China’s ‘national team’ propels EM ETF flows to new record

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

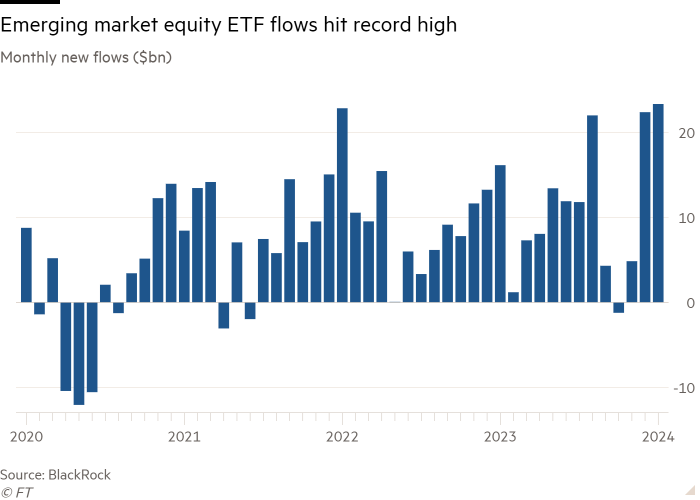

A wave of domestic buying by China’s “national team” of large, state-affiliated institutions helped propel overall net inflows to emerging market equity exchange trade funds to record levels in January.

EM equity ETFs took in $23.3bn in January, according to data from BlackRock, surpassing the previous record of $22.8bn in January 2022. However, 99 per cent of this money was pumped into ETFs listed in the Asia-Pacific region, in contrast to a more normal month such as December when 30 per cent of EM equity buying was through US-listed ETFs.

The wall of buying has Beijing’s fingerprints all over it as Central Huijin, an investment arm of China’s sovereign wealth fund, joined a raft of state-owned insurance companies and asset managers in buying ETFs in an effort to prop up the country’s ailing stock market after the benchmark CSI 300 index tumbled 45 per cent from its 2021 peak.

EPFR, a data-tracking company, reported on Friday that flows to EM equity funds hit a record weekly high in dollars at the start of February — also hitting the highest level as a percentage of assets under management since the global financial crisis of 2008 — in a move that had “obvious Chinese characteristics”.

With $19bn being sucked up by Chinese equity funds (including mutual funds) alone, EPFR said: “The latest flows into China-mandated funds went predominantly to domestically domiciled ETFs as Chinese policymakers move to put a floor under an equity market that has lost over $6tn in value over the past three years.”

Enthusiasm for Chinese equities outside the country remains minimal, though, with State Street Global Advisors reporting that 87 per cent of the $995mn that went into US-listed EM equity ETFs in January was vacuumed up by funds with an investment objective that explicitly excludes China.

US-listed ETFs focused purely on China bled $304mn in January, SSGA said, taking outflows over the past year to $3bn.

“There have been concerns about China’s relative economic prospects as well as the political uncertainty,” said Todd Rosenbluth, head of research at VettaFi, a consultancy.

“We have seen products like EMXC [the iShares MSCI Emerging Markets ex China ETF] be quite popular, with $700mn of net inflows in January,” he said, while the smaller Columbia EM Core ex-China ETF (XCEM) took in $100mn.

Overall, net inflows to global ETFs hit $107.5bn in January, according to BlackRock, below December’s blowout $170bn but still a solid start to the year.

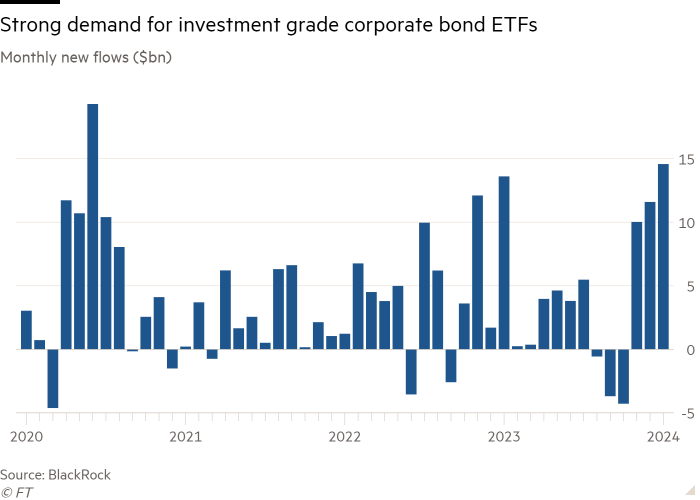

The major global trend was a continuation of the “risk-on” mantra that emerged in the final quarter of 2023, particularly in corporate debt.

“Investment grade [corporate] credit stole the show in January,” said Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region. Inflows hit $14.6bn, their second-highest level ever, beaten only by June 2020 as markets rebounded from their Covid lows.

Chedid tied the buying to the broader global disinflationary backdrop. “We are seeing investors taking full duration risk in credit exposures,” he said, referring to investors’ desire to seek portfolios of bonds whose price is highly sensitive to interest rate changes.

“This is the year of disinflation and interest rate cuts, so having the comfort to take on full duration risk in a year when you are probably going to see rate cuts in the middle of the year makes sense,” he added.

US-listed ETFs accounted for $9.2bn of the inflows, up from $5.9bn in December, with VettaFi’s data indicating the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) drew in $3.3bn of this, and the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) $2bn.

“We saw, coming into the new year, that investors were more comfortable taking on interest rate risk and some credit risk,” Rosenbluth said of the US market. “They had confidence that 2024 was a year of economic growth in the US and that the Federal Reserve would be cutting rates at some point, and quite aggressively, many people thought.”

This sentiment has, though, taken a dent, with investment-grade flows reversing in the US at the start of this month.

“The Fed seems to be saying they are not going to be cutting rates as aggressively as the market was expecting,” Rosenbluth said. “Expectations shifted for some folks and so we have seen, in the initial days of February, that some of that [money] has bled out.”

This chimes with BlackRock’s house view is that returns from taking on duration risk are likely to be higher in Europe than the US this year.

“There is more room to extend duration risk in Europe, if you think about the market pricing of rate cuts this year,” Chedid said. Not only does the market pricing suggest the European Central Bank will cut rates five times, a fraction more than the 4.5 from the Fed, but “we think the ECB has a higher chance of delivering on these rate cuts expectations because there are fewer signs of inflation pressures and growth is weaker,” he added.

The mystery of ETF investors’ waning appetite for gold, despite its decent showing with a rise of 13.7 per cent in dollar terms last year, also deepened amid continued outflows.

After $2bn more selling in January, SSGA put cumulative outflows at $6bn in the US alone in the past year, with Matthew Bartolini, head of SPDR Americas research, calling it a “missed opportunity for those that redeemed”.

Chedid believed a turnaround was likely, saying “in an environment where there is still macro uncertainty, [gold] is still the one [area] where I would expect some demand”.

However, Rosenbluth believed last month’s keenly awaited US rollout of ETFs investing in spot bitcoin — dubbed “digital gold” by some — meant demand for actual gold might remain muted.

“There is only so much room in a portfolio. The alternatives bucket now has more competition,” he said.

Comments