Surge in ETF closures and fall in launches hits European market

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Latest news on ETFs

Visit our ETF Hub to find out more and to explore our in-depth data and comparison tools

Europe’s exchange traded product market has seen a sharp fall in launches and a dramatic rise in closures this year, despite the supportive backdrop from firmer financial markets, in a sign that it may be reaching saturation.

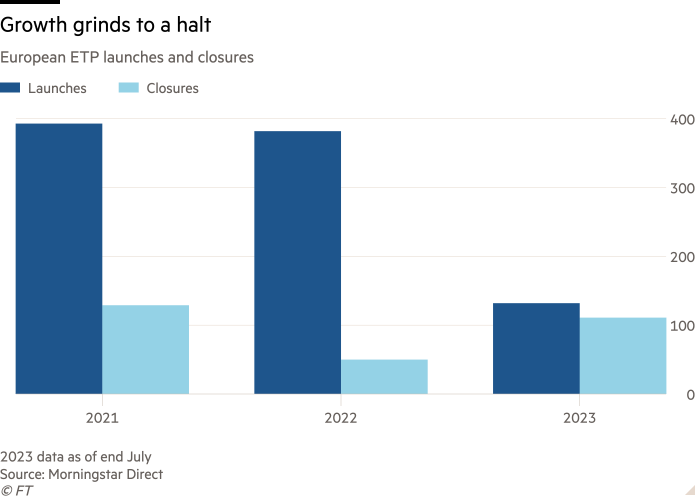

Product proliferation ground to a virtual halt in the first seven months of the year, with the 132 launches almost cancelled out by 111 closures, according to data from Morningstar Direct.

The mix represents a marked deterioration from 2022, when Europe saw the launch of 382 exchange traded funds and products and just 50 closures. The balance was also strongly positive in 2021, with 393 launches and 129 closures, although it was negative in the dark days of 2020.

“The ETF market in Europe is maturing. We may have seen the peak [of launches] in recent years,” said Kenneth Lamont, senior fund analyst for passive strategies at Morningstar.

“Probably the market is getting saturated. There are only a certain number of funds you need. The driver over the last few years has primarily been sustainable funds but we have seen a damping of interest in these funds,” Lamont added.

Another driver of growth has been “thematic” funds, focused on concepts such as renewable energy, the blockchain and the metaverse. But with enthusiasm having been jolted by “the dip in performance, that market is also getting relatively saturated”, Lamont said.

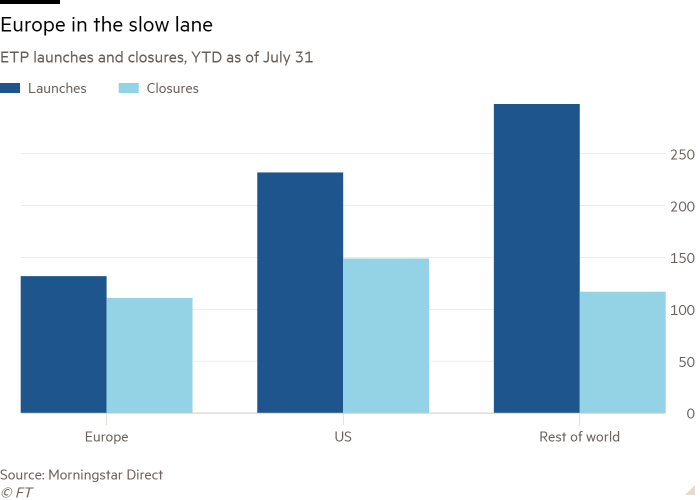

The figures suggest Europe is lagging behind growth in the US, despite the latter widely being considered a more mature market.

The rest of the world also appears to be stealing a march on Europe, with 298 launches in the first seven months of 2023 versus 117 closures, according to Morningstar.

Michael O’Riordan, founding partner of consultancy Blackwater Search and Advisory, said he was “unsurprised” by the slowdown in European launches.

“It’s hard to come up with new ideas that haven’t been beaten to death already,” he said. “After the core building blocks were launched, smart beta was in fashion and there were lots of launches, then ESG came along and there were a ton of ESG launches. What is the next fashion?”

However, Detlef Glow, head of Europe, Middle East and Africa research at Refinitiv Lipper, argued the slowdown in product launches was largely a consequence of tighter monetary policy in both Europe and the US.

This is because ETFs typically start life with a slab of seed money. Without this, a fund may be unavailable to institutional and professional investors with self-imposed limits on how much of a product they can own.

“Seed money faded away when interest rates moved up”, Glow wrote in a blog post. “The risk appetite of investment banks decreased since they no longer must search for alternative ways to earn an income on their free cash.”

In addition, Glow said that gloom over the prevailing economic and market backdrop was holding fund managers back.

“No promoter wants to launch new products shortly before a market downturn,” he said. “Therefore, the ongoing fears over possible recessions in the leading global economies may hold ETF promoters back.”

Idiosyncratic factors may also be at play. Europe is so far missing out on the rapid rollout of actively managed ETFs that has taken the US by storm.

Active funds accounted for 158 of the 232 new launches in the US this year, Lamont said, but just 35 of the 132 new offerings in Europe.

Much of the divergence is likely to stem from taxes: ETFs receive favourable capital tax treatment vis-à-vis mutual funds in the US. In Europe there is no differential treatment, blunting the rationale for active ETFs.

“The gold rush for active ETFs in the US is skewing the stats,” Lamont said.

Another factor influencing the European market is Amundi’s acquisition of fellow French house Lyxor in 2021 — 42 of the European ETPs that closed this year were managed by either Amundi or Lyxor.

Lamont said this reflected an “ongoing rationalisation of product lines” in the wake of the deal, but added that it could also be read as “a sign of market maturity, as the market consolidates”.

As many as 46 of the terminated funds were categorised by Morningstar as “miscellaneous” funds, a segment largely consisting of cryptocurrency, leveraged and inverse ETPs.

Leverage Shares alone accounted for 21 of these closures — all single-stock long and short products — although it launched 15 more.

Lamont said this was “part of business as usual” in such a niche field, “as smaller players launch esoteric products, quickly closing anything that fails to capture traders’ imaginations”.

Latest news on ETFs

Visit the ETF Hub to find out more and to explore our in-depth data and comparison tools helping you to understand everything from performance to ESG ratings

Overall, he did not believe the data was evidence of a “cooling of interest in ETFs per se”.

“We have gone through a dramatic expansion in numbers but the market has expanded more in terms of breadth than it has in terms of size,” Lamont said. “Much of this was providers positioning themselves for growth [so] I would expect the number of launches to be lower.”

O’Riordan also foresaw an extended period of muted launch activity.

“I would not be surprised if the numbers were the same next year,” he said. “Product innovation and development are hard and you can only have so many me-too products.”

Glow was more upbeat, though, arguing that the dearth of new products was reflective of the market environment and had “nothing to do with a possible lack of innovation or a maturing industry”.

“Rather, the opposite is true,” he added. “I am expecting a high number of new ETFs to be launched once the outlook for the markets becomes clearer because I have learned from conversations with ETF promoters that they have a lot of ideas to enhance their current ETF offerings.”

Comments