Paris-based International Energy Agency warned that diesel, another key commodity for chemicals groups, could be the next focus of Europe’s energy crisis.

“High diesel prices are fuelling inflation, adding pressure on the global economy and world oil demand,” it said — adding that “competition for non-Russian diesel barrels will be fierce” once an EU embargo on Russian oil imports is implemented in February.

Industries in Europe are looking to alternatives to reduce fossil fuel dependency and build resilience.

BASF says it is “working to significantly reduce its dependence on fossil energy, especially gas, in the medium term”.

“We need to build out renewable energy at a pace that we’ve never seen before,” says Holsether. Yara is developing a “green”, fossil-free fertiliser that will be fuelled by hydropower. A pilot plant is under way in Norway and the fertiliser is expected to reach market next year.

Bray reckons the energy crisis will ultimately accelerate Europe’s investment in renewables but it will be a “tricky transition period”.

“There is a cost in terms of procuring more gas, shutting plants, and also in the outlook for European economic growth,” he says. “It may be a case of near-term to midterm pain and some long-term gain to make up for it.”

This article had been amended to include up to date figures for European ammonia capacity

Comments