Korean degens have gone nuts for leveraged ETFs

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Forget Mrs Watanabe and her carry trades in Turkey, Indonesia or Brazil; it turns out that South Koreans are the true trading degens of Asia.

MainFT’s Song Jung-a has written a fascinating piece on how South Korean retail investors’ love of leverage and volatility are now even freaking out local financial regulators.

South Korea’s financial regulators have vowed to curb short-term speculation by retail investors, as their bets on tech stocks fuel fears of a market bubble.

Retail investors have made big bets on themes including electric vehicle battery materials, quantum computers and superconductors, making the tech-heavy Kosdaq one of the world’s best performers this year.

“Their investment patterns are highly risky so we are cracking down on leveraged buying and margin call risks,” said Lee Bok-hyun, governor of the Financial Supervisory Service. “They seem to be recently lured by high volatility, which leaves bigger room for strong gains.”

Alphaville has previously written about South Korea’s infatuation with structured equity products known as autocallables — there they are given cool names like Super Lizard, Cobra and Boosters — but we hadn’t appreciated the extent of their embrace of leveraged ETFs as well.

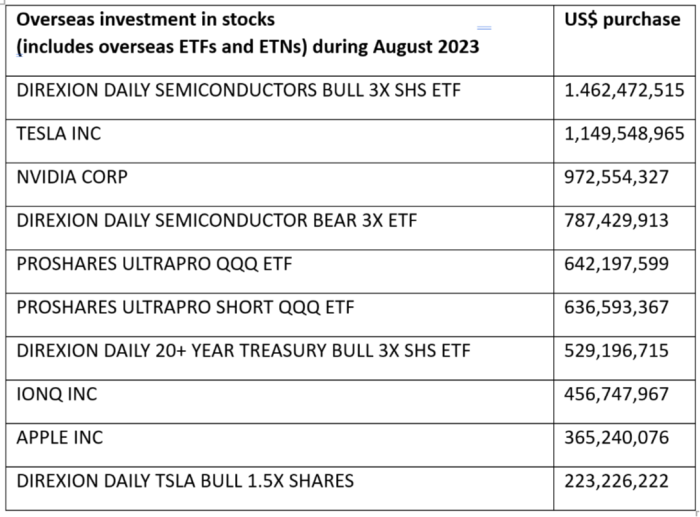

Just in August, South Koreans invested $1.4bn in Direxion’s triple-leveraged semiconductors ETF, making it the single most popular overseas equity investment among locals, according to Korea Securities Depository data obtained and sent over to us by ETFGI’s Deborah Fuhr.

That $1.4bn is equal to almost a quarter of the ETF’s current $6.2bn of assets. Tesla (natch) and Apple were the second and third most popular, but after that it was mostly a long list of leveraged and inverse ETFs and ETNs (zoomable version):

According to Fuhr it’s a similar story onshore.

At the end of August there were 1,134 ETFs in South Korea with total assets of $90bn. Leveraged or inverse products accounted for 14.7 per cent of the local industry’s assets — compared to 1.16 per cent for the global ETF industry as a whole (zoomable version).

A reminder that the Bank of England earlier this year also took a jaundiced view of leveraged and inverse ETFs and warned that they could destabilise markets due to their outsized footprint.

The overall size in South Korea is probably still too small to matter internationally (though the popularity of autocallables mean that South Korea is arguably the Saudi Arabia of vol-selling). The proverbial Mrs Watanabe really could affect the fate of entire markets and countries.

But one to watch?

Further reading:

— Inside the $10tn ETF industry

— As the ETF world booms, so do the risks

Comments