Downfall of once-mighty Gars fund offers investors lessons

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The demise of Abrdn’s Global Absolute Returns Strategy (Gars) marks an ignominious end for a once-successful fund that turned sour.

As Abrdn announced last month, a fund that was worth £53bn at its 2016 peak is shutting with a value of just £1.4bn, after delivering seven consecutive years of disappointing performance for thousands of retail clients.

That’s painful for all involved. But Gars’ downfall has wider implications, with lessons for fund managers and investors alike — not least because rival funds with similar diversification-based investment strategies are still very much in business.

Gars was designed as an all-weather fund that could perform well irrespective of market conditions. That’s always a tall order as, by definition, the future is always uncertain.

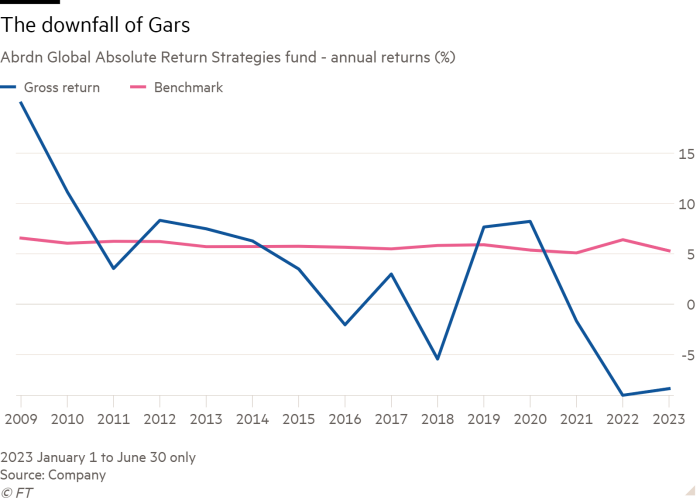

Gars aimed to deliver gross returns of 5 per cent above cash over rolling three-year periods by pursuing multiple strategies across the main asset classes.

The fund met the performance target between its launch in 2008 and 2015 but later failed dramatically to reach its objective. The gross return was -9.1 per cent for 2022 and -8.4 per cent for the first six months of this year.

“The promotional hype for Gars was incredible and the idea of a ‘holy grail’ all-weather strategy captured investors’ imagination. The closure highlights the necessity of questioning the slick marketing that often surrounds fashionable investment strategies,” says Amin Rajan, chief executive at the consultancy Create Research.

The team running Gars invested in equities, bonds, interest rates and currencies via bets on both short- and long-term trends.

The managers believed this highly diversified approach was less risky than a standard 60/40 equity-bond portfolio. The managers did well to begin with by wagering successfully on the bull market in bonds.

But, as market conditions changed, Gars struggled to maintain the momentum and suffered losses, including on trades linked to volatility and equity market positions.

For example, the latest update for the second quarter of 2023 showed Gars sitting on a lossmaking short position in US stocks along with wagers on US interest rates and US inflation-linked bond yields.

Charlie Morris, former head of absolute return at HSBC, says Gars’ huge size should have been a warning signal because delivering alpha — market-beating returns — becomes increasingly difficult as assets rise.

He believes the team running Gars became “far too risk averse” to achieve the fund’s performance target.

“They were overly obsessed about short-term capital preservation which prevented them from doing their real job which is to make money. Fund managers must have the confidence to ‘swing the bat’ to deliver alpha, as Warren Buffett shows,” says Morris, now chief investment officer at ByteTree Asset Management.

Charles Younes, head of manager selection at the data provider FE Fundinfo, says any investor that saw Gars as a one-tool solution for all their needs “got it very wrong.”

Diversification is essential in any portfolio. A single fund, even one implementing scores of different trades at the same time, as Gars did, will struggle to achieve full diversification, because at least some of the underlying investment assumptions will be shared.

“An investor can’t just buy one fund and hope to get a cash plus 5 per cent return without doing anything else. You need to be diversified across multiple strategies,” says Younes.

Gars’ clones established by Invesco and Aviva Investors, with the help of staff that left Standard Life, have also disappointed.

Invesco’s Global Targeted Returns fund has delivered gross annualised returns of 2.6 per cent since it was launched in September 2013, compared with 5.9 per cent for its benchmark. The Aviva Investors Multi-Strategy Target Return fund has delivered gross annualised returns of 3.1 per cent since its launch in July 2014, also well below its 5.8 per cent benchmark.

Numerous rivals, including funds run by BlackRock, Schroders, M&G, Fidelity and Baillie Gifford, also promise similar cash plus or inflation plus returns with significantly lower volatility than a purely equity-based portfolio.

But despite the apparent similarity of aims they should not be lumped together as, in practice each develops its own market analysis.

Toby Nangle, a former global head of asset allocation at Columbia Threadneedle Investments, says such targets provided a poor guide to the funds’ returns or risks.

“Managers’ self-appointed performance targets have been poor guides to returns. Investment approaches differ wildly across these diversified growth strategies. It is important to understand your manager’s approach,” says Nangle, who oversaw a direct competitor to Gars between 2013 and 2022.

As well as varying exposures across the main asset classes, absolute return funds can also operate with significant differences in overall portfolio volatility limits, the size of their cash holdings and short bets and also the extent of any hedging against adverse currency movements.

Gars generally operated with 20 to 35 high-conviction ideas. Too many, you might think, to explain to clients what it was doing.

Fundhouse, a research company, published a negative rating of Gars as early as August 2014 which questioned whether its management team could demonstrate investment skill — superior performance — across the entire range of its strategies.

Rory Maguire, managing director at Fundhouse, says Gars “looked well diversified at first glance” but the majority of its returns were derived from fixed-income related strategies while the bulk of the other 100-plus ideas had added little value.

The hit rate — percentage of ideas that delivered positive returns since Gars’ inception — was 56 per cent, says Abrdn. That’s comfortably above the industry average of under 50 per cent, on CFA institute data. Meanwhile, multiple banks competed to participate in derivative trades to ensure the fund fulfilled its best execution obligations, adds Abrdn.

Gars also emphasised patience, aiming for its bets to pay off over three years or longer.

“The macro landscape changes every day and you can’t sit for three years hoping that your views will play out. Investors don’t have the patience but more importantly, the fundamentals for those macro decisions change everyday,” says Younes.

Abrdn has decided that Gars’ remaining £1.4bn assets will be merged into a renamed Diversified Growth and Income fund following a review of its multi-asset team which will see at least 27 roles lost.

The restructured multi-asset team would deliver solutions that “meet or exceed performance expectations” and “bring the results our clients need today while being ready for the challenges of the future,” Abrdn says.

Investors in Gars’ UK fund classes can vote on the proposed merger at an extraordinary general meeting in late September.

The Edinburgh-based manager declined to be interviewed for this article and several former senior members of the Gars’ team did not respond to requests for comment.

Whether Abrdn can recover the trust of its former Gars’ clients is debatable: investors have again been left to ponder the old truth — if a financial company makes a promise which looks too good to be true, it almost certainly is.

Comments