The rise of the platform economy

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In scale and significance, the digital economy is now impossible to ignore. Customers are increasingly comfortable with buying goods and services online, reinforcing the move from physical to digital transactions.

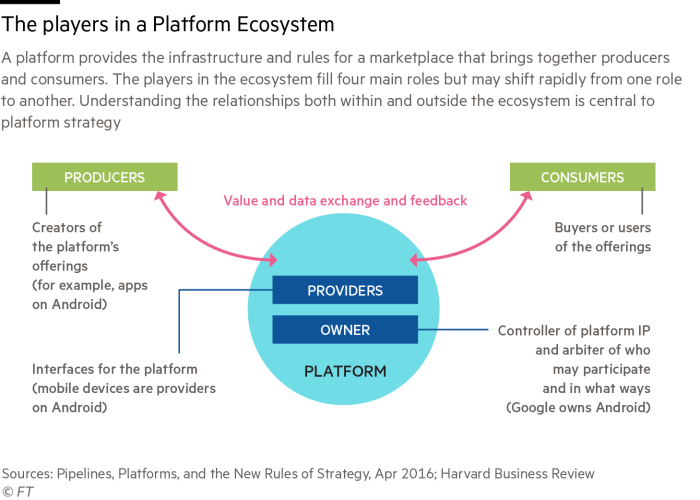

Successful operators use digital platforms to foster reliance and loyalty. They benefit from the network effect, so providing greater value to more users.

How effective is the platform model? In 2019 a team of academics from MIT Sloan School of Management, University of Surrey and Harvard Business School, found that the top 43 publicly-listed platform companies had nearly twice the operating profits, growth rates and market capitalisations of the 100 largest firms in the same businesses over a 20-year period — with half the workers.

While not purely digital, businesses such as the Amazon marketplace are the most visible success stories. “Digital natives” — companies with a digital-first model such as Netflix, Google and Uber — are now household names. That said, adopting a good digital strategy can allow companies that began in the analogue age to reap rewards.

Tech for Growth Forum

Michael Cusumano, professor of strategic management at MIT Sloan and co-author of The Business of Platforms, has researched more than 400 unicorns (companies that are worth more than $1bn) that have platform businesses. He says several were established many years ago and have successfully handled digital evolution.

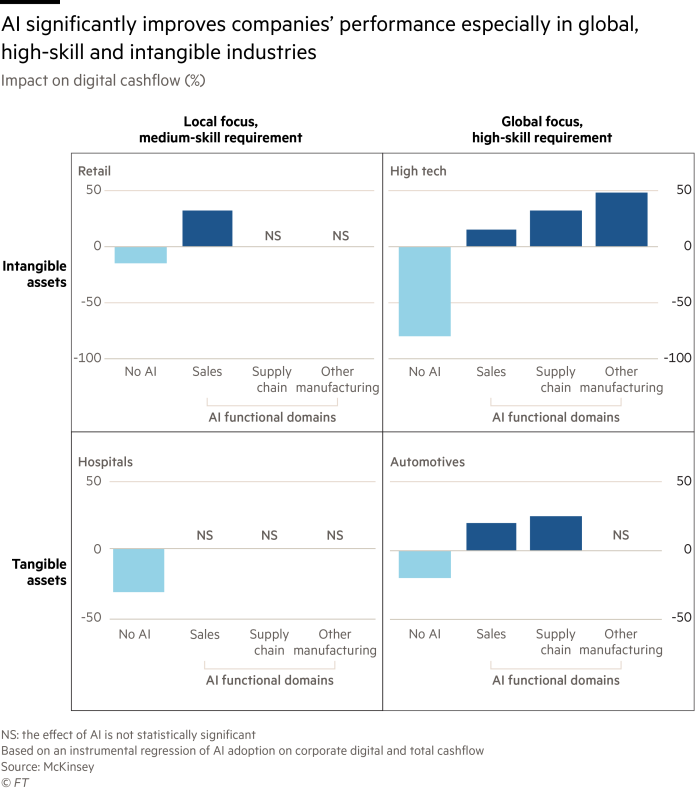

Nimble companies that seize the opportunities presented by the platform economy can gain an advantage in their core business and beyond. Research by the McKinsey Global Institute, based on a 2018 survey, found that companies with any kind of platform can boost earnings growth when compared with businesses that do not have a platform presence.

The right digital strategy can help a company to leap national borders and open new markets, geographically and across product lines. Here, control of interactions with customers and insight into their data is more important than ownership of physical assets and infrastructure.

Not every company has the ability to build its own digital platform and develop the community needed for it to thrive. Some sectors already have powerful incumbents — for example Facebook in social media or Amazon in retail. In other areas the market may be too fragmented for one actor to unite. Nevertheless, every company should have a strategy to deal with platforms.

Sangeet Paul Choudary, who writes about the platform economy and is the founder of Platformation Labs, says: “Somewhere in your value chain you’ve got to work with platforms — either closer to the customer where they become a gatekeeper to market access, or further from the customer where they provide critical infrastructure capabilities to you.”

Without a considered strategy “you run the risk of getting locked in, or getting some key activities commoditised because their scale gives them a data advantage”.

Consumer trends

The need for a platform strategy is most evident in retail. Insider Intelligence, the research firm, anticipates that ecommerce sales will grow by 50 per cent worldwide in the four years from 2021 and says they will account for 24 per cent of global retail sales by 2025, with a value of $7.4tn.

Even as the growth in the number of digital shoppers slows after the surge at the height of the Covid-19 pandemic, the proportion of online consumers is still expected to increase from 32 per cent in 2021 to 34 per cent by 2025. In other words, 2.77bn of the world’s population of 8.2bn will shop online.

The US is probably the most mature ecommerce market, with 70 per cent of adults shopping online in 2018. Despite this, America is still likely to be in the top 10 countries by online retail sales growth in 2022. By region, retail sales in Asia Pacific, dominated by China, are expected to be three times the value of those in North America.

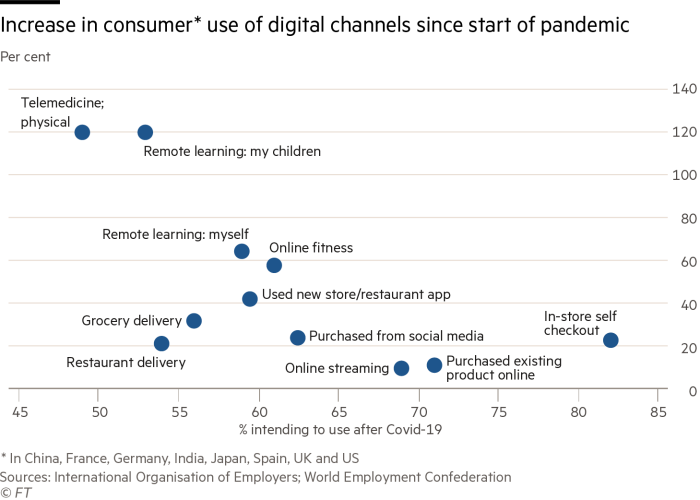

While retail has led the way in digital migration, it is not alone. The pandemic has meant that more consumers are used to looking online for goods and services, says the World Employment Confederation. The medium offers flexibility to both users and providers.

The impact of the digital economy extends beyond the consumer sector. IbisWorld estimates that after stagnant growth in the second year of the pandemic, online commerce will expand from just over one quarter of all business activity in 2020 to reach 28 per cent in 2023. Meanwhile, research in the Socio-Economic Review in 2021 said 70 per cent of service industries in the US — more than 5mn businesses — were potentially affected by one or more platforms.

Formulating a platform strategy

Avoid failure

Some businesses suit the platform model better — for the 43 successful platforms referenced above, 209 competing companies failed.

Cusumano stresses that bad businesses cannot be transformed simply by being “platformised”. When businesses have to pay or subsidise users, for example, “the platform business is essentially bribing people or players . . . to use the platform. Those are bad ideas — and there are a lot of them”.

Software products that are scalable, meaning they have low marginal costs for replication, migrate online most easily. Think Spotify or Netflix. Cusumano and his co-authors refer to these as “innovation platforms” if third-party businesses contribute products and services to enhance them.

Transaction platforms are the biggest category they have encountered. Cusumano says they cover “some sort of market failure. In other words, you have different market actors that have trouble finding each other. Transaction platforms connect them”. Airbnb, for example, takes underutilised assets worldwide and matches them with demand from users.

Useful technologies to deploy

Search Engine Optimisation involves deploying keywords to help a company “game” the system by appearing in more online searches.

Artificial Intelligence algorithms assess data regarding customer preferences and behaviour

Machine Learning AI assists with demand insights for resource matching as well as optimised pricing

Platforms with lopsided business models will not take off. Examples of these include WeWork’s property portfolio, which suffered from a duration imbalance, or any venture that requires the same staffing as an offline business model to achieve similar sales.

A recent paper published by MIT Sloan Management Review identifies “launch, scale, mature and evolve” as the lifecycle phases that underpin a developing platform. The study includes the metrics of success as well as red flags that presage failure.

The analysis highlights the best way to measure the health of the system, including ensuring buy-in from significant partners, maintaining balance between participants and sustaining engagement and feedback. A willingness to drop bad ideas swiftly is as important as getting it right first time.

Go large or go it alone?

The most rapid way to extend online reach is to go with an incumbent platform. In many areas there is a dominant player, the obvious example being Amazon in the retail sector. The danger is that with so much power in the hands of strong platforms, their trade customers are simply subordinates and vulnerable to competition from the platform itself and the other enterprises that use it.

Particularly in the retail sector, the platform’s interests lie in homogenising offerings for convenience and comparison by the consumer. This is seldom of benefit to a traditional business, whose advantage lies in being able to differentiate its product through distribution and marketing.

Dominant platforms can dictate terms favourable to their own business and in conflict with users’ interests — through the fees they charge, the services they force upon them or the preference given to their own products. At the extreme, platforms’ control over the means of distribution can lead to companies being expelled or unable to continue doing business through that route.

For smaller companies that cannot develop their own distribution, the risks may be worthwhile — the platform offers a larger market than they can access alone.

For larger companies with existing brand recognition, the potential to have their best products imitated may not be worth the reach of third-party distribution. Some may choose to shun the incumbent or adopt a hybrid approach, hosting their own website and restricting the lines to which a third-party distributor has access.

Proprietary apps offer another way to build customer loyalty, especially if they offer incentives.

Safety in numbers

Some companies find that it makes sense to join forces with others. Choudary says that clubbing together can create a critical mass to combat new entrants.

In Sweden local banks worked together to develop Swish, a domestic digital payments system, which successfully pre-empted the entry of ApplePay. “It works in the platform’s favour to have its ecosystem as fragmented as possible because that creates the difference in bargaining power between the platform and the ecosystem players,” Choudary says. Collective action, however, can undermine the power of the platform.

Another approach is to partner with a platform — a recognised brand, for instance, backing a new entrant with exclusive distribution in a joint venture, which will benefit the brand as the platform grows.

Partnerships can also further the development of technology. Cusumano offers the example of Mobileye, the listed autonomous-driving subsidiary of Intel, which has licensed its technology across multiple automakers, providing it with more data to hone its product.

Finally, if there is an area in which a company has specific expertise, it can offer that across multiple platforms. Stripe, for example, settles payments for merchants that participate on platforms from Lyft to Shopify.

Look beyond the consumer

B2B trailed the consumer sector in platform development but it now offers more potential for platform entrants, particularly as data standards develop. More portable or open data, especially for homogeneous services, allows for the development of platforms, a trend seen in the finance sector and now emerging among healthcare diagnostics and energy providers.

Leonardo Weiss Ferreira Chaves, the global offer lead for intelligent products and services at Capgemini Invent, stresses that while businesses in highly regulated industries may have the luxury of moving more slowly, “the question is not if they will implement a digital strategy but when”.

To identify platform opportunities, especially in a fragmented sector, it is worth asking whether you can be the connector. (Note that consolidated sectors can benefit from platform co-ordination but these tend to be based on collaboration and shared infrastructure.)

Siegwerk is one example. The provider of printing inks and coatings for packaging and labels built Packiro, a platform that consolidates packaging demand from companies with small-batch needs and connects them to print shops.

“The paint manufacturer is not actually printing, they’re just making sure that people come together, so it’s a purely digital business model,” says Weiss Ferreira Chaves, adding that Packiro is scalable to any number of customers.

Owning the “control point” in an industry gives a company the strongest edge when identifying a platform opportunity, says Choudary.

B2C platform dominance, for example, relies on owning the consumer interface or the critical functionality that powers it. Apple owns the iPhone and Google owns Google Maps, so Android handset companies that want Google Maps must feature the Android store.

B2B platform success is more likely to depend on being the player that manages and coordinates data in an area in which many companies operate.

Choudary cites Autodesk, which produces AutoCAD, the market leader in construction design software. In a value chain with four steps — design, planning, construction and operations — design was the foundation on which the other aspects relied, giving AutoCAD a unique vantage point from which to co-ordinate all the stages.

Through acquisitions over the past ten years it has created the Autodesk Construction Cloud to manage the lifecycle of a building from design to operation, and to co-ordinate inputs.

Car repair workshops can access digitalised inventory management thanks to 3M, the miner-turned-materials innovator. Its RepairStack platform links them directly to insurance companies’ claims systems. It enables automated ordering of stock while ensuring more accurate requisitioning and less claims leakage. There is also full bill itemisation. The data is shared by garages, parts suppliers and insurance companies, forming a workflow chain.

Data from digitalised products can also offer opportunities to even the most traditionally analogue of industries.

Weiss Ferreira Chaves says that makers of agricultural equipment now offer “smart farming”, which goes beyond services such as geofencing, fuel efficiency and predictive machine maintenance.

He says: “You also want to offer digital services that don’t have anything to do with the tractor and can help a farmer plan when to spray or harvest — and create a benefit for him. So he’s willing to pay money for that regardless of whether he’s driving your tractor or a tractor from another brand.”

Take it from the top

Critical to success in any digital strategy is the right management approach — whether you are creating a platform or developing products.

Weiss Ferreira Chaves says: “It’s not a technology problem, it’s about the mindset. The challenge companies have is becoming customer-centric.” Knowing a customer’s priorities is paramount. For instance, in a B2B segment such as farming, customers are conservative. Their focus is on efficiency, risk reduction, productivity and profitability, while in the consumer segment being “cool” is more important.

To ensure rapid product evolution, it is important to fully consider the ownership of the product development process and structure of the team.

“Imagine you’re designing new digital business models, new digital services,” says Weiss Ferreira Chaves. “Who in your company has the profit and loss responsibility for that . . . the sales department . . . aftersales? Do you create a new digital team? Also, how do you develop these solutions?”

In the digital business, he says, work processes must be far more agile, with new releases scheduled over weeks and months rather than years.

The salesforce may need a rethink, too. It can take an agricultural equipment dealer half a day to sell a harvester worth €500,000, “so he’s not spending another hour to sell a small intangible service for €400 a month”.

Platform factors for success

Trust

According to Choudary, platforms have three market-making functions: they allow discovery of a counterparty, they enable the decision to engage, and they manage the relationship between counterparties.

A decision to engage is facilitated by trust such as five-star ratings from previous customers and confidence in the platform’s ability to referee. Any lack of trust, visibility or transparency can quickly lose users, especially in a world connected by social media.

Platforms rely on a healthy community, so loyalty and longevity of customer relationships are central to success. Trust is a large part of this.

Fairness

For open architecture platforms, such as those that allow collaboration on product development, fairness is also key. If users are permitted to contribute, they must also be allowed to share in the rewards.

Consider Apple’s app store, where independent developers list their apps for consumers to buy. In 2020 Epic, the Fortnite game developer, sued Apple for failing to share the rewards its app had brought. The original ruling went in Apple’s favour but this is on appeal.

Clear rules

Another aspect is clarity of rules. As with fairness, contributors must feel that rules are transparent, easily understood and applied, and are not subject to change. On larger, more dominant platforms, there can be an imbalance of power that can leave smaller users vulnerable to the whims of the platform operator.

Data ownership

Given this imbalance, smaller users need to consider how they can keep control of their business and be wary of how they give their data to the platform operator.

For a smaller company the benefits of enhanced reach may outweigh the loss of such data, but market expansion through a larger platform should be a short-term strategy. The longer-term goal would be to migrate the business to a proprietary website or online shop.

A company that feels vulnerable going into business with a bigger player can consider differentiation across channels, for instance restricting sales of some items to its own shop or offering loyalty bonuses for use there.

Good user experience

User experience is key to keeping customers. Solutions should put customer needs before corporate productivity or efficiency. One winning approach is to merge the technology function with product development. This worked at Wincanton, the supply-chain solution provider, as noted in a previous report.

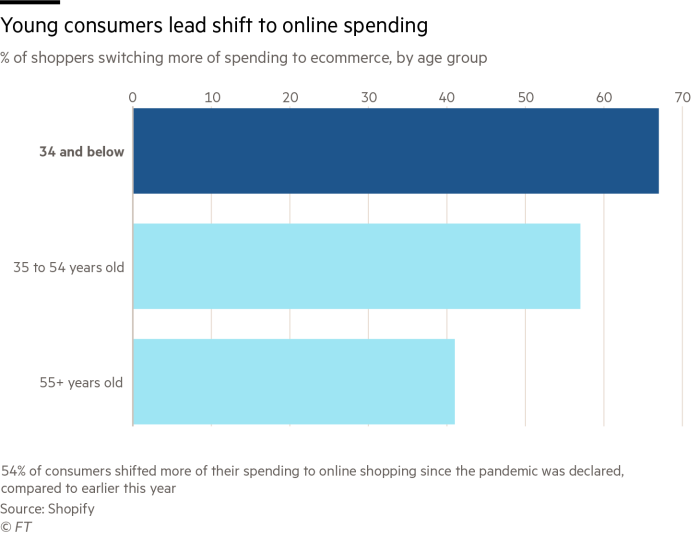

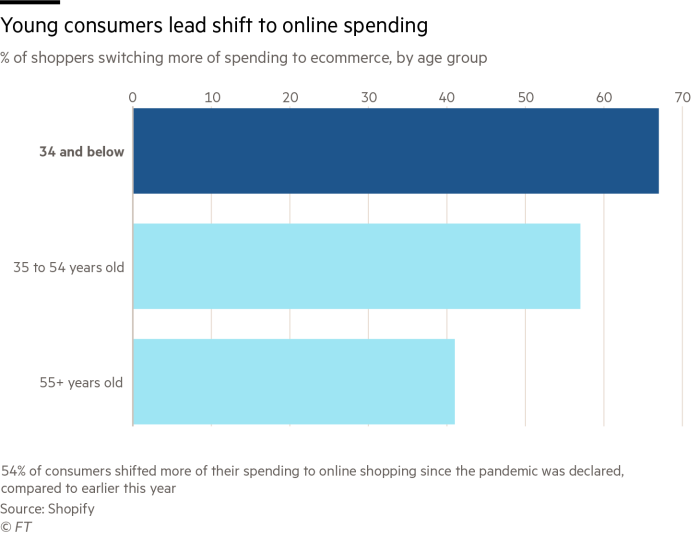

Young user appeal

Good user experience is especially important when considering younger consumers who will dictate a company’s future success. Millennials and Generation Z customers, who have grown up with digital devices, have high expectations of the groups that serve them: digital access is not an add-on but an integral part of how they expect to transact.

To meet this expectation, companies have to consider the “customer journey”, which should optimise the customer experience.

Research by Shopify shows that younger customers are more open to social media marketing but they also care more about the values and authenticity of the companies whose products they use.

Agility

Agility and flexibility can ensure that a company recognises new market opportunities and stays ahead on product development. Structuring a company’s technology in a modular and dynamic fashion — facilitated by enterprise resource planning software and cloud-based solutions — allows for it to be more responsive.

A modular approach can be a lot more nimble. It can also help to deal with failure in a timely way.

Be prepared to cannibalise

Companies must be ready to cannibalise their revenues in pursuit of higher growth. This can be tough but research by McKinsey finds that the improved revenue and earnings that result from a digital strategy more than makes up for any leakage as existing revenues move online.

Leveraging platform potential — some uses

Marketing

Digital marketing is essential to any modern marketing approach. Social media including Instagram or Facebook is an integral part of this. Brand awareness can be enhanced by product placement and advertising campaigns that use AI and machine learning.

Weiss Ferreira Chaves says the wealth of data available, coupled with progress in analysis, means that a company can be much more targeted. “The more you know, the more you can personalise engagement to the needs of your customer,” he says.

For instance, sales and demographic data is useful to try to anticipate when a customer may want to upgrade their car. This results in better sales conversion.

Developing new markets

Platforms enable overseas expansion but can help location-based operations too. Restaurants have used the scalability of online ordering to grow beyond the constraint of table covers using services such as Deliveroo and UberEats.

Such deliveries were key to survival for many businesses during the pandemic. They also spawned a new type of takeaway service using “ghost kitchens” separate to restaurants.

Trialling products

Using the internet to roll out new products lets a business test the market. They can quickly establish whether an item will succeed.

Booksellers achieve this with presales while others use crowdfunding sites such as GoFundMe. One example of this is SwytchBike, which turned to Indiegogo to launch its add-on electric motor for bicycles. Testing demand for a new product means that viability can be assessed before too much money is invested in its creation.

Identifying new products

Data has fast become a valuable asset in its own right. Whoever owns data has an unparalleled insight into customer behaviour, which can bring opportunities for cross-selling and new product development.

Some companies morph into selling digital solutions to other businesses, an example being Ping An, the Chinese insurance provider. Siemens and GE are now also data service providers.

Products based on data intelligence have greater global reach as they are more easily “exported” into new markets than physical goods.

Connectivity and productivity of employees

Platforms that connect businesses to customers can also link companies to their workers. Staff who were previously unable to attend an office meeting can do so over the internet.

Training and commercial insights can be shared more widely online, democratising access to data and allowing better collaboration between physically remote units.

Open platforms, whether internal or external, allow users to collaborate with inputs and so optimise products. Communities of users can share solutions or replicate a problem to work on solving it together.

Don’t forget the physical

Despite the concentration on digital matters, physical distribution is not obsolete, as Amazon illustrates with its move into bricks and mortar shops.

Physical locations can be part of an online strategy either as a “last mile” service for deliveries or as a location for customers to “try stuff out”. They could also be a back-up function for the main business.

Risks

Hacking

As companies depend more on the internet, the risk of hacking increases. In December 2022 Zurich Insurance warned that cyber attacks would become “uninsurable”.

No company or organisation is immune. Last year LastPass, the password manager provider, suffered a data breach. In January hackers disrupted Britain’s Royal Mail parcel delivery service.

Regulation change

In some instances, governments consider changes in regulation in response to lobbying — think Uber and London’s black taxi drivers.

The less regulated a market, the easier it may be to establish a platform, but companies should be cautious not to provoke governments into imposing more rules.

Regulation is not all bad, however, especially for smaller players. In Europe the EU is moving to curb the power of some of the digital groups that are seen as having abused their power. Google, Apple and Amazon have all been in the crosshairs of EU legislation.

Existential

Companies need to be wary of any strategy that leads to a long-term handover of competitive advantage, be it customer relationship or sales data.

If it identifies a popular third party product, Amazon will cannibalise its customers’ ideas or charge the seller more. The number of the group’s own-brand products trebled to 23,000 between 2018 and 2020, according to the MIT Sloan Management Review.

Reputation

With the rapid and open spread of information over the web, a company’s standing can rapidly go from positive to negative. Poor experiences can lead to an exodus of users and customers. Businesses have to be on the front foot when dealing with crises.

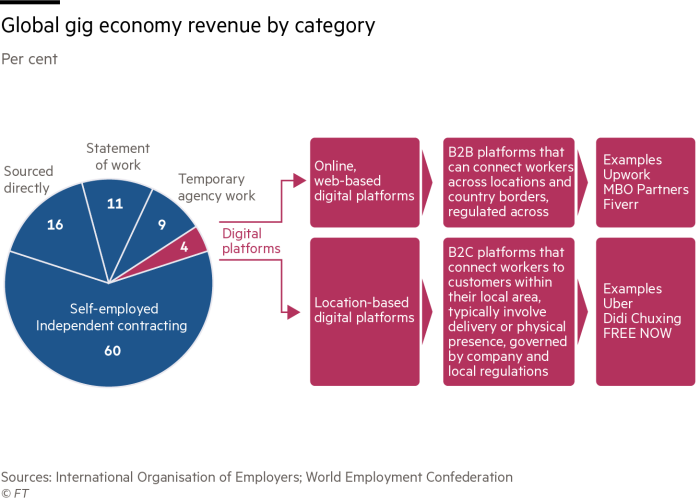

Exploitation

People who work for platforms can be at risk of exploitation. That said, most platform or “gig” workers prize flexibility more highly than revenue stream, according to the World Employment Confederation.

It is worth noting that despite the noise made, the percentage of people employed under gig conditions is small.

Conclusion

It should be clear that a digital strategy is no longer an optional add-on to a traditional business model. It is instead a core part of a company’s approach to the modern economy.

Mindset is at least as important as skill set, and the lead on this has to come from the boardroom.

The importance of productivity and efficiency have been eclipsed and companies must now place customers’ needs at the heart of problem-solving for growth and profitability — and even survival — to be assured.

Businesses must be ready to boost technological capabilities in order to ensure that management of data, that increasingly important asset, can be brought in-house.

The more forward-looking and technologically enabled a company is, the more it will be able to compete for the new generation of talent.

Comments