Exploring beauty’s biotech frontier

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Biotech beauty products are increasingly filling our bathroom cabinets; the science may have been used in a simple way for decades, but new innovations are driving considerable change. And they have pretty much given us a new future of possibilities in skincare, fragrance, even make-up.

Put simply, biotech uses living organisms to create new products, technologies and solutions. The process, mainly through microorganism cultivations such as fermentation, allows scientists to create bio-identical molecules to those found in nature, or to tweak sustainably sourced ingredients to give them superpowers without adding to the environmental costs. Biotech is behind that shiny new bottle of hyaluronic-acid-enriched serum you bought last week — it’s the reason it no longer has to be made from cockerels’ combs, and can use a bioidentical ingredient instead. And it’s being met with an enthusiasm not seen since the arrivals of Botox and retinol.

Little wonder the beauty industry is energetically prospecting the biotech frontier. This summer, L’Oréal’s venture capital arm Bold invested in the start-up Debut, which specialises in “cell-free” ingredient manufacturing, leading a $34mn series-B round of funding. Oddity, the parent company of make-up brands Il Makiage and SpoiledChild, has acquired the start-up Revela, a biotech platform that utilises artificial intelligence, for $76mn. Chanel, too, has invested in biotech company Evolved by Nature, which last summer raised $120mn in series-C financing, as well as Arcaea (which also received investment from fragrance manufacturer Givaudan and the hair brand Olaplex).

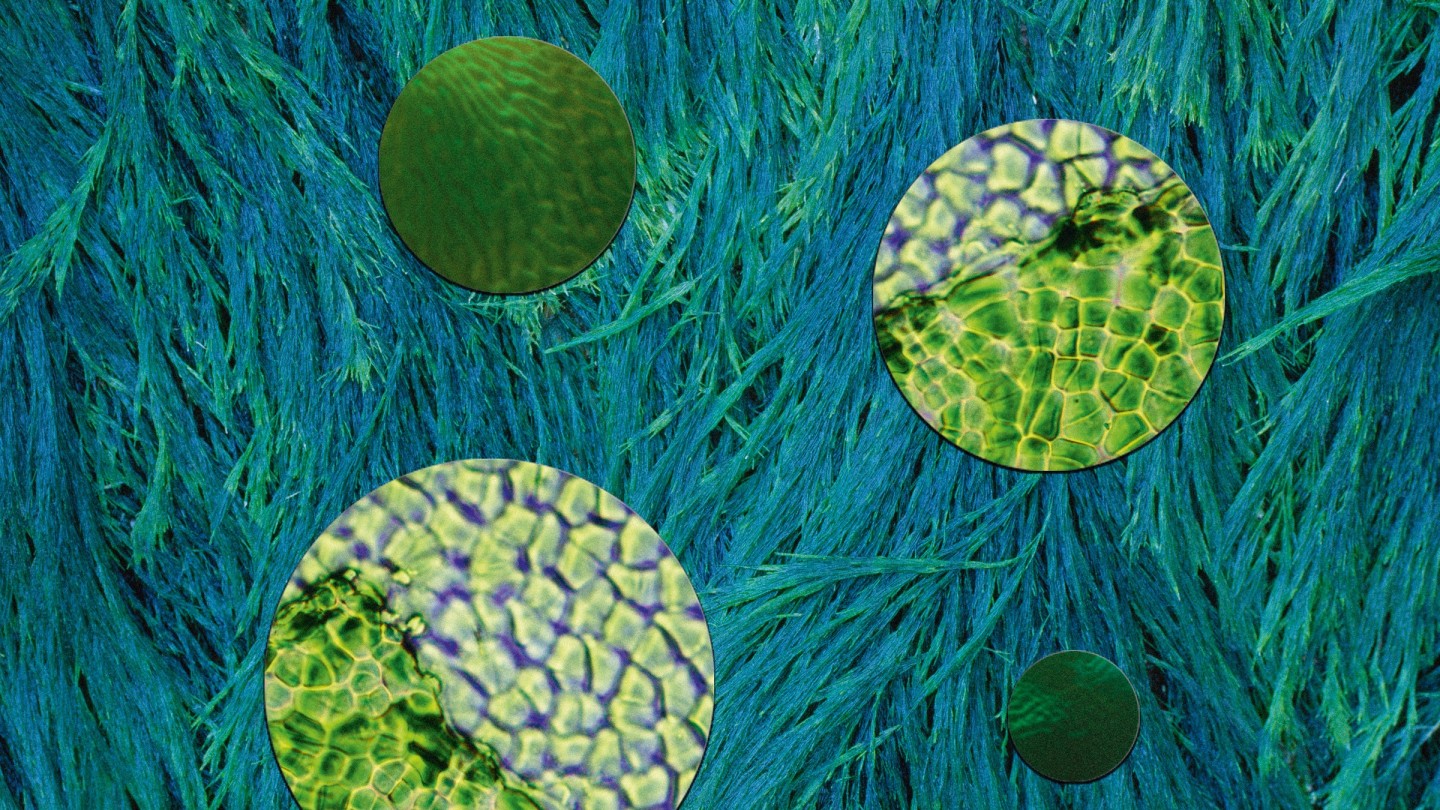

Alongside this, bio-brands are launching with increasing regularity. Take Pavise, for example, created by chemical engineer Sophie Bai, which uses a patented molecular ingredient called DiamondCore, developed with scientists at Harvard and MIT, that promises to repair UV damage by blocking 95 per cent of UVA. New skincare line Gezeiten uses photobioreactors to farm marine algae that could not previously be cultivated effectively in a bid to rebalance and protect the skin’s microbiome. And British brand Reome, founded by former beauty editor Joanna Ellner, launched with the multifunctional daily serum, Active Recovery Broth, which uses biotech forms of Vitamin B3 and E, instead of extracting them from avocado and almond oils. Biotech ingredients achieve the same calming and nourishing properties, says Ellner, but they can be sourced in a more effective and sustainable way.

“Biotech gives us access to rare substances that would traditionally be difficult to extract,” echoes Dr Shimei Fan, chief scientific officer at Coty. “More importantly, depending on the technology involved, it preserves natural resources by saving energy, water and the use of solvents.” Fan gives as an example the marine enzymes used in much of the Coty-licensed Orveda skincare range, an early adopter of biotechnology since it was founded in 2014. “If we had to collect these microorganisms and extract their enzymes,” says Fan, “we would spoil the natural habitat. Through biotechnology, we can unlock all this potential in our laboratory — a microorganism that was sampled decades ago can now be cultivated via bio-fermentation.” Further, thanks to the controlled manufacturing conditions (there’s no variation in batches, for example, which you might find with crop-grown ingredients), it’s easier to ensure quality.

BioEffect EGF Hand Serum, £39

Omorovicza Queen Essence, £75 for 100ml

In 2022, L’Oréal achieved the target of 61 per cent of bio-based ingredients in its formulas: “derived from abundant minerals or from circular processes”, says Anne Colonna, general manager of L’Oréal Advanced Research. The group’s goal for 2030 is to make that 95 per cent, including the development of entirely new ingredients. “Thanks to biotech we have been able to create micro-organisms that can offer new, superior, even unequalled performance,” says Colonna. In collaboration with biotech start-up Micreos, L’Oréal has reproduced the action of endolysin, a microorganism found on the skin’s surface that eliminates the bacteria responsible for skin lesions such as eczema, atopy and acne. “We managed to enhance its performance through genomics, proteomics and biotechnology,” says Colonna. The active ingredient is used in La Roche Posay’s Lipikar Eczema Med cream.

However, the recent filing for Chapter 11 bankruptcy by one of the biggest and earliest biotechs, Amyris, rocked the industry. The California-based firm, founded in 2003 with funding from the Bill & Melinda Gates Foundation, had captured 50 per cent of the global market in squalane, a skincare humectant that mimics squalene, naturally found in the livers of sharks. But Amyris had also branched out into being an incubator for beauty start-ups including Rose Inc, Costa Brazil and JVN hair care, and it proved too huge a leap from developing molecules to developing brands. It’s widely believed that the move to sell these off will allow Amyris to revert to what it does best.

“Biotechnology is a buzzword for now,” says Dr Sigrún Dögg Guðjónsdóttir, chief research and development officer for Bioeffect, which was founded by three Icelandic scientists who created skin-friendly growth factors using barley plants. But “it’s important that the term isn’t misused”. The consumer, she adds “has to be on their toes” so it doesn’t become a misrepresentative branding exercise. “If it’s advertised as such, then ask, ‘Where is the biotech?’”

Biossance Squalane + Copper Peptide Rapid Plumping Serum, £54 for 50ml, spacenk.com

Gezeiten 7-day Skin Immunity Defence Treatment, £165

From a formulating point of view, Dögg Guðjónsdóttir also points out that biotechnology is not quite at the level where it can do everything — yet. “We want our growth factors to stay pure, stable and active through the lifetime of the product,” she says. “This means we can’t use acids, like alpha or beta hydroxy acids [often used by chemists to help smooth skin texture] or they will degrade. And we can’t use harsh enzymes [sometimes used to help dissolve hard skin and encourage new growth].”

Consumers also need to remember that how we respond to ingredients varies from person to person. “Some people react quite strongly and get great results,” says Dögg Guðjónsdóttir, referring to the much-lauded Bioeffect EGF Serum, “while others see hardly any results. Skin is different. Not everyone gets great results from retinol or from vitamin C, but we know the majority will. That’s just how it is.”

Comments