US bank stocks tumble and Treasuries rally amid SVB collapse

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

US bank stocks dropped and traders raced into government bonds on Monday after regulators moved to prevent the collapse of Silicon Valley Bank from spreading into the wider economy.

The KBW Nasdaq Bank Index fell 11.7 per cent on Monday in the US, with regional banks plummeting the most as investors worried smaller lenders could have fragile balance sheets. First Republic Bank fell 61.8 per cent, Western Alliance Bancorp lost 47.1 per cent, and KeyCorp dropped 27.3 per cent.

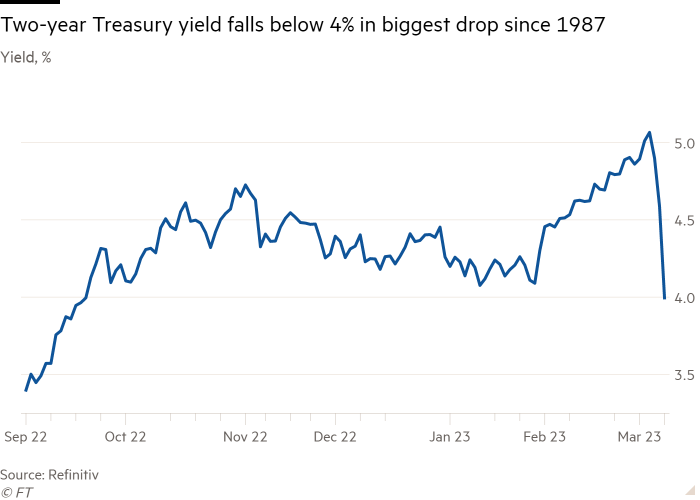

Traders flocked to the safety of sovereign debt as jitters spread through the market following regulators’ moves over the weekend to insulate customers from the failure on Friday of California-based SVB. The collapse also prompted traders to temper expectations of a big rate rise by the US Federal Reserve at its meeting this month, sending yields sharply lower.

The yield on the two-year US Treasury note, which is sensitive to interest rate changes, fell 0.62 percentage points to 3.96 per cent — its biggest single-day drop since 1987. German 10-year Bunds fell 0.21 percentage points to 2.25 per cent. Yields fall when prices rise.

“This is how asset cycles end, and now it converts to a credit crunch and the economy will move towards recession,” said Steven Blitz, chief US economist at TS Lombard. “All the shareholders and depositors are nervous, so what are you going to do? Expand your loan book? No, they’ll put cash and deposits back with the Fed.”

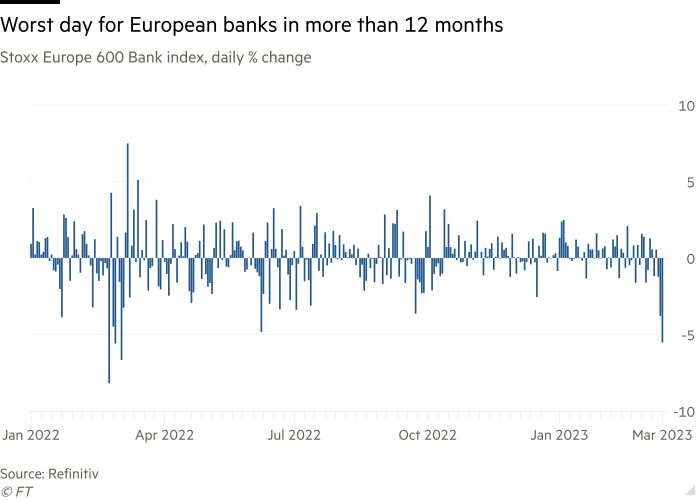

Among larger banks, Bank of America lost 5.8 per cent and Citigroup fell 7.5 per cent. In Europe, Credit Suisse shed 9.6 per cent and Commerzbank lost 12.7 per cent. The UK’s Virgin Money fell 9 per cent.

Neil Shearing, group chief economist at Capital Economics in London, said: “There’s a sense where markets are thinking that the Federal Reserve stepped in aggressively to stop problems spreading, but that doesn’t apply in Europe . . . cracks are starting to appear and it’s a reminder that if rates go up that could cause problems for [banking] institutions.”

The declines in some of the biggest bank shares pushed benchmark indices in Europe lower, with the Stoxx 600 closing down 2.4 per cent. The European Stoxx banking index dropped 5.8 per cent as investors worried about the value of banks’ bond portfolios.

However, broader US markets were more assured, with the blue-chip S&P 500 losing 0.2 per cent and the tech-heavy Nasdaq Composite gaining 0.5 per cent. Investors were assured by US regulators saying the bank’s depositors would be fully repaid in their attempt to shore up the banking system. The small-cap focused Russell 2000 Index was down 1.5 per cent in choppy trade.

Investors abandoned bets that the US central bank will raise interest rates by 50 basis points at its meeting next week, following the recent failure of three banks — SVB, Silvergate and Signature. Just over 50 per cent of traders expect federal funds rate to hold, with the rest betting on a quarter-point increase, according to Refinitiv. Traders bet interest rates would fall to 4 per cent by September.

However, the Fed will also closely watch US consumer price index numbers due to be released on Tuesday, as it determines the path forward for monetary policy.

“Until now we’ve had very little case against the Federal Reserve’s hawkish stance,” said Mobeen Tahir, director of macroeconomic research and tactical solutions at WisdomTree Europe. “[Silicon Valley Bank’s collapse] is the first real development to challenge that.”

London’s FTSE 100 fell 2.6 per cent after the UK government confirmed that the UK unit of SVB would be sold to HSBC. The CAC 40 in Paris fell 2.9 per cent.

Oil also fell, with Brent crude falling 2.4 per cent to $80.77 per barrel and US equivalent West Texas Intermediate dropping 2.9 per cent to $74.53 per barrel.

The dollar dropped 0.9 per cent against a basket of other currencies.

Equities in Asia were mixed. Japan’s Topix lost 1.5 per cent while Hong Kong’s Hang Seng index rose 2 per cent and mainland China’s CSI 300 rose 1.1 per cent on Monday.

At an annual session of parliament on Sunday, China announced it was keeping the head of the central bank and finance minister in their posts. The country’s credit growth in February was also higher than expected, bolstering economic recovery hopes.

Shanghai Pudong Development Bank, which owns a stake in a joint venture with Silicon Valley Bank’s China unit, lost 1.3 per cent.

Comments