Why your financial conditions index sucks

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Daniel Davies is a managing director at Frontline Analysts, the author of Lying for Money, and co-author of The Brompton.

Financial conditions indices, a wise economist once told me, are like dreams and assholes. Everyone has them, they’re not as unique as you’d think, and people are much more enthusiastic about studying their own than anyone else’s.

This was back in 2009, in the immediate aftermath of the financial crisis, when economists were trying to compensate for not having seen the crash coming by creating a really well-polished statistical rear-view mirror. A survey paper from that year compared the methodology of seven of them, all of which gave the same message: “things are terrible”. There was the Bloomberg FCI, Citi FCI, Deutsche FCI, Goldman Sachs FCI, Kansas City Fed Financial Stress Index, Macroeconomics Advisers Monetary and Financial Conditions FCI and the OECD FCI.

Some of these have since fallen by the wayside, but most are still maintained; some are proprietary and some pop up in sellside research from time to time. There’s also a Chicago Fed National FCI and a Vanguard FCI. And that’s just in the USA — many other central banks have compiled local versions and the Bank of England now has two. Check behind the sofa, you might find you’ve got a financial conditions index yourself. Is there a financial conditions index of financial conditions indices? Not yet, but there’s an academic paper on how to compile one.

What are they good for? As noted above, the real boom in FCIs came in the late ’00s, when they acted as a comfort blanket and a way of putting a chart on a slide where honest analysis would have put a picture of a dog drinking coffee in a burning room (or a less anachronistic late-’00s equivalent). But the purpose for which they were invented, and the reason they’ve stuck around, is they’re directly related to the core activity of sellside and policy economics — providing a convincing explanation tomorrow for why the thing you predicted yesterday didn’t happen today. Any time your model says that something should be happening with the relationship between interest rates and the economy, but it isn’t, you can point at your index, scratch your chin wisely and point out that what really matters is financial conditions.

As recently as a couple of weeks ago, financial conditions seemed to be the go-to argument for policy hawks like Catherine Mann and Jerome Powell. The case they made was that we shouldn’t believe our lying eyes when it comes to counting the number of rate hikes already made, because financial market developments were cancelling them out. Two or three bank runs later and with the perspective of hindsight, of course, the idea that financial conditions were easy and getting easier at the start of March seems a bit quaint.

So it’s worth asking – what does a financial conditions indicator actually measure, exactly?

Mentioning “index number construction” is a great way to stop getting invited to economists’ parties, because it’s both boring and annoying. Basically, some things are easier to add up than others. Unemployment is great, it’s just a headcount. GDP is a bit more tricky, but it’s basically a sum of transactions. Inflation is where things start getting problematic; the CPI basket is always a bit arbitrary, and comparisons over long periods of time or between countries are very questionable. But “financial conditions” don’t have a natural unit at all; is a 5% move in the SP500 bigger or smaller than a 20bp move in the single-A commercial paper spread? And even if you can get the different markets onto a similar scale by taking a z-score, how should you weight them?

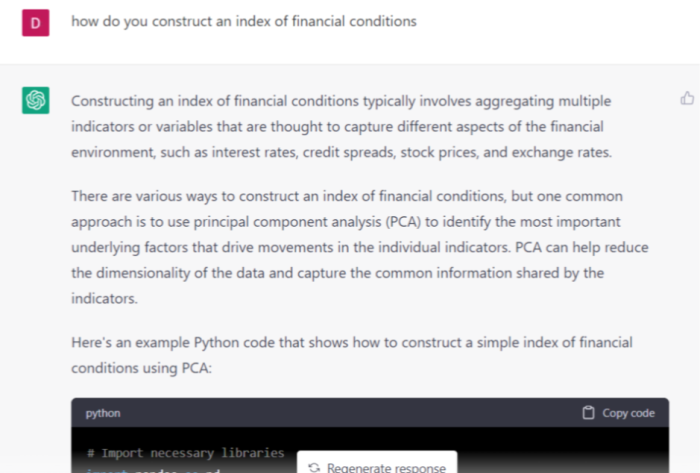

There are dozens of answers. Some FCIs do a Principal Component Analysis, like the ECB. Some do a regression and weight the components according to their correlation with GDP, like the OECD. You can detrend the components like the Bank of England, or use a Kalman Filter to calculate time-varying weights like the Nederlandsche Bank. You might use dozens of components like the Chicago Fed or four like Goldman Sachs. You don’t even have to do the work yourself these days:

The thing is, whatever method you choose, you will get a time series that has a huge spike in 2008 for the GFC, a somewhat smaller spike in 2012 for the Eurocrisis, another spike in March 2020 for the COVID shock, and which wiggles about uninformatively for the rest of the time, in a manner roughly correlated with stock markets and bond spreads. This accounts for the proliferation of roll-your-own FCIs by sellsiders — they’re easy to produce and nobody is in a position to gainsay you. It’s both good and bad news.

It’s good news because the fact that you get basically the same answer no matter what method you use suggests that there is some underlying thing that the indices are measuring. You might quibble whether this thing should really be called “financial conditions” rather than “risk on/off” or even “animal spirits”. But there’s a real signal in the data; it isn’t just a pure fitting of noise to noise.

It’s bad news too, though, because the existence of this big common factor means that the FCI isn’t really doing the advertised job of summarising the varied conditions of the whole complexity of the financial sector — it’s basically just a weighted average, that’s heavily driven by equity markets.

When financial crises happen and conditions suddenly tighten, it tends to come out of a blue sky. Because financial sector problems usually start in places where nobody was expecting trouble, they are always going to be linked to things which don’t have good data collected at all, or which have been stable for a long time – not things which get a large weighting in historically estimated indices.

In any case, because a financial conditions index has no natural unit, it can’t really be compared over long periods – as Catherine Mann points out, there’s no absolute answer to whether conditions are “loose” or “tight”, just a sense that if the line is going up they’re getting tighter and if they’re going down they’re getting looser. This means that the FCI, however cleverly constructed, isn’t giving more information than you could get by looking at a chart of share prices (with maybe a fleeting glance at a chart of bond spreads).

It’s an exercise in statswashing – however sophisticated the econometrics, all the financial conditions index is ever really used for is to dress up the old — and unpopular — monetary policy proverb that “if it isn’t hurting, it isn’t working”. Hopefully one small silver lining from the last couple of weeks may be that it will be a while before we hear about financial conditions again.

Comments