Technology shifts automakers into high regulatory gear

Simply sign up to the Automobiles myFT Digest -- delivered directly to your inbox.

When the first set of EU emissions rules were drafted in 2009, the text comprised 15 pages. Last year’s update ran to 35 — with impact assessments adding another 196.

But despite this increase in rule writing, the impact on the industry over the past decade has not been transformative. All that, however, is about to change.

From zero-emissions regulations to the rules governing self-driving cars, the auto industry is facing a multi-fronted regulatory onslaught.

Rules that compel the sector to sell zero-emission cars — effectively pushing manufacturers to embrace battery models — are coming into force from Europe to China, and other parts of the world.

Complex regulations, many yet to be written, will govern the way carmakers use these batteries, and recycle them. Then, as vehicles become connected to the internet — and carmakers wade into the arena of information trading and connected services — telecoms and data regulations will come into force.

Although the technology regulations being written today will shape the industry in decades to come, experts argue that this new forest of rule books is not necessarily a bad thing.

“Yes, there is more regulation than ever, but there’s also more innovation,” points out Daniel Sperling, professor of energy and climate policy at the University of California. Sperling is a member of the California Air Quality Resources Board, which draws up emissions rules for the state.

Regulators have to strike a balance between creativity and potentially harmful development. Sperling says they want to push change but have to avoid throwing the “baby out with the bathwater”.

“The key question regulators need to ask is: Are they imposing too many rules such that they inhibit innovation?” he says.

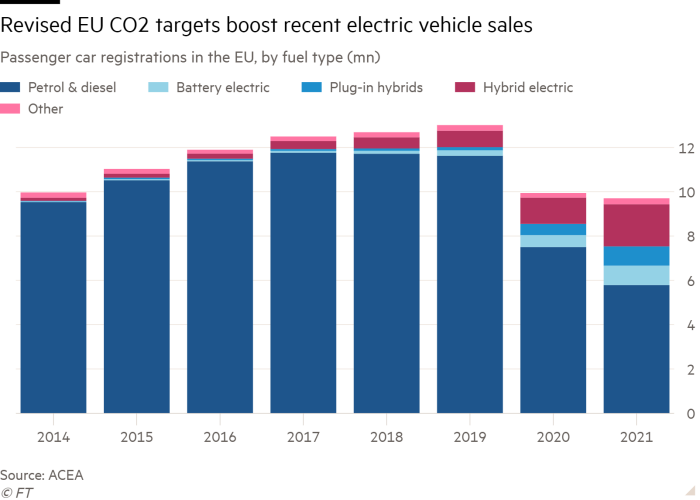

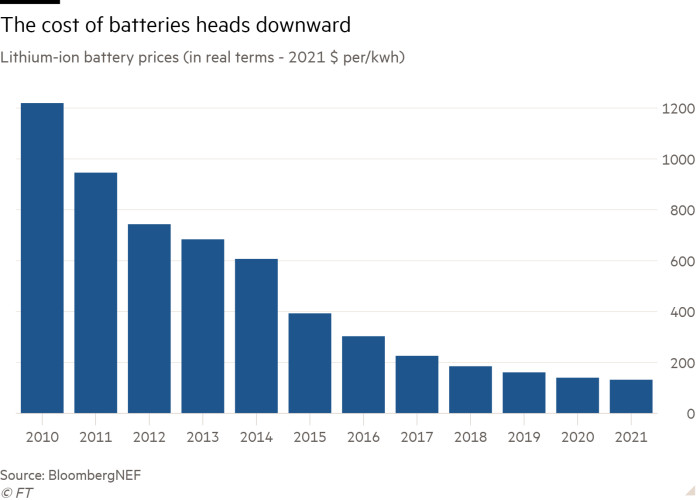

In parts of the industry, regulators are even driving technology development. Electric cars have become better as battery costs fall, but it was only when Europe imposed stricter CO2 limits that most manufacturers started producing the vehicles seriously.

Julia Poliscanova, a senior executive at the environmental campaign group Transport & Environment, says the car manufacturers needed the rules to spur them on.

Incremental rules like “improve tyres and get 2 per cent efficiency improvement,” she adds, are being replaced by a more fundamental race for zero emissions completely.

Opinion splits on how to push carmakers towards that goal. Some territories, including China, California and soon the UK, have opted for sales mandates that require manufacturers to sell a certain number of zero emission vehicles.

Other regions, particularly the EU, are tightening the screws on emissions rules and leaving companies to decide how they clear the hurdle — an approach viewed by some industry observers as best allowing innovation.

While most carmakers used electric vehicles to meet the tighter EU targets, Toyota did so by increasing its hybrid models. Meanwhile, Peugeot owner Stellantis hit the targets, in part, by overhauling the efficiency of its petrol engines.

“Generally, I would say that mandates are not good policy,” argues Sperling. “You want to provide market signals, flexibility, in the design of your policy.”

Sales mandates also require policymakers to rule in — and out — what technologies are allowed, as the UK government has discovered. Having said it will ban petrol and diesel car sales from 2030, and hybrid sales from 2035, it now faces strong lobbying on what is classified as a “hybrid” from manufacturers seeking to give their technology another five years’ viability.

But, while the direction of travel — everything going to zero emissions within a decade or so — may be clear, just what the rules will be once that point is reached, remain unclear.

“You could argue that the biggest problem the industry has right now, rather than in two years' time, is uncertainty,” says Roddy Martin, head of automotive at lawyers Herbert Smith Freehills. “There is a lot of regulation coming down the line, particularly the battery regulation, and until the ball stops moving, how do people prepare for it?”

Autonomous vehicle regulation is an even more difficult area. Current rules, even in draft form, often differ between countries and US states. A self-driving car crossing a boundary may have to adapt to a different set of road rules — such as how much space to leave between it and the car in front — or have to switch off its features altogether and hand back control to the human occupant.

This makes it more difficult for carmakers that have mastered self-driving in, say, one city to deploy it in another — delaying the prospect of a country-wide, let alone worldwide, rollout of the technology. Ultimately, engineers developing self-driving systems for widespread use may have to programme in rules for every possible place a vehicle might travel to.

Some of the new technologies embedded in vehicles, such as data connection, are governed by existing regulations that apply to other sectors, such as telecoms. This makes adapting to them easier, since manufacturers can hire regulatory experts from those sectors.

But self-driving regulation is a blank space on the map, where a completely new set of rules is being written. Carmakers wanting a complete understanding of the new rules therefore face the challenge of training their own experts.

Nonetheless, carmakers are still poaching specialists from sectors that have witnessed disruption or huge regulatory shifts — such as aerospace or pharmaceuticals.

“There are new areas in terms of the legal and regulatory framework that carmakers have not had to deal with in the past,” says Chris Donkin, managing partner at executive search firm Savannah “We are at, or fast approaching, a hiring peak in terms of that demand, but it’s not a peak that will then drop off in a few years time,” he adds.

“Think of it more as a plateau over the next few years. The complexity [of regulation] is going to remain, and you’d be a brave person to predict there won’t be further technological impact, and additional complexity, further down the road.”

Comments