F1 sponsorships steer towards a younger market

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The return of the British marque Aston Martin to the Formula One grid, two years ago, signalled a turning point for the sport and the team. “I remember when we became Aston Martin, you’re wearing green, the car is green and you’re part of one of the most iconic brands,” says Jefferson Slack, managing director of Aston Martin’s F1 team.

Slack joined a team in late 2020 that had been rescued from administration by Canadian billionaire Lawrence Stroll only two years prior. Racing Point, as it was then known, had a legacy of punching above its weight, even winning a Grand Prix in a previous incarnation.

This year, after millions of pounds of investment and a doubling of the workforce to 800 people, the team has achieved a string of podium finishes. Driver, and two-time world champion, Fernando Alonso even climbed as high as third in the drivers’ championship early in the year, beating rivals from more established teams.

Aston Martin’s performance on the track has dipped slightly since, as the big players — Ferrari, McLaren and Mercedes — returned to the front of the field. But Slack says the 2023 season has signalled the team’s ambition, with the ultimate objective to win championships in a few seasons.

Underpinning Aston Martin’s transformation is the arrival of sponsors seeking to leverage the sport’s global reach, and efforts to tap into a younger audience and attract new business.

Some 300 brands and companies sponsor F1 teams, according to data compiled by Decalspotters. This is nearly double the number that accompanied the cars weaving around grand prix circuits a decade ago.

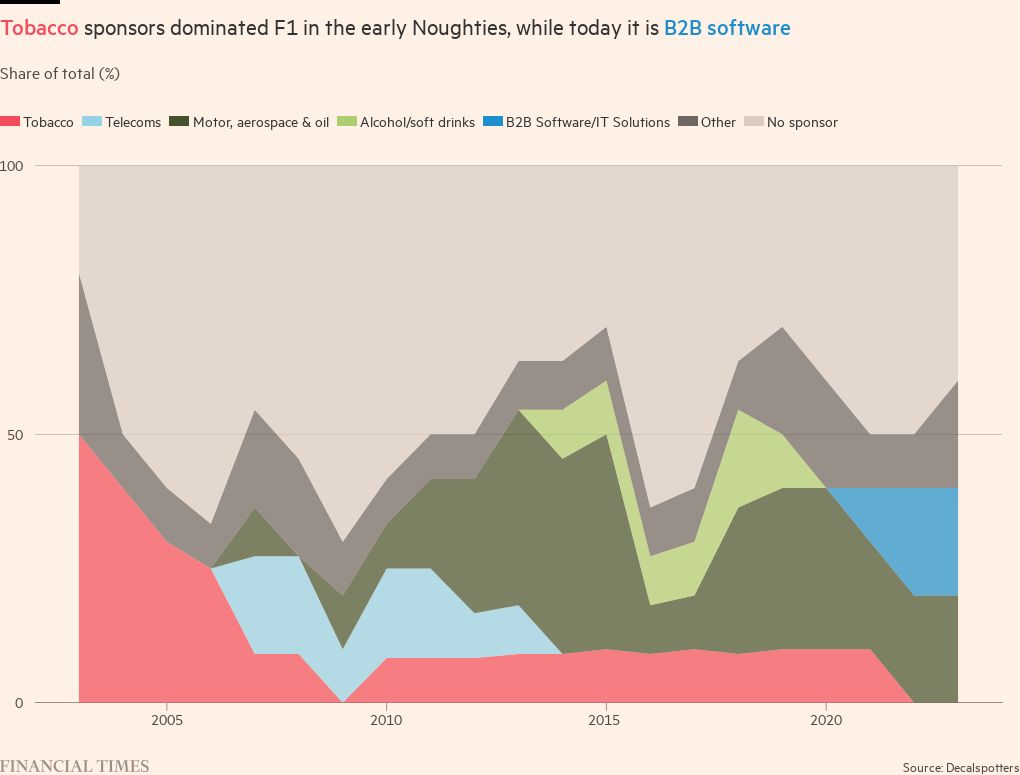

In 2003, half of all title sponsors were from tobacco companies such as Philip Morris and British American Tobacco. The pendulum swung to telecoms after a tobacco ban was introduced in 2006, before B2B software providers, such as Cognizant and Oracle, took up prime position in recent years.

Louise Johnson, chief executive of sports marketing agency Fuse, says F1 under US owners Liberty Media has focused on a “media first approach”, including investment in digital content.

“Drive to Survive is really brave and has really paid off,” says Johnson of the Netflix series currently filming behind the scenes in team garages for its sixth season.

She says the show has helped deliver F1 to a new generation of fans, while bringing out the personalities of drivers — and even team managers.

Johnson, whose two decades in the sport included coordinating telecom giant Vodafone’s titular sponsorship of the McLaren F1 team in the early 2000s, adds that sponsors have long experimented with using drivers to build brand engagement, but are finding the sport is now having a “cultural moment” thanks to recent changes in how the sport is managed.

Liberty Media, which acquired the sport for $8bn in 2017, has relaxed the rules around sharing footage on social media among teams, drivers and fans, while steering F1 into the lucrative North American market.

In January, its executives said they hoped the Las Vegas Grand Prix weekend — which went ahead last week — would generate some $500mn in revenue alone this year, amounting to nearly one-fifth of the $2.57bn in total revenue generated by F1 last year, according to SEC filings.

But, while direct-to-consumer companies, including fashion brands Hugo Boss and Tommy Hilfiger, are taking a liking to the sport, its B2B appeal has been essential for Aston Martin.

“Our sweet spot has been B2B technology companies, largely because of the brand,” Slack notes. He says C-suite executives are drawn in by Aston Martin. Current title sponsor Cognizant, a software provider, is a company few consumers deal with, due to its commercial nature.

Slack jokes that, when the opportunity arose with Cognizant to sponsor the team, owner Stroll responded dumbfounded. “Who’s Cognizant?” he asked.

Cognizant will step down as Aston Martin’s title sponsor at the end of the season, but will remain a significant partner. Last week, private equity group Arctos Partners joined the team’s backers, taking a minority stake, valuing the business at about £1bn.

Joe Cobbs, a marketing professor at Northern Kentucky University, says another attraction for B2B backers is the Paddock Club — an exclusive trackside area that plays host to executives, allowing them to schmooze clients and tie up sales deals.

Over the course of a whole weekend — unlike a few hours at a Champions League football match or NBA basketball game — sponsors are able to make a compelling case for their products and services to their clients, according to Cobbs. He says teams monitor and track any possible return on investment generated through these types of engagement.

“So, when there is an economic crisis, or change in company leadership, they’re able to provide data on what they’ve delivered,” he adds.

Research compiled by Cobbs and two associates found that, between 2010 and 2019, teams were 20 per cent more likely to retain a B2B sponsor as opposed to direct-to-consumer brands, reversing a trend of previous decades.

For Aston Martin — and the rest of the grid — it’s a matter of staying on top of these partnerships in order to deliver their ultimate objective each weekend, which, as Slack puts it, is: “a commitment to racing”.

Comments