US investors in emerging markets switch to ETFs that exclude China

Simply sign up to the Emerging markets myFT Digest -- delivered directly to your inbox.

Emerging markets investors in the US are snapping up exchange traded funds with no exposure to China and dumping those focused on the world’s second-largest economy, where a weakening growth outlook has left stocks lagging behind other markets.

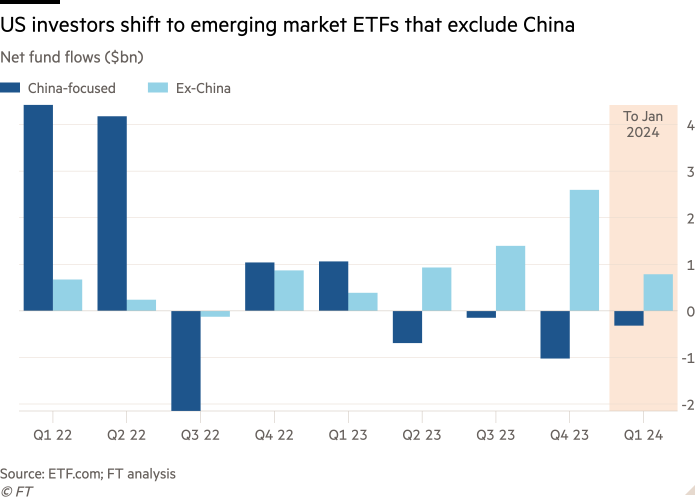

The net capital inflow into eight US-listed emerging markets ETFs that exclude China more than tripled to $5.3bn last year from a year earlier, according to a Financial Times analysis of ETF.com data. That came as 55 China-focused ETFs suffered combined net outflows of $802mn in 2023, compared with inflows of $7.5bn in the previous year.

The change in demand underscores how global investors are cutting exposure to China, which has long been the largest country in most emerging market portfolios. Geopolitical tensions and growing state intervention in the economy have weighed on the country’s capital market as stocks in other parts of the developing world rallied.

“The correlation of Chinese equities towards other major emerging markets has absolutely collapsed in the last few years,” said David Dali, head of Portfolio Strategy at Matthews Asia, a San Francisco-based asset manager that invests in China and other developing countries. “There is certainly a percentage of our investors that just prefer not to have China in their portfolios at all and [the solution] is an ex-China version of the emerging markets,” he said.

Asset managers have been offering emerging markets ETFs that exclude China since as early as 2015, when the country’s economy was still booming and index providers such as MSCI were planning to increase its weighting in benchmark emerging markets indices to as high as 40 per cent.

Marc Zeitoun, chief operating officer at Columbia Threadneedle Investments North America, said the asset manager launched its namesake EM Core ex-China ETF, the first of its kind, that year after clients suggested “having such an overconcentration in China” might not help emerging markets investors gain a “simple and broad exposure”.

The idea, however, did not catch on until 2021 when Beijing’s crackdown on private groups, led by Jack Ma’s Ant Group, led to a rout in US-listed Chinese tech companies.

“This [was] the beginning of investing in China being associated with risks that don’t exist in other areas,” said Zeitoun, “People started to say I would rather have a non-China emerging market solution.”

As China’s post-pandemic recovery faltered thanks to a prolonged real estate meltdown and a lack of private sector confidence, its stock market went on a rollercoaster ride. The benchmark CSI300 index had tumbled more than 20 per cent since last January before recovering some lost ground following a state-led wave of buying of local ETFs in recent weeks.

The volatility has triggered an exodus of foreign capital including via the US-listed, China-focused ETFs, which accounted for 7.7 per cent of US residents’ holding of Chinese and HK stocks as of last November, worth about $23bn.

According to ETF.com, an industry portal, China-focused ETFs have suffered three straight quarters of outflows since last April.

“China’s growth is slowing and it’s just not where it used to be,” said Angela Miller-May, chief investment officer of the $52bn Illinois Municipal Retirement Fund, adding that her fund had “minimal” exposure to the world’s second-largest economy.

While Chinese equities fell 11.4 per cent in 2023, other emerging markets rallied on hopes of economic reform and a supportive international environment. India and Mexico, two beneficiaries of US efforts to diversify supply chains away from China, reported jumps of 19 per cent and 16 per cent in their benchmark stock indices last year.

China’s size, making up a quarter of the MSCI Emerging Markets Index, means, meanwhile, that a downturn there can cause index investors to lose money even when other emerging countries are holding up.

Its divergence from other emerging markets has prompted more investors to consider EM ETFs, which limit exposure to China or cut it altogether.

“In EM there is too much focus on China,” said Rajiv Jain, chief investment officer of GQG Partners, a $120bn asset manager known for its bets on emerging markets, “but the rest of EM is doing fine”. GQG’s flagship EM Equity Fund has cut its China allocation to 5 per cent from 40 per cent and redeployed the capital to markets from India to Saudi Arabia over the past five years.

The race to divest from China in ETFs does not mean that investors have lost interest in one of the world’s largest markets. Several ETF managers said China’s size and its uncertain policy environment meant it made more sense to treat the country on its own instead of as part of any investment universe.

“It’s not that investors don’t like China,” said Dali of Matthews Asia, which last year launched an EM ex-China ETF, “It’s just that they prefer a specialist to manage what is becoming a very complicated country to generate excess returns.”

Zeitoun of Columbia Threadneedle said the asset manager still provided actively managed EM funds with China exposure.

“All that we were doing was enabling investors to calibrate how much China they wanted, not to remove them entirely,” he said.

Comments