Worries over skills gap overshadow US jobs boom

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

After four decades of factory closures and job cuts, the supply chain troubles caused by the Covid crisis boosted employment prospects in US manufacturing. High shipping costs and prolonged delays prompted companies to make more products in America.

But, as economic growth has slowed and vacancies in traditional industries have dried up, manufacturing workers have become reliant on federally subsidised “cleantech” jobs for employment.

However, many of these jobs have yet to be filled, leaving workers and economists questioning whether US manufacturing will ever boom again.

As a part of its pandemic recovery plan, the Biden administration has sought to stimulate investment in new industrial projects, such as building electric vehicles and assembling semiconductors, through the Inflation Reduction and Chips and Science acts. Their aim is to create hundreds of thousands of what the government calls “good paying jobs” in manufacturing.

Companies, including Intel, Micron, Analog Devices, and Taiwan Semiconductor Manufacturing Company, have pledged to spend over $200bn on more than 100 projects and thereby create tens of thousands of jobs, taking advantage of billions of dollars in federal subsidies.

Spending on manufacturing construction in August reached its second-highest figure since the Census Bureau began tracking the data in 2002, up 143 per cent from the same month in 2019. But the jobs heralded as the future of US manufacturing have been slow to appear as raw material shortages have delayed construction. Companies also say they are struggling to find workers with the knowhow to operate high-tech facilities.

“Manufacturers have been a standout during the jobs recovery over the past two years, particularly over the past eight months as the skilled service economy has slowed,” says Aaron Terrazas, chief economist at jobs site Glassdoor.

While the elevated consumer spending that powered the jobs gains of the past two years has slowed “there are some legitimate points about changing trade patterns that would support the idea of a more enduring sustained recovery in manufacturing jobs”, he explains. However, he adds that “there are lingering questions over the degree to which that can or will continue”.

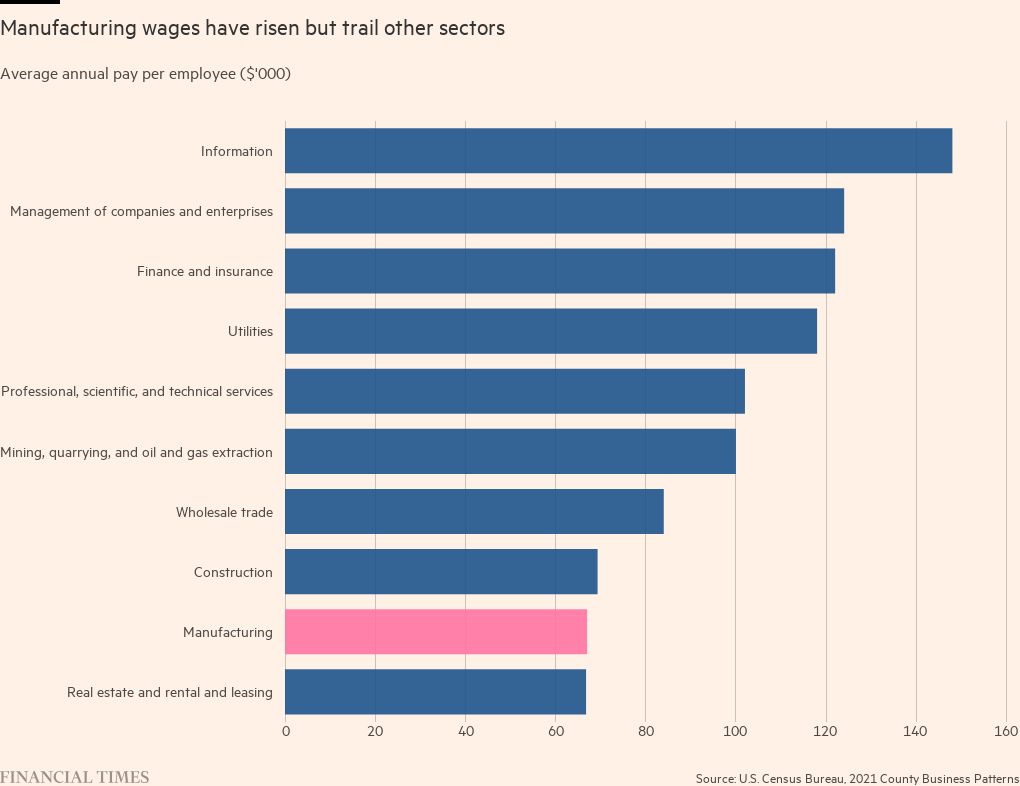

The number of jobs and wages certainly grew dramatically during the Covid crisis, as spending shifted from services to goods, and manufacturers hired rapidly to keep up with demand.

By May 2022, more Americans were working in manufacturing than before the pandemic. By this September, manufacturing employed 13mn people, up from 12.8mn in the same month in 2019. Job creation and wage growth have slowed but remain elevated, according to Indeed, the largest the jobs site in the US. On September 22, there were 51.3 per cent more manufacturing jobs posted on Indeed than in February 2020. Total postings on the site were up just 26.6 per cent over the same time period.

Growth has slowed, though. Manufacturing vacancies on the site are down more than 20 per cent on September last year, according to Indeed economists Cory Stahle and Nick Bunker, compared with a 15 per cent fall overall.

The new “cleantech” jobs have yet to fill the gap, Terrazas says, as many projects are still in their early stages.

Semiconductor companies say that they are hiring as fast as they can, but have had to invest in workforce training for their highly specialised jobs. As many as 58 per cent of the 115,000 positions the semiconductor industry is predicted to add by 2030 may go unfilled because of the relatively small number of students who complete degrees in engineering and other science and technology subjects, according to a report published in August by the Semiconductor Industry Association.

These roles require very different skills to those in traditional manufacturing — a factor in companies’ struggles to find qualified workers, says Jin Yan, an economist at workforce intelligence group Revelio Labs. The specialised work can also make it difficult for staff to transition to new jobs in a semiconductor fabrication plant, or ‘fab’.

“The requirements are very different from an automaker factory, for sure,” says Yan. “When we look into the actual skills that are mentioned in job postings, we are seeing a lot of key words that would not show up in other manufacturing jobs . . . like ‘integrated circuit design’ or very specific programming languages other than the usual Python.”

Many chipmakers are launching their own training programmes as part of efforts to expand workforces.

Massachusetts-based Analog Devices, which is building a $1bn semiconductor wafer fabrication plant in Beaverton, Oregon, will welcome its first cohort of students into its eight-week semiconductor manufacturing class this month. The course is designed to transition military veterans and people re-entering the workforce into careers at the plant, as well as upskill existing employees, says Fred Bailey, vice-president of fab operations at the group.

Intel has partnered with a group of community colleges near its Ohio fab to create a one-year semiconductor technician certificate programme. Gabriela Cruz Thompson, director of university research collaboration at Intel’s research organisation Intel Labs, says she hopes the initiative will also help diversify the workforce in addition to upskilling existing employees.

The majority of Intel’s jobs will require a two-year associate degree, pay between $50,000 and $60,000 on average, and include full medical benefits as well as paid parental leave and sabbaticals, Thompson says.

But, when asked if the semiconductor industry’s training and recruitment efforts will be enough to jump-start the manufacturing jobs market, she is hesitant. “We are hoping that we are doing enough in Ohio,” Thompson says. “But is it enough at the national level? I do not know the answer to that question.”

Comments