Can Cathie Wood’s Ark crack Europe?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday.

Does the format, content and tone work for you? Let me know: harriet.agnew@ft.com

One scoop to start: Bill Ackman, the billionaire founder of hedge fund manager Pershing Square Capital Management, made a profit of about $200mn from his high-profile bet against US 30-year Treasury bonds, after exiting a short position he first announced in August.

Cathie Wood faces ‘tough nut to crack’ as Ark sets sights on Europe

Armed with messianic conviction and social media savvy, Cathie Wood has built a lucrative career pitching disruptive companies to US retail investors, write Chris Flood and Emma Boyde in London.

But even the 67-year-old acknowledges that her quest to bring Ark Investment Management, the Florida-based firm she set up in 2014, to Europe is a daunting one.

Europe is a “tough nut to crack,” Wood told the Financial Times. “We knew, as an American company, that Europe and the UK is the most complicated region in the world. We needed local talent and local leadership.”

Wood has long harboured ambitions to break into the $1.5tn European exchange traded fund market, but it was only last month that Ark took its first step with the acquisition of London-based Rize ETF, which manages more than $450mn.

The decision by Martin Gilbert’s AssetCo to sell Rize barely two years after acquiring it points to the obstacles in breaking the dominance of the 10 players — among them BlackRock, Amundi and DWS — who control more than 90 per cent of the ETF market in Europe.

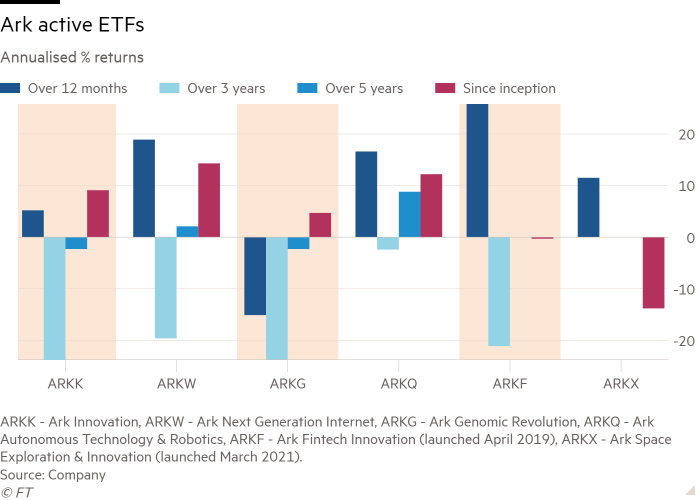

Alongside Ark’s poor performance and questions over whether her evangelism could misfire in Europe, Wood and Ark will need to overcome several hurdles.

In many European countries, asset managers can pay financial advisers a commission to recommend an actively managed mutual fund. ETF providers do not pay any similar incentives, which has slowed their adoption by financial advisers in Europe.

ETF trading in Europe is conducted across multiple exchanges, dividing liquidity and increasing transaction costs. Meanwhile, distribution channels for selling ETFs also vary across the continent, which will require Ark’s salesforce to win orders from a mix of fund supermarkets, banks, brokers, wealth managers and financial advisers, alongside individual retail investors. And unlike in the US, ETFs do not offer tax advantages in Europe.

Amin Rajan, chief executive of the consultancy Create Research, cautioned that almost every small ETF manager had failed to gain critical mass in Europe, before adding that “if there is anyone that can, then it is Cathie Wood”. Read the full story here

How investors lost their love for UK property funds

Investors in UK property funds have had their ups and downs since the Brexit vote. Now they are losing patience, writes my colleague Sally Hickey in London.

Earlier this month, fund manager M&G announced plans to close its £565mn property fund and return cash to clients, citing declining interest from retail investors, and St James’s Place suspended trading in its £829.5mn property unit trust after a surge in redemption requests.

A third property fund, run by Canada Life Asset Management, at the beginning of the month announced plans to close for the same reason.

It is not the first time UK investors have had this experience. Property funds have lived through rushes for the exit and temporary closures on and off since 2016.

But rising interest rates have caused a marked shift in investment away from these funds, which come with worries about rising debt costs and empty post-pandemic offices, and towards fixed income and cash products which look more attractive and safer.

Max Nimmo, a real estate analyst at stockbroker Numis, pointed out the particular problems for “open-ended” property funds, which allow daily dealing when the underlying asset is inherently illiquid.

“After several fund gatings in recent years, confidence in the open-ended vehicles has continued to dwindle,” he said. “We are surprised it has taken this long for the market to accept this.”

Redemptions from UK property funds have been consistently high over the past year, with between £50mn and £190mn taken out on a net basis each month, according to Morningstar. The market has shrunk to £10.4bn at the end of September, from a peak of £35bn in April 2016.

Read the full story here

Chart of the week

When UK regulators probe what private assets are really worth, they are likely to find a mix of rigour, guesswork and wishful thinking, write my colleagues Laura Noonan, Josephine Cumbo and Arjun Neil Alim in London.

The Financial Conduct Authority is expected to begin its review this year — a critical moment of scrutiny for a sprawling asset class that pension funds and other investors piled into as they hunted for returns during the long era of low interest rates.

Regulators have three reasons to be worried. Private assets more than doubled between 2017 and mid-2022, accounting for a record share of global financial assets, leading to fears that an upset there could ricochet across broader markets.

Rising interest rates and slowing economic growth represent a danger to some private equity models, as highlighted by regulators including Iosco, which recently warned about difficulties in refinancing assets and potential fire sales.

The method for valuing the assets is a grey area. Owners are required to hold assets at “fair value” under accounting rules. Typically, private equity firms will use the valuations of comparable public companies as a guide for audits and investors. How accurate these are will only be determined when the asset is sold.

Judgment carries risks, especially when managers are incentivised to present a rosy picture for as long as they can, particularly if they are seeking to raise money from investors. It often also suits investors such as pension funds to cling on to upbeat, but stale, valuations.

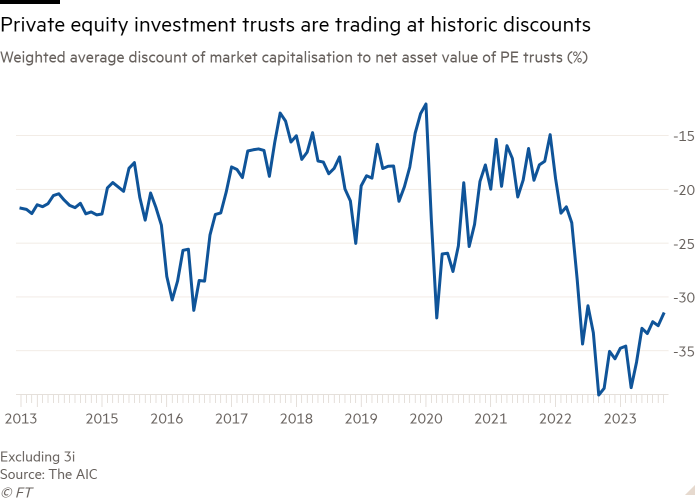

Valuation gaps are most apparent in listed private equity trusts, which trade on stock exchanges and should trade close to the value of their assets.

UK private equity trust net asset values are currently about 30 per cent above share price valuations, data from the Association of Investment Companies shows. That gap is close to a historic high, suggesting that share prices are cheap or asset valuations far in excess of what could be achieved in a sale tomorrow.

Nick Britton of the AIC said the private equity managers are “all saying the same thing: the valuations at which they’re holding investments on their balance sheets they believe are conservative and the evidence they’re presenting is that when they’ve exited investments in the last decade, it’s consistently been at an uplift to their valuation”.

While listed private equity has traded at a discount since the financial crisis, “they’re struggling to understand how extreme it is at the moment”, he added.

Five unmissable stories this week

Investors including Pimco, Janus Henderson, Vanguard and BlackRock are snapping up US government bonds with longer maturities, betting the pain in the Treasury market is nearly over and an elusive slowdown in the US economy may be on the horizon.

The pension fund looking after the retirement savings of Britain’s MPs and ministers has given the cold shoulder to UK companies, in spite of efforts by chancellor Jeremy Hunt to funnel more cash into domestic investment.

Brookfield and the Qatar Investment Authority, the owners of Canary Wharf Group, will inject £400mn of fresh capital into the London office district, which has suffered the departure of key tenants as companies cut back office space in response to hybrid working.

A New York jury has convicted Neil Phillips, the high-profile manager of a London-based hedge fund previously backed by George Soros, over an alleged scheme to manipulate the US dollar to South African rand exchange rate as part of a ploy to trigger a $20mn options payment.

Investors are punishing companies that report disappointing earnings or outlooks with unusually harsh share price declines, in an illustration of the tougher attitude emerging in the high interest rates environment.

And finally

Swiss multimedia artist Rolf Sachs brings a retrospective spanning two decades to Sotheby’s, from now until November 6. Accompanying the exhibition is a jewellery and design pop up, St. Moritz Pops Up At Sotheby’s. St Moritz is where Sachs converted the Olympic stadium used in the 1928 and 1948 Winter Olympics into a family residence. The striking pavilion housed rooms for officials and umpires and still has the Olympic flame on its tower.

FT Live event: Future of Asset Management Europe

Hosted by the Financial Times, in collaboration with Ignites Europe, Future of Asset Management Europe is taking place on 14-15 November at the Carlton Tower Jumeirah in London. The two day event will bring together senior leaders from Europe’s leading asset and wealth management firms, including BlackRock, Legal & General and Federated Hermes. For a limited time, save up to 20 per cent off on your in-person or digital pass. Register now

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. Sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

Comments