Bitcoin ETF boost cuts two ways for Coinbase

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Coinbase investors should be in celebratory mood. The crypto-trading platform last week posted its first quarterly profit in two years. Trading volume bounced back towards the end of last year as a bitcoin rally and expectations that regulators would approve the creation of the first spot bitcoin exchange traded funds triggered renewed interest in the token.

Having surged nearly 400 per cent in 2023, shares in Coinbase are about flat this year.

The excitement was premature. While the Securities and Exchange Commission did give the greenlight to 11 bitcoin ETFs in January, the long-term benefits to Coinbase are not clear cut.

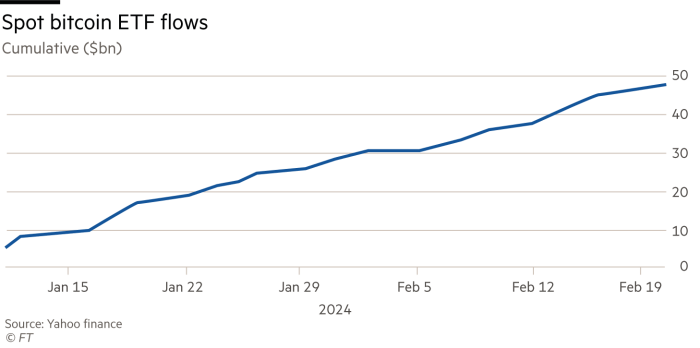

Spot bitcoin ETFs offer investors exposure to the world’s largest cryptocurrency without directly holding it. The funds, which include those from BlackRock, Franklin Templeton and Invesco, have attracted net inflows of nearly $4bn, according to ETF.com.

Coinbase stands to benefit by acting as the custodian for the bitcoins held by these funds. Although the $69.5mn it made from custodian fees in 2023 accounted for just 2.2 per cent of total group revenue, the figure should rise this year. The company has said that it serves as custodian for eight of the 11 spot bitcoin ETFs.

The downside is that margins from custody are thin. Mizuho reckons Coinbase earns a fee of around 0.07 per cent for its service. That compares to trading commissions of as much as 0.6 per cent that it can charge customers every time they buy or sell cryptocurrencies.

The bigger worry is that the rise of low-cost spot bitcoin ETFs will give investors fewer reasons to trade actual bitcoins. For Coinbase, a volume drop in the trading business could quickly offset any gains from the custody of assets.

So far, Coinbase says it has not seen evidence of cannibalisation. First-quarter subscription and services revenue could grow by as much as one-third year on year to $410mn-$480mn, the company said.

It is not clear how much of that growth is coming from interest income that it earned on its stablecoin reserves and other products. This has become an important revenue stream, growing 150 per cent last year to around $868mn — or 30 per cent of total group revenue.

Coinbase’s valuation looks full. The shares trade on 14 times revenue, up from 3 times a year ago. That is more than twice the multiple for Robinhood. Larger and more profitable exchange operators Cboe and the London Stock Exchange are on 5 times and 6 times respectively. Another reason, then, for investors to avoid getting swept up in crypto’s ETF frenzy.

Comments