Budgets are blown as luxury exhibitors beat a path to Baselworld

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The world’s largest and most costly watch and jewellery fair begins in Basel, Switzerland’s third city, on Thursday and is expected to attract more than 120,000 visitors from 100 countries during its eight-day run.

The show is open to the public, who will join retailers and press in scrutinising the 1,400 exhibitors, for whom Baselworld is the business fulcrum of the year.

The near-century-old show was renamed in 2003 (it was previously called just Basel), since when its importance has grown exponentially, as have its rates. Last year, following a $454.5m makeover to the halls, price increases of a reported 20 per cent were imposed on exhibitors.

The site and the event are owned by MCH Group, a public company that returned a half-year operating income of SFr344.9m ($390m) in the first six months of 2013, a 30 per cent rise on the previous year. Much of that can be attributed to increased income from Baselworld. According to sources, MCH expects it will take at least 50 years to amortise its investment in the halls. But it believes it will be worth it.

Baselworld has become the lifeblood of the watch and jewellery industry, and – along with Richemont Group’s smaller but hugely influential January fair, the Salon International de la Haute Horlogerie held in Geneva – it dominates the annual schedule.

This is not lost on its organisers. “The worldwide impact of the show is tremendous,” says Sylvie Ritter, Baselworld’s managing director. “If you are a brand presenting your product at Baselworld, you can be sure that the most important buyers from all over the world will be here.”

The investment for exhibiting brands is significant. Insiders suggest the largest stands at the show, some of which are three or four storeys high, can cost in excess of SFr10m ($11.4m) for the structure alone. Basic ground rent, paid to the organisers, is SFr420 per square metre. According to Baselworld, the largest stand covers 1,625sq m. It would not confirm who rents it, but it is widely thought to belong to Rolex.

Brands then pay an undisclosed premium dependent on the width of the gangway to the exhibitor opposite, which is at its most generous in the area where Rolex and Patek Philippe are located. According to Ms Ritter, prices were fixed last year until 2017, justifying the 2013 increase.

On top of these fees, Baselworld charges exhibitors separately for water, electricity, air conditioning and access to its wireless networks. Yet despite the soaring costs, brands say they cannot afford not to be there.

“It’s a high investment, of course,” says Jean-Frédéric Dufour, chief executive of Zenith, a watch company that is part of the LVMH Group. “But it gives you a good return on your investment. We do up to 50 per cent of our annual business there.”

Mr Dufour will not be drawn on exact figures, but admits his investment is between SFr5m and SFr10m. “But not going to Baselworld would be a mistake,” he says.

Thierry Stern, Patek Philippe’s chief executive agrees. “Basel gives me the opportunity to meet all our partners, distributors, affiliates and retailers,” he says. “It’s like a family meeting that can only take place there. It’s also the largest press platform for us.”

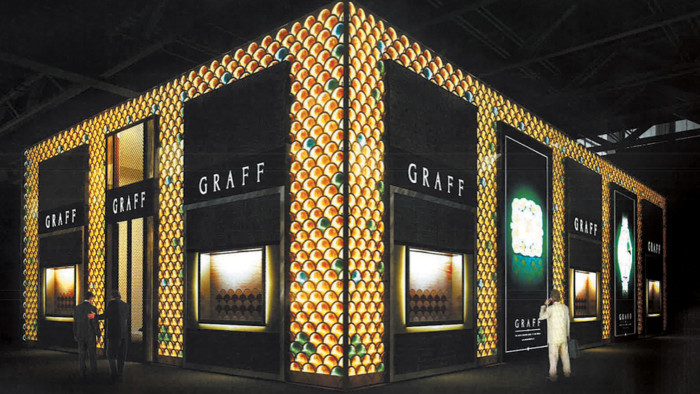

Such is Baselworld’s draw that this year Graff will exhibit at the fair for the first time, despite the fact it does not sell its products wholesale.

It will take the position on the first floor of hall 1 vacated by Harry Winston, which joins the Swatch Group brands on the ground floor this year after its $1bn buyout last spring.

Baselworld . . . provides the perfect environment for us to continue the expansion of the Graff Diamonds brand and our watch division globally,” says François Graff, the company’s chief executive.

Emporio Armani has returned to the show after a decade-long hiatus, while British brand Bremont, which is reporting more than 40 per cent growth over the past 12 months, has also taken a stand for the first time.

“We tried not to do it for so long,” says Giles English, who co-founded the brand in 2007. “But it got to a point where it was doing us damage not being there. We’re too big not to do it now.”

One brand still ploughing its own furrow is Louis Vuitton. While officially under the event’s umbrella, it presents its collections in a villa in the town centre. “We are there exclusively for the press – we don’t have buying and selling sessions,” says Hamdi Chatti, the brand’s director of watches and jewellery, by way of explanation. Mr Chatti says this strategy has not harmed the brand, citing more than 1,000 press visitors in 2013.

But consensus remains that being inside the halls is critical. Rob Diver, TAG Heuer UK’s managing director, says: “As much as I believe we could do our business without it, it gives us the opportunity to show the trade in particular what we’re about.”

Despite the stranglehold Baselworld’s organisers have over brands, Ms Ritter stresses the symbiotic nature of the relationship. “I don’t think ours is a position of power. The return on investment is important for brands – that’s why they spend such a lot of money. They aren’t supporting Baselworld because they are in love with us. It’s a business case.”

Comments