Hedge funds make retreat from US stocks after big swings hurt returns

Simply sign up to the Hedge funds myFT Digest -- delivered directly to your inbox.

Hedge funds have dramatically scaled back their footprint in the US stock market as sharp swings have pummelled big money managers.

Funds that trade with some of the largest banks on Wall Street including Morgan Stanley, Goldman Sachs and JPMorgan Chase have rapidly cut long and short stock positions, or bets on prices rising or falling, according to interviews with traders and data that the banks have circulated to their clients.

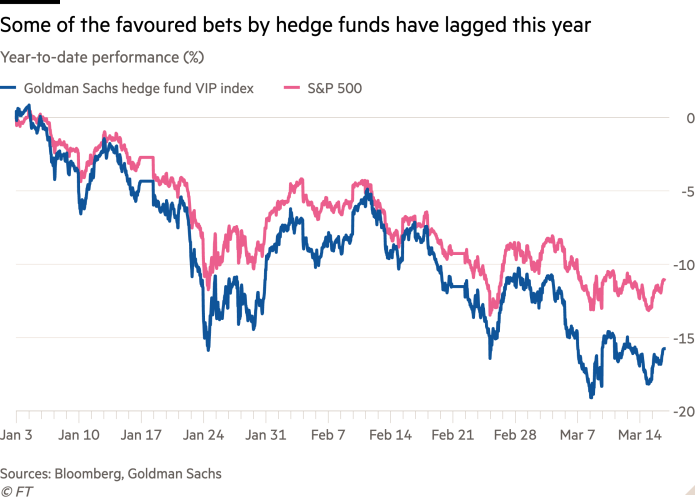

The moves accompany the worst sell-off in the $46tn US stock market since it was rocked by the coronavirus pandemic two years ago. The benchmark S&P 500 index has fallen 11 per cent this year as investors react to surging inflation, tighter monetary policy from the Federal Reserve and Russia’s invasion of Ukraine, which has helped to drive up commodity prices and thrown global growth forecasts into doubt.

“This has become a ‘nowhere to hide’ market,” said Charlie McElligott, a strategist on Nomura’s trading desk.

Morgan Stanley last week notified clients that they had seen one of the largest five-day periods of selling in North American stocks by hedge funds on record, noting that the size of the sales trailed only the final week of January 2021, when the retail meme-stock frenzy was roiling markets, and the onset of pandemic lockdowns in March 2020.

Goldman Sachs noted that in the first week of this month, hedge funds sold tech and consumer stock holdings at the fastest rate for any five-day period in the past decade, according to a note sent by the bank’s prime brokerage service seen by the Financial Times.

John Flood, who works in Goldman’s trading business, told clients on Tuesday that selling on March 11 and 14 was “eye-popping”, with stocks in every region of the globe hit. He added that the pullback by hedge funds underscored the “extreme levels of derisking” being undertaken by investors.

Many hedge funds use borrowed money to amplify returns, though they often cut back and begin shrinking positions during periods of rising market volatility, something analysts call “de-grossing”. Nomura’s McElligott warned last week that funds were unwinding positions when the market rallied as they reduced the risks they were willing to take.

Even before the latest turn lower in financial markets, many equity funds were cutting the size of trades made with borrowed money. Data from Barclays’ prime brokerage unit showed that gross leverage in February fell to its lowest level in at least a year.

Several hedge funds with ties to Julian Robertson’s Tiger Management have suffered big losses from widely held tech and consumer stocks. Tiger Global Management, one of the largest tech investors, fell 23.2 per cent in its main hedge fund through February this year, said one person briefed on the numbers.

The head of trading at one of Wall Street’s largest banks said there was “massive, massive confusion” among investors and that many tech-focused equity funds were nursing steep losses, sometimes exceeding 20 or 30 per cent.

“I don’t hear any conviction in anyone’s voice,” the person added.

Comments