Mining tycoons battle over lithium’s ‘corridor of power’ in Australia

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The vast tracts of desert in Western Australia, which have yielded gold, nickel and iron ore to prospectors in decades past, have now become a major battleground for miners of lithium, a critical raw material for batteries as the world transitions to greener energy.

A struggle for control of the resource has been ignited this year as multinational companies have clashed with Australian mining billionaires over a series of takeover attempts in two of the remotest parts of the state.

A section of desert near the mining town of Kalgoorlie in the Goldfields region has become known as the “lithium corridor of power”, while merger moves in the Pilbara in the state’s north-west have triggered memories of the iron ore boom there in the 1960s and Western Australia’s nickel rush in the 1970s.

“These exciting periods don’t come around too often, these prolonged periods of demand for a commodity. It is driving a frenzy,” said Tom Reddicliffe, a 40-year mining veteran and executive director of GreenTech Metals, whose exploration rights in the Pilbara have buoyed its share price amid heightened deal activity.

“There’s only so many seats at the table. It’s like musical chairs — you don’t want to miss out,” he added.

The “land grab” for mining rights in the lithium corridor kicked off in September, when US company Albemarle, the largest producer in the world, agreed to pay $4.3bn for Liontown Resources, an emerging project that has struck supply deals with Tesla and Ford. However, the takeover was foiled by Gina Rinehart, Australia’s richest person, who stealthily built a 19.9 per cent stake in Liontown, forcing the US suitor to walk away.

Rinehart, an iron ore magnate, then moved to spoil another lithium takeover, this time in the Pilbara. Chile’s SQM had agreed to pay about $1bn to buy out early-stage lithium player Azure Minerals before Rinehart pounced again by buying an 18 per cent blocking stake.

Chris Ellison, who controls A$12bn ($8bn) miner Mineral Resources and is a shareholder in Azure, said this month that SQM’s bid looked “dead in the water”.

Rinehart and Ellison have become increasingly active investors in a host of small lithium projects in both parts of the state, where foreign companies including Albemarle, SQM and China’s Tianqi Lithium have previously been among the biggest investors.

Ian Hansen, head of the chemicals division of Perth-based retail-to-chemicals conglomerate Wesfarmers, which has partnered with SQM on lithium assets, said the recent flurry of activity represented a “growing belief in the fundamentals of Western Australian lithium”.

“Similar to the way that iron ore production has grown in the north-west of the state, players in the lithium sector may want to be in control of a large portion of the resources to consolidate their position,” he said.

Rio Tinto, which was blocked in its attempts to open a lithium mine in Serbia last year, also has an eye on Western Australia’s potential, having applied for a range of tenements — licences to explore a block of land for resources — covering about 130,000 hectares in the lithium corridor.

Small explorers such as St George Mining are also being courted. It had originally established tenements in the Goldfields region in the hope of finding nickel, until the operator of a neighbouring tenement discovered spodumene — the hard rock containing lithium — two years ago. That company renamed itself Delta Lithium and now counts Ellison and Rinehart as major shareholders.

In recent weeks, St George has benefited, despite not yet finding any spodumene deposits. Amperex Technology, TDK’s lithium-ion battery-making division, invested A$3mn in a joint venture with the Australian miner. In addition, Shanghai Jayson New Energy Materials, a supplier to lithium battery makers in China, has put A$3mn into the company.

John Prineas, executive chair of St George, said the investments showed that companies in the battery supply chain were following the lead of carmakers such as Tesla in backing early-stage Australian miners. “Big players are taking a position early as it is very expensive to do so after discovery. That’s definitely a positive sign for the future of the lithium industry here,” he said.

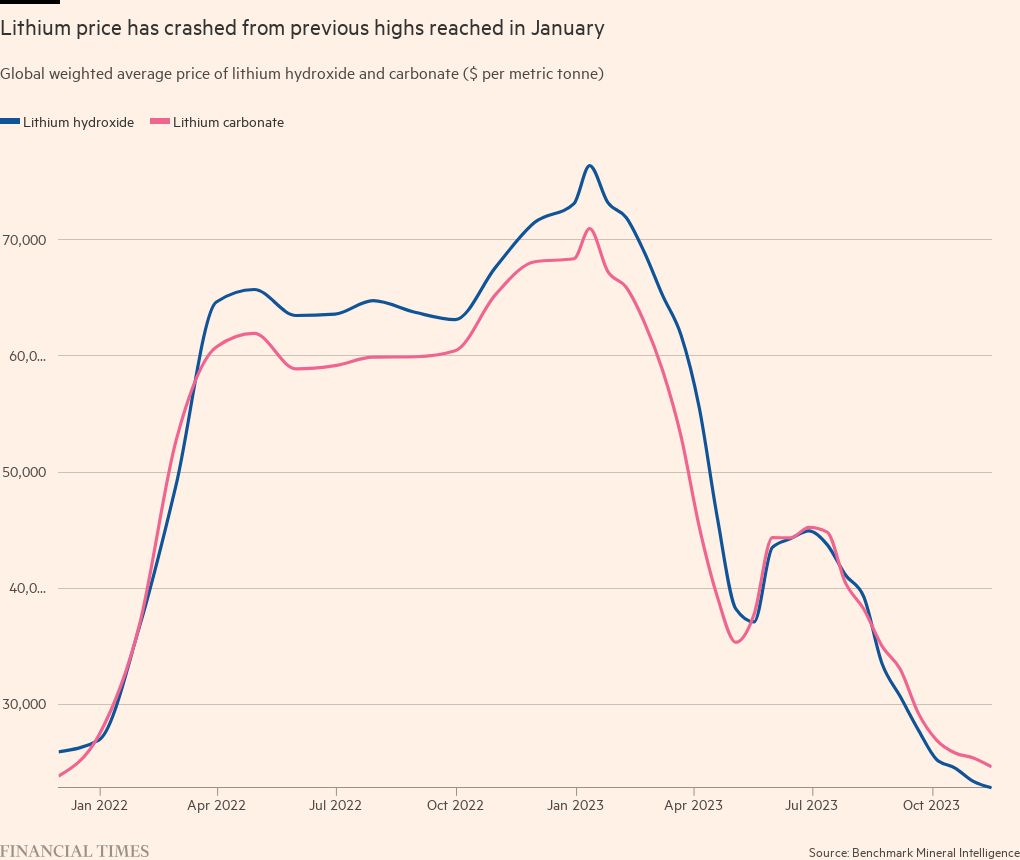

The deal frenzy has also come at a time when the lithium price has crashed as much as 70 per cent compared with highs seen last year, as expectations of electric vehicle demand in crucial markets such as China have been lowered. Prineas said the investment in his company showed demand remained robust. “All the talk is oversupply of lithium, but it's not what we’re seeing from the end users,” he said.

Western Australia already supplies about half of the world’s raw lithium and is seen as a stable place to invest compared with parts of Africa, where there has been political instability, and Chile, where the state has moved to take control of lithium projects.

Local expectations are high. A report by Australia’s chief economist said lithium product exports should exceed A$20bn in the year to June 2023, up from A$5bn in the previous year. The report added that by 2028, the value of lithium exports should exceed those of coal, a staple of Australia’s economy for decades.

Australia has ambitions to step up its efforts to refine spodumene to keep more of the value onshore rather than shipping all of its resources to China, which has a commanding share of the refining process.

Refining creates higher-value lithium hydroxide, a chemical compound used in EV batteries. Western Australia now has two refineries, with a third due to be opened by SQM and Wesfarmers next year.

Australia’s resources minister Madeleine King said critical minerals such as lithium and rare earths required more processing than coal and iron ore, which Australia has historically focused on. “We have high ambitions and we want to compete with those who currently dominate the market.”

However, the push into refining has been plagued by delays, cost overruns, technical challenges and a lack of skills, meaning Australia’s challenge to China’s position has made slower progress than anticipated.

Mineral Resources backed out of an Australian refinery joint venture with Albemarle this year, citing the difficulty in competing with Chinese companies on cost. Ellison said his strategy was to now focus on “gathering up rock wherever I can”, including in the Goldfields, which he said was “known as the most prospective lithium ground in the world”.

Reddicliffe said companies such as Liontown and Azure, which had looked set to be swallowed up, now needed to prove that the value of their deposits lived up to industry expectations. “Geology is geology, but the big challenge is figuring out the economics of it.”

Comments