Central bank and consumer buying in India and China arrest gold’s slide

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Gold buying by central banks and consumers in India and China is stirring hopes for a recovery in the market, which has been hit by a wave of selling this year driven by large exchange traded fund outflows.

The metal has staged a tentative recovery in the past fortnight, rising about 2 per cent as a handful of bullish factors have converged.

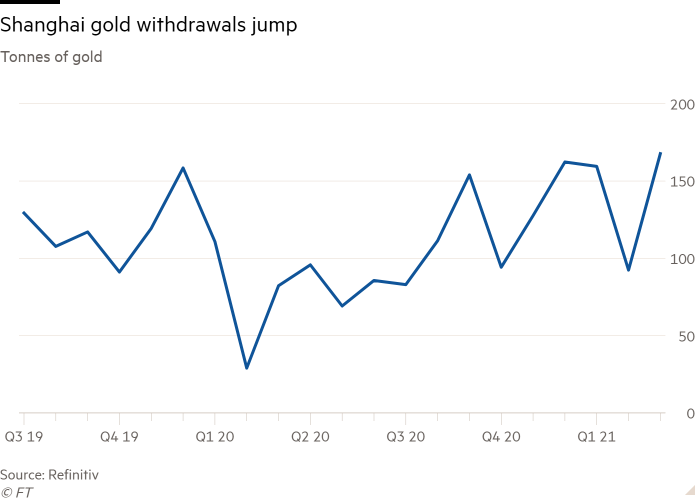

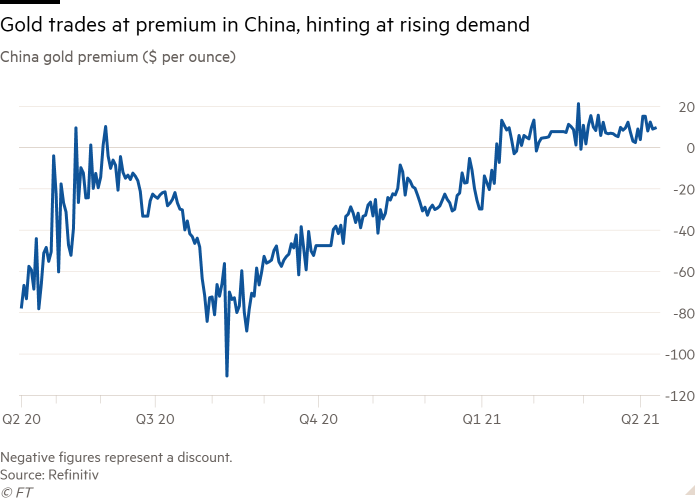

Two indicators have pointed to robust demand in China, the world’s biggest consumer. The price of gold in the country has traded at a premium to international prices in recent weeks, from a discount in 2020. At the same time, the amount of gold withdrawn from the Shanghai Gold Exchange doubled in March from a year earlier to 168 tonnes, according to exchange data.

Much of this gold will have been used to restock inventories in the manufacturing and retail sector following a strong period during the Chinese Lunar New Year in February, according to John Reade, chief market strategist at the World Gold Council.

“It’s a reflection that demand was strong and is expected to be decent going forward,” he said.

Demand for gold jewellery has also rebounded in India, where imports hit a near two-year high in March of 98.6 tonnes, according to Bloomberg.

“There’s been a sea change in sentiment in Asia,” Rhona O’Connell, an analyst at brokerage StoneX in London, said. That could provide a floor for gold prices if central bank gold demand also remains strong, she said.

Central banks bought 8.8 tonnes of gold in February, driven by India, Uzbekistan, Kazakhstan and Colombia, according to the World Gold Council, an industry body made up of gold miners.

Still, in the first two months of the year overall, central banks were net sellers of the metal, with sales totalling 17 tonnes, led by Turkey — the weakest start in more than a decade.

Hungary said last week it had increased its gold holdings from 32 tonnes to 95 tonnes in March, after “taking into account the country’s long-term national and economic policy strategy objectives”.

“The appearance of global spikes in government debts or inflation concerns further increase the importance of gold in national strategy as a safe-haven asset and as a store of value,” Hungary’s central bank said.

Gold is still off about 8 per cent in 2021 despite the recent pick-up as investors have shifted money into equities following the rollout of coronavirus vaccines in the US and Europe. The precious metal has fallen out of favour in part due to rising bond yields, which make gold less attractive since it does not provide investors with a fixed income stream.

Persistent outflows from gold-backed exchange traded funds present another headwind, analysts say. The funds, which can be bought and sold like a stock, were responsible for driving gold to a record high of above $2,000 an ounce last August.

Since November 2020, however, gold ETF holdings have fallen nearly 9 per cent in tonnage terms, “on a par with the approximate loss in the price of gold over the same period”, according to the World Gold Council. Holdings in gold-backed ETFs fell by 108 tonnes, or $6bn, in March alone — the fourth month of outflows.

Investors will need to be convinced that physical demand is returning, O’Connell said.

“As the physical market strengthens it can absorb the metal out of the ETFs, up to a point, helping to put a cushion under the weakness of the price,” she said.

Comments