Investors pull $1.5bn from bond ETFs in January on inflation fears

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

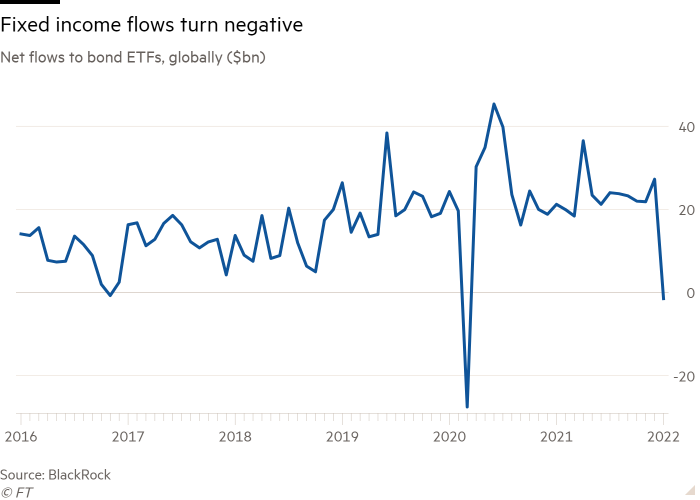

Investors pulled money from fixed income exchange traded funds for the first time in more than five years in January, barring a one-off blip at the onset of the Covid-19 pandemic.

The selling comes amid a sharp repricing of bonds as central banks have turned more hawkish in the face of multi-decade high inflation in much of the developed world.

With bond yields rising and prices falling, some investors jumped ship, resulting in net outflows of $1.5bn globally from fixed income ETFs in January, according to data from industry leader BlackRock, a far cry from the $27.3bn pumped into the sector in December.

Barring outflows at the height of the Covid-induced market crash in March 2020 — which were fully reversed a month later — this was the first outflow since an $800mn dip in November 2016, when Donald Trump’s presidential election victory fuelled a sharp jump in US Treasury yields amid expectations of rising inflation off the back of higher government spending and radical tax cuts.

The sell-off “is not completely unexpected because of the volatility we have seen with the repricing in the rates market in both the US and Europe,” said Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region.

The selling was driven by the largest monthly exit on record, of $7.6bn, from high-yield bond ETFs led by outflows from US-focused and listed funds.

Despite rising concerns over central banks being behind the curve, inflation-linked bond ETF flows also turned negative for the first time since April 2020, with a net $1.7bn of selling, BlackRock said, with US-focused ETFs again bearing the brunt. Eurozone linkers manage to notch up small gains of $200mn.

Chedid said he did not find the flight from US linkers surprising.

“While they still look interesting from the point of view of inflation hedging, they still have duration exposure. Just as we have seen selling from duration in the nominal bonds market, we also see that in inflation-linked,” said Chedid.

Elisabeth Kashner, director of global fund analytics at FactSet, believed outflows from “narrow bond market segments” were “not surprising, as investors are using specialised bond ETFs to express short-term views”.

To her, the bigger surprise was that investors withdrew a net $200mn from investment-grade bond ETFs.

“What’s more interesting is the slackening of the pace of inflows to the broad-based investment-grade bond funds that serve as core holdings,” said Kashner, such as the $88bn iShares Core US Aggregate Bond Fund (AGG) and $82bn Vanguard Total Bond Market ETF (BND).

“Had core fixed income flows held steady, we might well have seen positive fixed income flows overall in January. The likeliest explanation is portfolio rebalancing, as the pullback in equities drove equity allocations below target for strategic portfolios,” she added.

Peter Sleep, senior portfolio manager at 7 Investment Management, believed many investors would wait on the sidelines for interest rate expectations to stabilise before re-entering the bond market.

There were bright spots, though, with local currency denominated emerging market debt taking in $3bn in January, continuing its recent trend and outweighing the $1.8bn pulled from hard currency EM debt.

Chinese bond ETFs were particularly popular, especially with European investors, despite outflows of $300mn from Chinese investors themselves.

Sleep said the Chinese bond market had been a “home run” for iShares, whose China CNY Bond Ucits ETF (CNYB) took in $1.1bn in January, taking assets to $13.7bn.

“China is an investment-grade credit with a stable currency” and a higher yield than on developed market bonds, with a weighted average yield to maturity of 2.66 per cent, Sleep said.

“It’s not a G7 country or Switzerland, but it’s not far from it. It will continue to see flows as it becomes more integrated, hopefully, into the global financial system,” he added.

The almost unbroken flood of money into fixed income ETFs at large, which hit a record $283bn last year according to BlackRock’s data, has been driven not just by market sentiment but also by the “structural story of increased financial adoption” of ETFs, Chedid said.

This has been more pronounced for bond ETFs than equities in recent years, as the ETF industry has steadily broadened out from its initial equity-heavy focus.

As a result, eyes will be on the February data — bond ETFs have not witnessed two consecutive months of net outflows since at least 2011, when the sector was in its infancy.

Figures for the first few days of February point to net inflows of $1.15bn, with Chedid saying he was starting to see signs of investors “buying on the dip” even in high-yield bonds.

While BlackRock has a tactical underweight call on fixed income for the year ahead, and Chedid said he expected more volatility ahead, he also anticipated “more differentiation” in flow dynamics, with local currency EM debt likely to be among the winners as it “looks attractive from a valuation point of view”.

Click here to visit the ETF Hub

Comments