Asian riches push private bankers to up their game

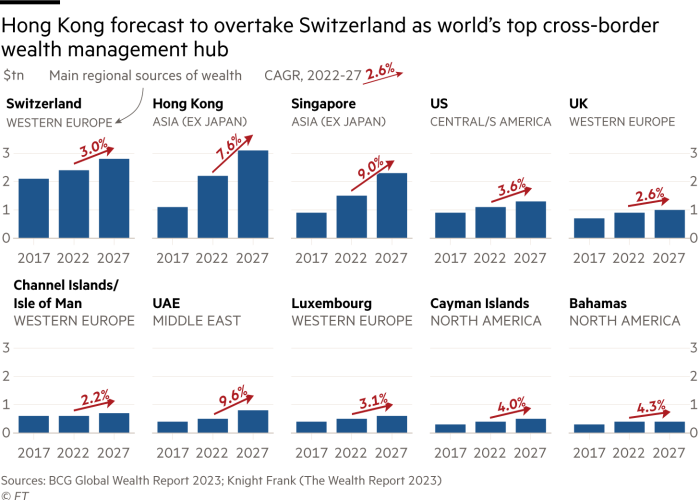

Global wealth is shifting — with Asia leading the way, in terms of forecast growth in financial assets over the coming years, according to a recent report from Boston Consulting Group.

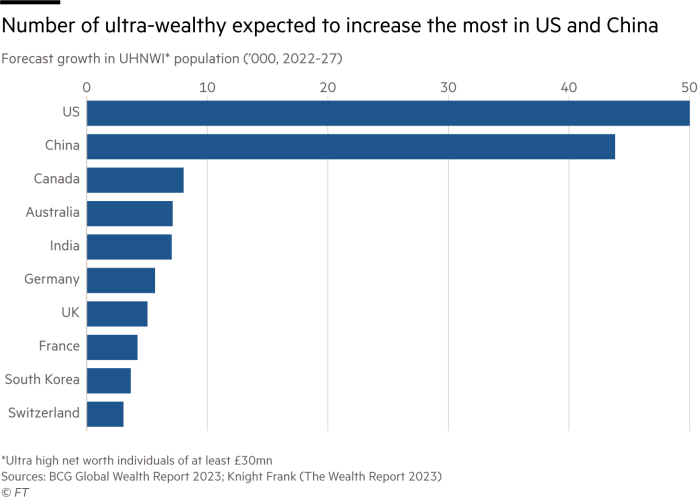

And it is a profound shift. Last year, HSBC forecast that Asia ex-Japan, as a region, will overtake the US for financial wealth by 2025, with Asian millionaires (outside Japan and China) expected to more than double in number by 2030.

Over that latter period, in India, the number of adults with net wealth above US$250,000 is expected to triple to 60mn, HSBC estimates — with similar growth trajectories in Vietnam, the Philippines and other Asean economies.

This growth has been fuelled by rising numbers of young, tech-savvy entrepreneurs — and they’re making a lot of money. Raymond Ang, global head of private and affluent banking at Standard Chartered, a familiar name in Asia for more than 160 years, highlights the extent of “growth in the ultra high net worth client segment”. He says it has been “driven significantly by wealth creation on the part of first-generation entrepreneurs”.

At the same time, Asian assets are moving within families — in what Kamran Azim, chief operating officer of RBC Wealth Management Asia, describes as “the greatest generational wealth transfer in history”.

Maggie Ng, head of wealth at HSBC Hong Kong says this combination of wealth creation and transfer “amounts to arguably the most compelling opportunity in consumer banking today”.

Unsurprisingly, these trends have spurred a flurry of activity among banks and wealth managers across the region, and beyond. In 2021, HSBC — already long established in Asia — announced US$3.5bn of investment to boost wealth management services there. Plans included the launch and expansion of global private banking in mainland China and India, a number of acquisitions and major digital investment.

UBS, having acquired Credit Suisse, has operations across 13 Asian markets and offers clients an “unrivalled geographical footprint”, scale and a range of investment solutions, according to Amy Lo, chair of UBS Global Wealth Management Asia. “Today, three out of five billionaires in the region have a relationship with us,” she points out.

Standard Chartered has been positioning itself as a leader in highly bespoke private banking for the very high end of the wealth spectrum. It says its focus is on the traditional “trusted relationship” between client and adviser, for the delivery of wealth planning, corporate and family advisory solutions.

These services reflect the wealth shift in the region. Ng at HSBC, for example, stresses that the bank’s approach is being driven by evolving customer needs: “As they accumulate wealth and progress through life, their needs and objectives tend to become more multi-faceted and complex,” she acknowledges.

Families, growing businesses and more global interests mean that advisers are under pressure to up their game in wealth preservation and succession planning services, as well as offering a broader range of investment choices and instruments.

Ng adds that there is also “a growing need for portfolio-level advice, as the sheer volume of information available to anyone at the tap of a finger means clients are more discerning about who they listen to and trust”.

In line with these trends, Asia has seen a proliferation of financial intermediaries (FIMs) in Asia in recent years, observes Jason Moo, chief executive of Bank of Singapore. “We expect FIMs’ market share of the business in Asia to trend upwards to levels more similar to that seen in the US and Europe,” he says.

Bank of Singapore’s assets under management from intermediaries grew by about 60 per cent from 2020 to end-2022, he notes. The bank is “sharpening its focus” with a dedicated family office advisory platform supporting single family offices, as well as FIMs.

Digitalisation is increasingly central to these wealth management services, especially for the younger generation of clients. For example, UBS has established a dedicated private client team to cater for younger, digitally focused clients who want an “omnichannel experience” when managing their wealth.

There has also been a response to the increasingly multigenerational aspect of wealthy families. At LGT Private Banking — which is owned by, and manages the wealth of, the royal family of Liechtenstein — this long-term intergenerational lens is central to its offering.

“The modern LGT client in Asia is now, typically, multigenerational in profile,” points out Lim Ping Ping, LGT’s vice-chair of Global Family Wealth Apac. “There is not only a respect for family heritage and legacy, but also an ambition to deploy capital strategically to achieve family goals.”

The multigenerational client profile can bring its own challenges, however. “We’ve increasingly seen diverging generational attitudes towards wealth management, how wealth should be invested, and how family businesses should be run or sold,” comments Azim at RBC.

That awareness has led RBC to build its own multigenerational teams to try to cater for the diverse perspectives and needs of clients of all ages, as well as “using financial education to help resolve conflicts around WM”.

In general, thought leadership and client learning are emerging as key areas of interest for the younger, entrepreneurial cohort of clients — and their bankers. In 2022, UBS launched two digital wealth management platforms: UBS Circle One delivers investment insights, actionable ideas and global networking; while WE. UBS was “the first digital-led wealth management platform set up by a global manager in China”.

LGT is also providing curated educational investment courses led by business and academic thought leaders, to meet client demand for more financial insights beyond the headlines.

Among the younger Asian client base, there is now strong interest in investing in sustainable solutions. As Jin Yee Young, co-head of UBS Global Wealth Management Asia, puts it: “Our next generation of clients have a strong sense of their ability and responsibility to use their wealth to create positive change in the world.”

Managers, therefore, provide a range of sustainable investment options. UBS also offers a networking “academy” to help connect wealthy individuals with each other and with environmental experts.

Sustainability is particularly well-embedded at LGT, driven by the Liechtenstein royal family’s own focus on the wellbeing of future generations. Ping Ping explains that some LGT clients are keen to embrace impact investing — whereby values and social outcomes matter as much as financial returns. Others “are simply curious to see if they can be early adopters in this rapidly evolving investment class”.

With so much more to play for in Asia, wealth managers are thinking laterally and digitally as they seek to meet demand.

Comments