T-Mobile and Sprint deal turns tables on SoftBank’s Masayoshi Son

Simply sign up to the US & Canadian companies myFT Digest -- delivered directly to your inbox.

The combination of T-Mobile USA and Sprint has been agreed at the third time of asking after years of wrangling, creating a company that could potentially dominate the world’s most valuable mobile phone market.

The deal agreed at the weekend to unite the US’s third- and fourth-largest mobile players will give Deutsche Telekom, Europe’s largest telecoms company, the whip hand in reaping the benefits.

It also represents a rare setback for SoftBank’s Masayoshi Son, the Japanese billionaire who led the $20bn acquisition of Sprint in 2012 and injected a further $8bn into the business as part of a bold plan to unlock the US market.

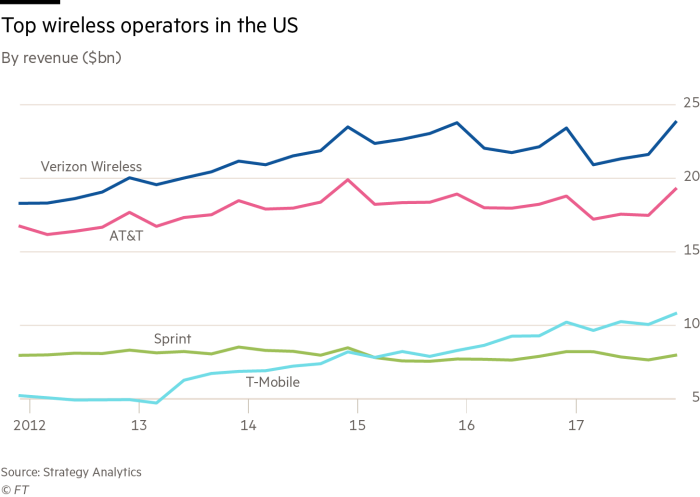

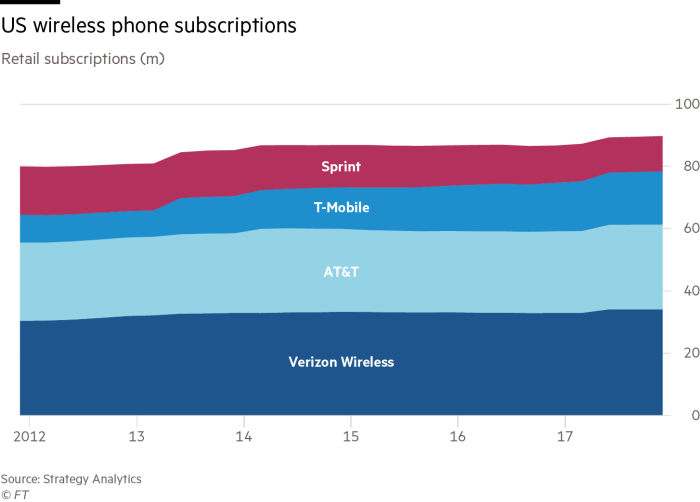

Instead, six years later, Sprint has been unable to stem customer losses and the deal it finally agreed will mean the company ends up as a minority shareholder in a German-controlled business.

T-Mobile, by contrast, has been transformed from a basket case to “kingmaker asset”, according to Tim Höttges, chief executive of DT, since an attempt to sell the network to AT&T in 2011 was blocked by regulators.

The unit, led by John Legere, a charismatic showman known for wearing hoodies and tweeting aggressively at rivals, has tripled in stock market value in that time.

The long power struggle between Sprint and T-Mobile reflects the divergent fortunes of the two companies.

Mr Son was in the driving seat in 2013, as Sprint looked to buy its rival. But those discussions were derailed when US regulators made it clear they would not accept a merger that reduced the number of companies in the wireless sector from four to three, because of fears it would harm consumers.

The two sides met again in 2017 but as equals. The price war waged by Mr Legere had propelled T-Mobile USA above Sprint in terms of size and market capitalisation. Yet Mr Son still pushed his case for control of the combined business and DT walked away from negotiations.

The third attempt was instigated by Mr Son earlier this year. This time the deal has been structured as Sprint being sold to its one-time target: DT will own 42 per cent of the shares in the combined company compared to SoftBank’s 27 per cent. The German company will also control the management and board with 67 per cent of the voting rights while the T-Mobile brand will be retained.

The terms did not even include a break fee for Sprint in case the deal falls through — a sign of just how weak its bargaining position had become, according to analysts.

Mr Höttges, who was appointed as DT chief executive in 2014, said the deal validated his strategy in the US. On a call with investors, he admitted that he was urged to sell off the US unit as soon as he took over but that he believed the opportunity in a $510bn US market was “worth fighting for”.

Marcelo Claure, the chief executive of Sprint, presented the deal as a necessity ahead of the arrival of 5G, the next generation wireless standard.

“Both companies need each other. The reason this will work is that T-Mobile cannot do the 5G strategy without Sprint, and Sprint cannot do it without T-Mobile,” he said when asked what had changed in the six months since the previous round of negotiations was abandoned.

5G has become a political flashpoint in the US because of concerns that Chinese companies have too much influence over its development. The Trump administration has warned that if Chinese companies took a lead it could pose a threat to US national security.

Sprint and T-Mobile say that the merger will “supercharge” its efforts in 5G against that backdrop.

Mr Höttges also pointed to tax reforms introduced by the Trump administration as an additional “sugar” for the talks. The estimated synergies related to the deal have increased by $6bn since the changes were announced in November.

Attention will now turn to whether US regulators will allow the deal to happen this time round. The companies have stressed that the merger will create jobs and be good for consumers.

T-Mobile also believes the takeover should be judged against the whole technology and telecoms sector rather than Verizon and AT&T only.

“Not just dumb & dumber! Comcast and Charter (soon to be named wifipipe & son of wifipipe) & all of their customers & shareholders should be worried,” Mr Legere said on Twitter.

Craig Moffett at MoffettNathanson said the chances of regulatory clearance were about 50/50 as regulators were still doing a “victory lap” after in 2011 blocking AT&T’s takeover of T-Mobile, which triggered a price war.

“That poses a problematic backdrop,” he said. “Seven years ago may seem like a lifetime on Wall Street. But it is the blink of an eye in Washington. It will be hard for Sprint and T-Mobile to convince regulators that ‘this time it’s different’.”

Walt Piecyk, an analyst with BTIG, put the chances of approval at lower than 40 per cent, which he said was more of a problem for Sprint and SoftBank than T-Mobile, which has a stronger balance sheet.

Yet, if a deal were landed at the third time of asking, it could also provide Mr Son with a chance to argue that his Sprint foray has worked out.

Oliver Matthew, an analyst at CLSA, said the deal would transform Sprint from “a mostly lossmaking business into a minority stake in a big synergy machine”.

“After SoftBank passed this deal over last year, question marks arose on the decision. This should encourage sentiment that SoftBank is willing to find the right deals,” Mr Matthew said.

Masayoshi Son’s lofty US ambitions take a hit

For Masayoshi Son, the billionaire founder of SoftBank, it was supposed to be a calculated bet when the Japanese telecoms group acquired Sprint in 2012, writes Kana Inagaki in Tokyo.

Mr Son had taken the same path previously. In 2006, he spent $15bn to acquire Vodafone’s struggling Japanese operations and transformed it into the country’s third-largest mobile carrier with aggressive marketing and discount pricing.

Mr Son was confident that his successful strategy would work to transform Sprint, then the country’s third-largest US wireless group, into a powerful player that could compete against AT&T and Verizon Wireless, its two bigger rivals. The only missing piece was a merger with rival T-Mobile, the fourth biggest player.

But for a man who claims to see 300 years ahead, Mr Son’s calculation faltered spectacularly.

After Sprint abandoned its pursuit of T-Mobile in the summer of 2014 in the face of US regulatory hurdles, he admitted that he might have made the “biggest mistake” in his life.

In early 2015, he considered selling the struggling US unit, only to find that there was no buyer willing to take it on as T-Mobile overtook Sprint to become the third-largest carrier.

A year later, with a sale unlikely, Mr Son changed tactics, naming himself Sprint’s chief network officer and personally becoming involved in improving the network of the US wireless group. “I am no longer going to run away or hide. The signs of recovery are clearly visible,” Mr Son told investors at the time.

In 2017, the companies attempted a second deal but talks broke down after Mr Son refused to give up control over Sprint. “I truly believe this is the right decision,” he said in explaining his reasons for walking away from a deal with T-Mobile.

Now, just six months later, Mr Son has agreed to effectively sell Sprint to T-Mobile representing a turnround that he certainly did not foresee.

Comments