Japanese companies place US bets on Texas

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Houston is home to a huge air-conditioning factory where some staff use bicycles or golf carts to get around. The plant, a 40-minute drive from the city centre, is owned by Japanese company Daikin Industries. “It is the third-largest factory in the US, following Tesla and Boeing,” says Jiro Tomita, senior associate officer at the company, proudly.

Daikin Industries is based in Osaka, Japan, but its growth is driven from the US, particularly Texas. The share of its revenues from the Americas has risen from less than 1 per cent in 2000 to 37 per cent last year. This helped Daikin hit global revenues for air conditioners of ¥3.6tn ($24bn) in its full fiscal year to March — about 10 times the total at the beginning of the century.

Daikin acquired US air-conditioning manufacturer Goodman in 2012. The following year, it decided to close its factory in Houston and build a new one.

“Louisiana and Texas were the candidates for the new factory,” Tomita says. Ultimately, he chose Houston, a location with low state taxes and cheap living costs. Proximity to a large port — essential for the supply chain — and direct flights to Japan from the international airport were also deciding factors.

The Houston factory and research centre employ about 10,000 staff and make 4.9mn air conditioners a year. Cumulative investment in the facilities has reached $1.26bn.

Daikin is not the only Japanese company betting on the US. Manufacturing in the country has been a strategy for Japanese companies to avoid trade disputes. Carmakers from Japan especially remember the 1980s when trade frictions brought bilateral relations to their lowest point in the postwar period.

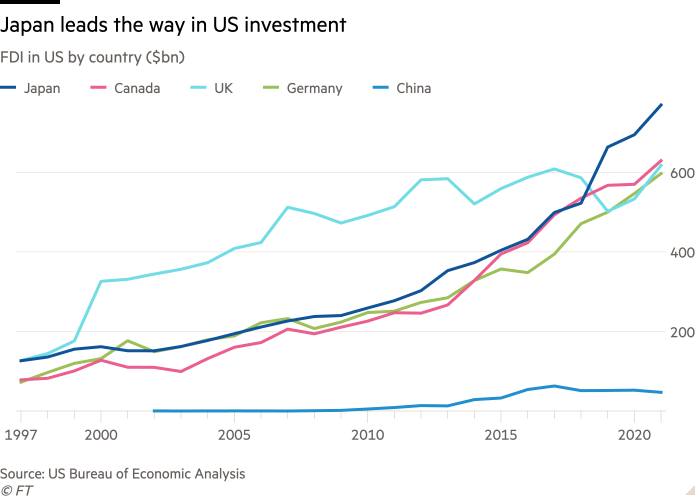

According to the US Bureau of Economic Analysis, by 2021, Japan had committed the largest amount of foreign direct investment in the US, with $768bn — putting it ahead of Canada, the UK and Germany. Japanese manufacturers employ the highest number of US workers, at over half a million — more than any other foreign country. Japanese enterprises also lead other countries in exports of goods from the US. And, as the risks of deepening trade links with China become apparent, Japanese companies are again recognising the importance of the US.

Amid this renaissance, affordable cities in the south are growing in popularity among Japanese manufacturers, compared with previous favourites on the west coast and in the north-east of the US, especially in states such as Texas, Florida and North Carolina. For example, in 2017, carmaker Toyota moved its North American headquarters from Torrance, California, to Plano, Texas and, in 2021, Nippon Steel consolidated its headquarters in Houston.

Currently, Japanese companies have more than 350 offices or branches in Texas, says Masahiro Sakurauchi, head of the Japan External Trade Organization (Jetro) in Houston.

Texas offers few incentives, such as tax breaks, for building factories. However, its generally low taxes and living costs outweigh the drawbacks. “Texan laissez-faire economic policies have attracted businesses,” Sakurauchi says.

For Houston, in particular, energy transition has become a tailwind. Mitsubishi Heavy Industries relocated its US headquarters from New York to Houston in 2016. The company had originally made New York its US base mainly for the shipbuilding business. However, by 2016, there were hardly any maritime transportation companies left in the city. “There was no real reason to remain in New York,” says Takajiro Ishikawa, president of Mitsubishi Heavy Industries’ US subsidiary.

The company is exploring opportunities in energy transition businesses, such as clean hydrogen and carbon capture, while continuing to make equipment for oil and gas companies. In October, the US Department of Energy announced seven hydrogen hubs that will receive $7bn in government grants, including two projects backed by Mitsubishi.

Houston’s role as a gathering place for the fossil fuel sector and its ambition to remain a focus of delivery on energy transition industries make it the natural place for Mitsubishi to pursue new ventures with US oil and gas companies, argues Ishikawa.

The city wants to transform itself from the world’s “energy capital” to the “energy transition capital”, he says. “Chicago could have been a possibility, but our customers were in Houston.”

Comments