Forget Soho House, this is the real elite club for bankers

Simply sign up to the European companies myFT Digest -- delivered directly to your inbox.

One scoop to start: US law firm Latham & Watkins is cutting off automatic access to its international databases for its Hong Kong-based lawyers, in a sign of how Beijing’s closer control of the territory is forcing global firms to rethink the way they operate. More here.

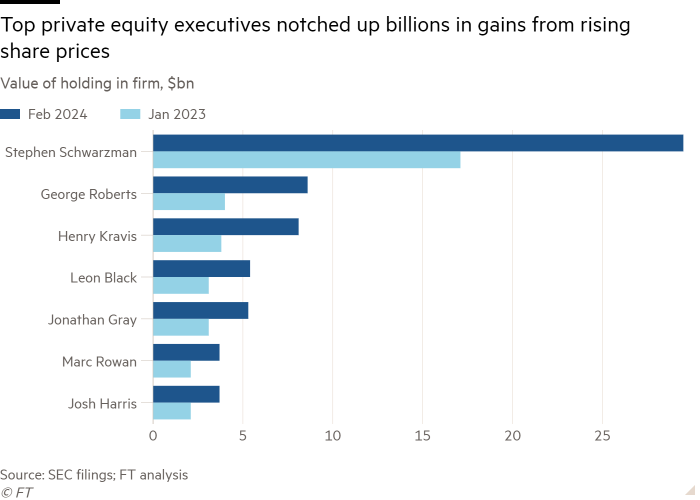

Plus, one chart via this story on private equity tycoons benefiting from their soaring share prices.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

Inside Europe’s banker club

A Carlyle airport deal goes awry

An Ozempic-funded M&A machine

The club for Europe’s top bankers

We might think of costly members clubs such as Soho House as exclusive, but everyone knows that the best social groups to be a part of are the ones you enter through status rather than money.

The Institut International d’Etudes Bancaires is just that. Members of the IIEB have been getting together with presidents, prime ministers and even royalty at châteaux and palaces across Europe for the past seven decades.

But you don’t pay to get into IIEB. Its doors are open only to the most powerful bankers in Europe who get together twice a year to discuss dealmaking and global policies while their spouses hit the shops.

The IIEB was founded in Paris in 1950 but its existence is such a closely guarded secret that few outside of its rarefied membership have heard of it — until now. The FT’s Owen Walker has taken us inside what happens at one of the most exclusive networking clubs in European finance.

Events organised by the IIEB are supposed to be a forum for exchanging ideas and discussing some of the most pressing issues facing the banking industry.

As an example, at a meeting in late October, members sat down with Switzerland’s finance minister Karin Keller-Sutter and central bank governor Thomas Jordan, both of whom were architects of the UBS/Credit Suisse deal in the throes of the banking crisis last year.

Dealmaking between banks is a big theme at the gatherings, so maybe this is where the evergreen wave of consolidation in European banking chatter is coming from. But it isn’t all work. There are banquets, private tours of historic landmarks and entertainment organised over the three-day period.

The secrecy around the gatherings — meeting agendas and notes aren’t made public — has led to concerns among some members that it could be viewed as a cartel. During his speech in Athens in 2006, European Central Bank vice-president Lucas Papademos quoted Adam Smith’s warning against collusion:

“People of the same trade seldom meet together even for merriment and diversion, but on those occasions when they meet the conversation ends in a conspiracy against the public or some contrivance to raise prices.”

Two years later, the entire banking system was on the brink of collapse and billions of taxpayer dollars were used to prop it back up.

While these gatherings of senior bankers at lavish locations may have been the norm in the past, they don’t help to assuage concerns that those in control of some of the most powerful financial institutions are out of touch, particularly in a post-2008 world.

Carlyle’s loan to a UK airport faces a crash landing

A near-deserted airport on the outskirts of London is at the centre of an escalating dispute between US private equity giant Carlyle Group and a tiny, London-listed infrastructure company.

The fight concerns a bet Carlyle made on Southend Airport in 2021, when the aviation industry was still reeling from a precipitous drop in international travel during the coronavirus pandemic.

The investment firm provided a £125mn convertible loan to the airport in a deal giving the site a £400mn valuation.

The airport sector is one Carlyle knows well, having played a leading role in financing the development of a new terminal at New York’s JFK Airport. Carlyle was taking the view that the airport would bounce back quickly and take market share from nearby rivals such as London City Airport and Stansted.

Things haven’t gone to plan. Passenger numbers have struggled to recover and remain way off pre-pandemic highs.

Carlyle says that the airport has breached the terms of the loan on multiple occasions and is seeking nearly £200mn it claims it is owed.

Esken, which bought the airport for just over £20mn in 2008, says Carlyle’s motivation for calling in the loan is clear: it wants to pick up the asset at a knockdown price.

“We are just at an inflection point when you see the real value of this airport over the next two or three years, and they have concluded ‘Wait a minute, let’s take this airport’,” Esken chair David Shearer told the FT’s Philip Georgiadis and Euan Healy and DD’s Will Louch.

“My sole objective is to make sure the airport doesn’t close. But if Carlyle decided to adopt a scorched earth policy, who knows what might happen.”

Novo Holdings readies its M&A machine

Novo Nordisk has become Europe’s largest company on the back of sales of weight loss and diabetes drugs Wegovy and Ozempic.

Its controlling shareholder Novo Holdings has a 28 per cent stake and a majority of voting rights in the drugmaker. Run by former Moelis partner Kasim Kutay, the life sciences investment group is swimming in cash thanks to dividends from the drugs.

The main thing holding Novo Nordisk back is making enough drugs to meet demand.

In August, Elliott Management pushed one of Novo Nordisk’s critical suppliers, Catalent, into a “strategic review”.

Kutay and Novo Nordisk’s leadership “looked at each other and said ‘hold on a second’”, he said.

Last week, Kutay led a $16.5bn acquisition of Catalent. Novo Nordisk paid Novo Holding $11bn to take on three Catalent sites, tackling its supply headache.

Now, Kutay is looking for more big deals. Novo Holdings plans to spend $5bn a year for the next five years, rising to $7bn by 2030, he told the FT in an interview.

“We did $500mn of venture investing last year. I can’t turn around to the venture team and say invest $2bn. There’s not enough deal flow,” he said.

“With buyouts, [we can] hunt for companies in the $5bn range . . . what you’ll see us doing . . . is start to do bigger deals and deploy more equity.”

The Ozempic funds are also boosting a third organisation: the Novo Nordisk Foundation, which owns Novo Holdings.

Its roots go back to the 1920s. Danish Nobel laureate August Krogh heard that Canadian scientists had discovered a new hormone that controls blood sugar levels: insulin.

He urged them to let him bring it back to Scandinavia to treat his diabetic wife. They agreed, as long as Frogh invested any proceeds from insulin sales into research.

In 1999, it spun out its assets into Novo Holdings. While Kutay and his team manage the foundation’s assets, Ozempic and Wegovy sales have helped it become the world’s largest philanthropic group.

Job moves

Kirkland & Ellis has hired Alex Amos as a partner in the investment funds group focused on credit funds. Amos previously worked at Macfarlanes.

Apollo has appointed Harry Seekings as co-head of infrastructure. He joins from InfraRed Capital Partners.

Smart reads

The toxic tycoon Mike Ashley, the retail tycoon behind Sports Direct, is suing Morgan Stanley over a $1bn trading row, The Sunday Times writes.

Raging Bill Bill Ackman’s fight against Harvard has made him the public face of a billionaire class anxious it no longer rules the world, New York Magazine reports.

The Tesla killer Here’s a look at how the leading Chinese electric vehicle company surpassed Tesla last year in worldwide sales, The New York Times writes.

News round-up

Exclusive Singapore wine club closes as ultra-rich shun flash for discretion (FT)

Diamondback Energy agrees to buy Endeavor in $26bn US oil deal (FT)

PwC delays graduate scheme promotions as client demand slows (FT)

Tod’s owner bid hardly looks luxurious for minority investors (Lex)

EY took on $700mn in debt for doomed ‘Project Everest’ spin-off plan (FT)

Ex-Freshfields lawyer convicted over tax fraud received €2mn severance pay (FT)

US biotech fundraising boom ends 2-year deal drought (FT)

Believe looks to take music group private less than 3 years since IPO (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, William Louch and Robert Smith in London, James Fontanella-Khan, Ortenca Aliaj, Sujeet Indap, Eric Platt, Mark Vandevelde and Antoine Gara in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to due.diligence@ft.com

Comments