Profile: Randy Breaux sees no let-up in the pace of change

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

When Randy Breaux left UCLA in 1975 with a newly minted economics degree, the southern California native entered a job market similar to the one facing twenty-somethings today — competing with a glut of overqualified applicants for few entry-level positions.

Financial services were not his first career choice, but in a tough environment, when Prudential Insurance offered him a job underwriting large corporate policies, it seemed as good a start as any on offer.

Decades later, Mr Breaux is one of only five advisers on the FT 401 list who has been advising defined contribution retirement plans for more than 40 years. His business, based in San Francisco, focuses on employee benefits and retirement plans for small companies that are mostly located in Silicon Valley.

Mr Breaux has seen much change in retirement plan advice during his own long career, including the implementation of the Employee Retirement Income Security Act of 1974, which dominates governance of retirement plans in the US.

Yet in all that time he says no period can compare to the seismic shifts that he has witnessed in the industry over the past few years.

In April, the US Department of Labor released long-awaited amendments to its fiduciary rule, which forces retirement brokers to put their clients’ interests first.

The changes, says Mr Breaux, could make it harder for some advisers to justify the commissions they traditionally received for selling financial products and signing clients to funds. As a result, Mr Breaux says he has seen many advisers choosing to be paid on a fee-only basis — shunning commission.

After more than 40 years in the business, Mr Breaux himself recently became “dual-registered” as both a commission-earning broker-dealer — governed by the Financial Industry Regulatory Authority — and a fee-earning registered investment adviser — regulated by the Securities and Exchange Commission. He can therefore provide both commissioned and fee-based services.

Yet even though the Department of Labor seems intent on stamping out the perceived conflict of advisers being paid to recommend specific financial products, Mr Breaux says he finds most of his clients prefer to stay in commission-based plans where they can clearly see what they are paying for.

“Until about ten years ago, clients didn’t pay much attention to expenses,” he says. “While they mightn’t agree that moving to a fee-based system is more in their best interests than commissions, clients want to understand their expenses so they [the advisers’ clients] can show they’re acting in the best interests of their plan participants.”

Mr Breaux says over the decades he has been in business, the main change he has seen in his clients is an increasing recognition of their own fiduciary duties.

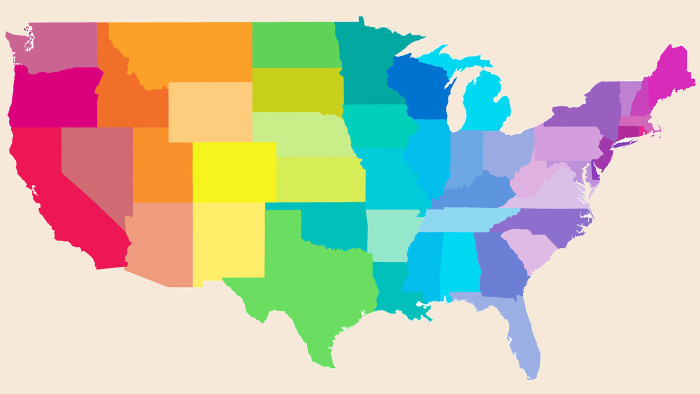

The elite professionals

A-Z of the FT’s top advisers state by state

“Most of these guys in the tech world started out with a few employees and grew quickly to 100 or more. They didn’t want to be bothered with thinking about corporate retirement plans. They just wanted to hand it over to someone to take care of,” he explains.

But when fiduciary liability started to become more apparent to even smaller companies, Mr Breaux says clients realised they were liable for the plans they put together. “When that pressure began, plan sponsors started to become increasingly more involved in the decision-making, asking me for more specific and detailed information on cost structures and investment choices.”

Mr Breaux thinks this change has made him — and advisers like him — more respected by clients. “As they come to understand the complexity and seriousness of providing retirement plans, clients think of me as a professional partner,” he says. “Earlier in my career I was simply seen as a vendor of products.”

Comments