Business school teaching case study: can green hydrogen’s potential be realised?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Hydrogen is often hyped as the “Swiss army knife” of the energy transition because of its potential versatility in decarbonising fossil fuel-intensive energy production and industries. Making use of that versatility, however, will require hydrogen producers and distributors to cut costs, manage technology risks, and obtain support from policymakers.

To cut carbon dioxide emissions, hydrogen production must shift from its current reliance on fossil fuels. The most common method yields “grey hydrogen”, made from natural gas but without emissions capture. “Blue hydrogen,” which is also made from natural gas but with the associated carbon emissions captured and stored, is favourable.

But “green hydrogen” uses renewable energy sources, including wind and solar, to split water into hydrogen and oxygen via electrolysis. And, because there are no carbon emissions during production or combustion, green hydrogen can help to decarbonise energy generation as well as industry sectors — such as steel, chemicals and transport — that rely heavily on fossil fuels.

Ultimately, though, the promise of green hydrogen will hinge on how businesses and policymakers weigh several questions, trade-offs, and potential long-term consequences. We know from previous innovations that progress can be far from straightforward.

Wind power, for example, is a mature renewable energy technology and a key enabler in green hydrogen production, but it suffers vulnerabilities on several fronts. Even Denmark’s Ørsted — the world’s largest developer of offshore wind power and a beacon for renewable energy — recently said it was struggling to deliver new offshore wind projects profitably in the UK.

Generally, the challenge arises from interdependencies between macroeconomic conditions — such as energy costs and interest rates — and business decision-making around investments. In the case of Ørsted, it said the escalating costs of turbines, labour, and financing have exceeded the inflation-linked fixed price for electricity set by regulators.

Business leaders will also need to steer through uncertainties — such as market demand, technological risks, regulatory ambiguity, and investment risks — as they seek to incorporate green hydrogen.

Test yourself

This is the third in a series of monthly business school-style teaching case studies devoted to responsible-business dilemmas faced by organisations. Read the piece and FT articles suggested at the end before considering the questions raised.

About the authors: Jennifer Howard-Grenville is Diageo professor of organisation studies at Cambridge Judge Business School; Ujjwal Pandey is an MBA candidate at Cambridge Judge and a former consultant at McKinsey.

The series forms part of a wide-ranging collection of FT ‘instant teaching case studies’ that explore business challenges.

Two factors could help business leaders gain more clarity.

The first factor will be where, and how quickly, costs fall and enable the necessary increase to large-scale production. For instance, the cost of the electrolysers needed to split water into hydrogen and oxygen remains high because levels of production are too low. These costs and slow progress in expanding the availability and affordability of renewable energy sources have made green hydrogen much more expensive than grey hydrogen, so far — currently, two to three times the cost.

The FT’s Lex column calculated last year that a net zero energy system would create global demand for hydrogen of 500mn tonnes, annually, by 2050 — which would require an investment of $20tn. However, only $29bn had been committed by potential investors, Lex noted, despite some 1,000 new projects being announced globally and estimated to require total investment of $320bn.

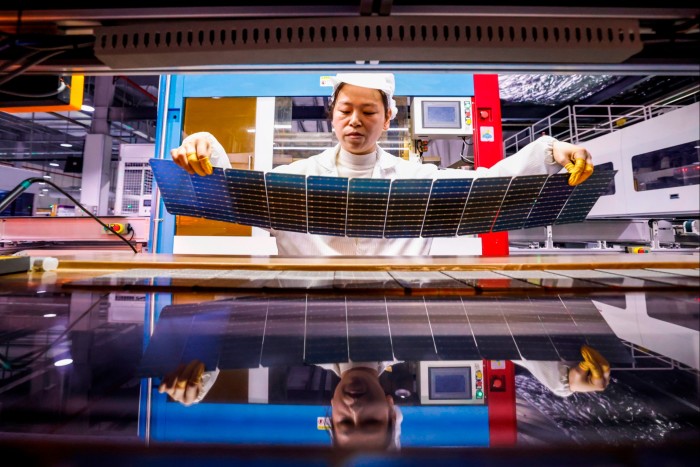

Solar power faced similar challenges a decade ago. Thanks to low-cost manufacturing in China and supportive government policies, the sector has grown and is, within a very few years, expected to surpass gas-fired power plant installed capacity, globally. Green hydrogen requires a similar concerted effort. With the right policies and technological improvements, the cost of green hydrogen could fall below the cost of grey hydrogen in the next decade, enabling widespread adoption of the former.

Countries around the world are introducing new and varied incentives to address this gap between the expected demand and supply of green hydrogen. In Canada, for instance, Belgium’s Tree Energy Solutions plans to build a $4bn plant in Quebec, to produce synthetic natural gas from green hydrogen and captured carbon, attracted partly by a C$17.7bn ($12.8bn) tax credit and the availability of hydropower.

Such moves sound like good news for champions of green hydrogen, but companies still need to manage the short-term risks from potential policy and energy price swings. The US Inflation Reduction Act, which offers tax credits of up to $3 per kilogramme for producing low-carbon hydrogen, has already brought in limits, and may not survive a change of government.

Against such a backdrop, how should companies such as Hystar — a Norwegian maker of electrolysers already looking to expand capacity from 50 megawatts to 4 gigawatts a year in Europe — decide where and when to open a North American production facility?

The second factor that will shape hydrogen’s future is how and where it is adopted across different industries. Will it be central to the energy sector, where it can be used to produce synthetic fuels, or to help store the energy generated by intermittent renewables, such as wind and solar? Or will it find its best use in hard-to-abate sectors — so-called because cutting their fossil fuel use, and their CO₂ emissions, is difficult — such as aviation and steelmaking?

Steel producers are already seeking to pivot to hydrogen, both as an energy source and to replace the use of coal in reducing iron ore. In a bold development in Sweden, H2 Green Steel says it plans to decarbonise by incorporating hydrogen in both these ways, targeting 2.5mn tonnes of green steel production annually.

Meanwhile, the global aviation industry is exploring the use of hydrogen to replace petroleum-based aviation fuels and in fuel cell technologies that transform hydrogen into electricity. In January 2023, for instance, Anglo-US start-up ZeroAvia conducted a successful test flight of a hydrogen fuel cell-powered aircraft.

The path to widespread adoption, and the transformation required for hydrogen’s range of potential applications, will rely heavily on who invests, where and how. Backers have to be willing to pay a higher initial price to secure and build a green hydrogen supply in the early phases of their investment.

It will also depend on how other technologies evolve. No industry is looking only to green hydrogen to achieve their decarbonisation aims. Other, more mature technologies — such as battery storage for renewable energy — may instead dominate, leaving green hydrogen to fulfil niche applications that can bear high costs.

As with any transition, there will be unintended consequences. Natural resources (sun, wind, hydropower) and other assets (storage, distribution, shipping) that support the green hydrogen economy are unevenly distributed around the globe. There will be new exporters — countries with abundant renewables in the form of sun, wind or hydropower, such as Australia or some African countries — and new importers, such as Germany, with existing industry that relies on hydrogen but has relatively low levels of renewable energy sourced domestically.

How will the associated social and environmental costs be borne, and how will the economic and development benefits be shared? Tackling climate change through decarbonisation is urgent and essential, but there are also trade-offs and long-term consequences to the choices made today.

Questions for discussion

Read:

Lex in depth: the staggering cost of a green hydrogen economy

How Germany’s steelmakers plan to go green

Hydrogen-electric aircraft start-up secures UK Infrastructure Bank backing

Aviation start-ups test potential of green hydrogen

Consider these questions:

Are the trajectories for cost/scale-up of other renewable energy technologies (eg solar, wind) applicable to green hydrogen? Are there features of the current economic, policy, and business landscape that point to certain directions for green hydrogen’s development and application?

Take the perspective of someone from a key industry that is part of, or will be affected by, the development of green hydrogen. How should you think about the technology and business opportunities and risks in the near term, and longer term? How might you retain flexibility while still participating in these key shifts?

Solving one problem often creates or obscures new ones. For example, many technologies that decarbonise (such as electric vehicles) have other impacts (such as heavy reliance on certain minerals and materials). How should those participating in the emerging green hydrogen economy anticipate, and address, potential environmental and social impacts? Can we learn from energy transitions of the past?

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Comments