China tech crackdown claims ETF victims

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Beijing’s regulatory crackdown on some of its biggest companies in technology and education has delivered a bruising blow to highly specialised China-focused exchange traded funds.

Broad-based tech ETFs have sailed through virtually unscathed, but some narrowly focused thematic instruments have taken a beating. Among those most affected, the KraneShares CSI China Internet ETF (KWEB) has nearly halved in value since its peak in February.

Some ETF buyers are hunting specifically for targeted strategies, despite the risks. But Kenneth Lamont, senior fund analyst at Morningstar, said this highlights the potential drawbacks of tracking a narrow theme without the flexibility to shift tactics.

“The [passive thematic] strategy has no way to quickly react to bad news and will hold the stock until the next rebalance. The small number of fund holdings also means that overall returns can be influenced by the performance of handful of stocks,” Lamont said.

He noted that for the KraneShares ETF, one Chinese education group alone — TAL Education Group — was responsible for knocking 2.8 percentage points off performance from the end of June.

Global X Education ETF (EDUT), which has a large exposure to the Chinese online education sector, was also badly affected.

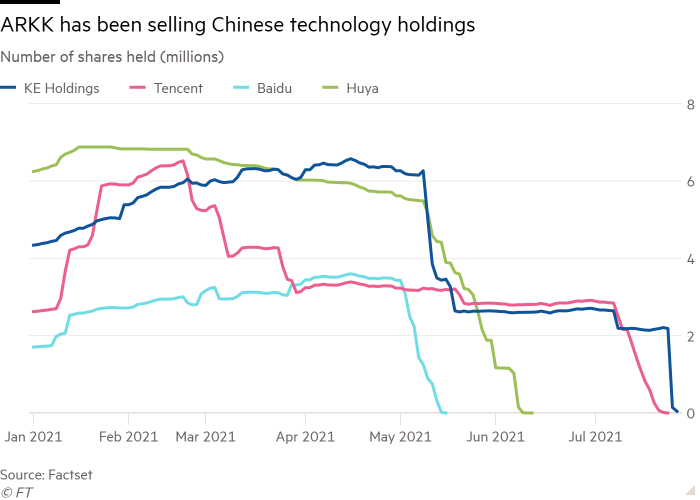

Actively managed ETFs, such as Ark Invest’s ARKK flagship Innovation fund, can react more quickly. After voicing her optimism for the prospects for China’s tech disrupters earlier this year, Cathie Wood, Ark’s chief executive, shed millions of dollars worth of shares in four China-domiciled companies.

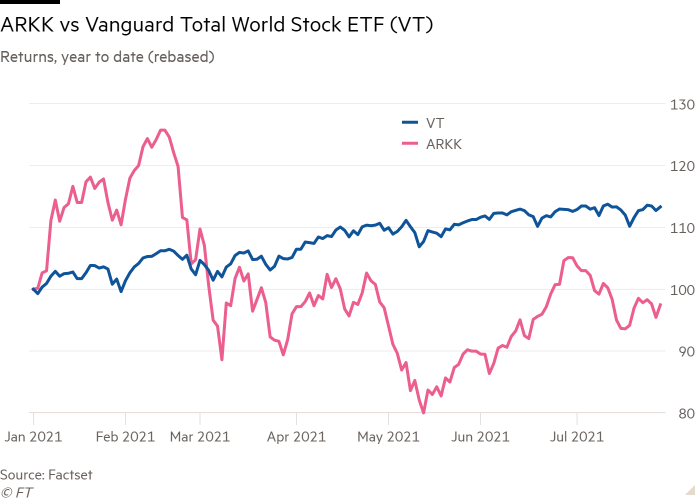

Investors in ARKK have not been rewarded as well as those who simply put their money in broadest based funds such as the Vanguard Total World Stock Index Fund ETF (VT), but they have still managed to ride out the China tech storm far better than more exposed counterparts.

Some investors insist Chinese investments can bounce back. Mark Martyrossian, chief executive of UK-based Aubrey Capital Management, said he believed many of the affected tech companies would maintain their market leadership.

“The gravy train may have slowed but you disembark at your peril,’ Martyrossian said.

Lamont said badly hit funds had suffered such losses because they were doing exactly what they had promised to do — provide narrow exposure.

More nimble active investment strategies also face their own challenges, said Elisabeth Kashner, director of global fund analytics at FactSet. “Active managers may successfully anticipate market reversals, but they can also miss them, sometimes seriously tanking returns,” she said. “Some people can be skilful and some people can be lucky and if you’re lucky and skilful in one period you might be lucky and skilful in the next, but you might not.”

Additional reporting by Steve Johnson

Click here to visit the ETF Hub

Comments