US bond funds rake in more cash despite inflation fears

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

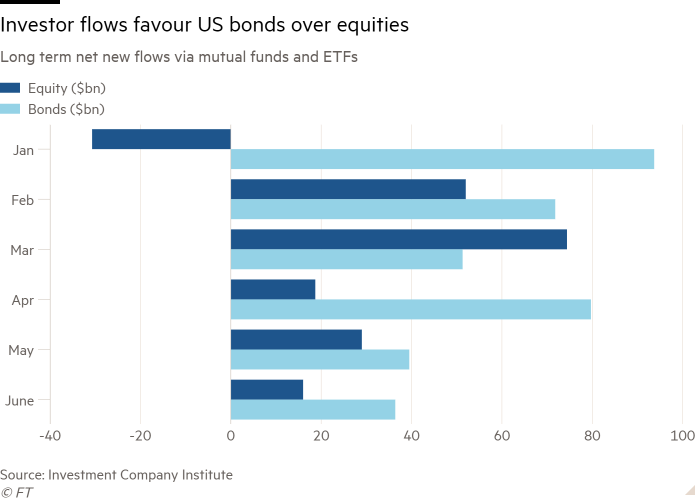

Net inflows into US bond funds are far outpacing those for comparable equity instruments this year, confounding expectations that inflation fears would erode the appeal of fixed-income holdings.

Bond mutual funds and exchange traded funds have added $372bn as of June 23, compared with a gain of $160bn for equities, according to the Investment Company Institute. Bond funds are on pace to eclipse the $446bn of inflows in 2020 and $459bn in 2019.

Analysts attributed the popularity of bond funds — which do not include money-market holdings — to concerns about lofty stock valuations and an ageing population’s need for steady income during retirement.

“Financial advisers follow asset allocation models and portfolio rebalancing and demographics are strong trends,” said Shelly Antoniewicz, ICI senior director of financial and industry research. “The cumulative flow to bond funds lines up nicely with the percentage of the population over 65 years.”

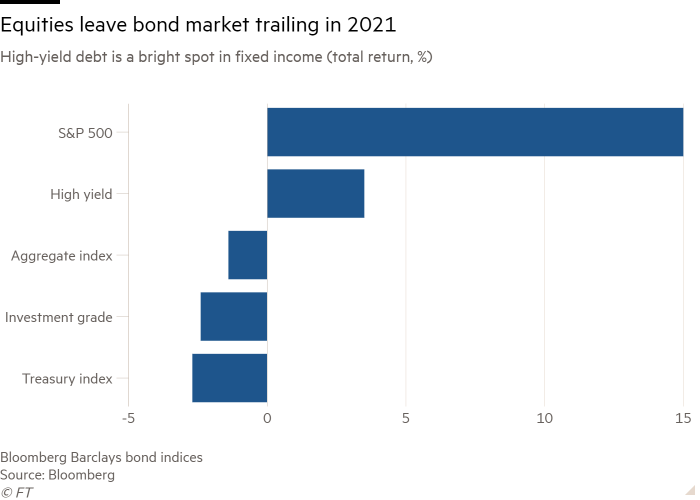

The preference for fixed-income securities came as equities outperformed bonds. The S&P 500 has gained 15.9 per cent, including the reinvestment of dividends, so far in 2021, and commands its most expensive valuation since the internet boom of 2000.

Total returns from high-quality government and corporate bonds remain negative this year. Their performance was hit hard as US 10-year bond market interest rates rose early in 2021 on expectations that large-scale fiscal and monetary stimulus would lead to a strong economic recovery — and hotter inflation.

Financial advisers have played a role in boosting bond funds by urging clients to maintain a balance between equities and fixed income. Periodic portfolio rebalancing involves selling assets that do well and buying those that have lagged. Pension plans have also been switching from equities to long-dated bonds to meet the needs of retirees.

“Pension plans are today at much better funding levels and it is a prudent strategy to lock in their equity gains and immunise the portfolio against the risk of a large drawdown in stocks,” said Mark Vaselkiv, chief investment officer of fixed income at T Rowe Price. “We expect a further rotation into bonds from asset allocators.”

Erin Browne, portfolio manager of multi-asset strategies at Pimco, said higher interest rates in the US than in Europe or Japan had also provided “a powerful driver of foreign buying demand for US fixed income”.

US bond flows this year have been spread across mutual funds and ETFs. Investors have favoured actively managed funds that can mitigate losses from rising market interest rates as well as inflation-protected bonds, floating-rate debt and municipal paper that provides tax-free income.

Equity investors have preferred ETFs to mutual funds, which have experienced outflows this year, according to the ICI.

Comments