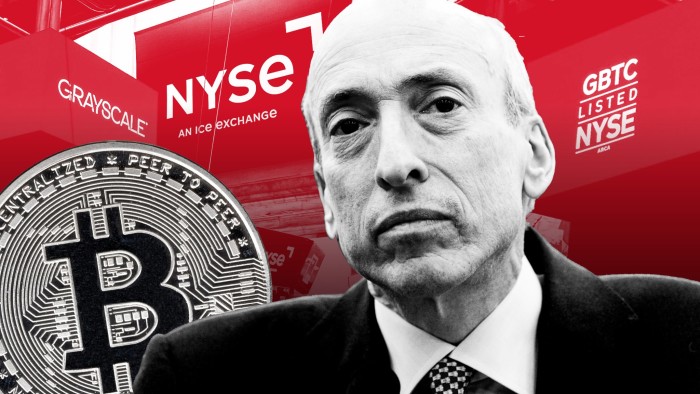

Gensler loses key bitcoin battle

Simply sign up to the Cryptocurrencies myFT Digest -- delivered directly to your inbox.

Hello and welcome to the first edition of the FT’s Cryptofinance newsletter for 2024. This week, we’re shining the spotlight on Gary Gensler’s crypto record.

On my way to work this morning I overheard a commuter: “Sometimes the new year at work starts slow, other times it hits you like a train.”

One person who would probably agree is US Securities and Exchange Commission chair Gary Gensler, who this week cast the deciding vote that approved 11 bitcoin spot exchange traded funds. It grants the coin Wall Street legitimacy, but leaves the self-proclaimed crypto cop on the beat with a shaky legacy on digital assets.

Under Gensler’s leadership the SEC has earned a hard-hitting reputation, issuing a series of lawsuits against many of the crypto industry’s biggest players. Platforms such as Kraken have felt the full force of the regulator, discontinuing its staking programme in the US and paying $30mn in a settlement in February last year.

Kraken is also fighting separate charges filed by the SEC in November that it allegedly operated as an unregistered securities business. The agency’s most high-profile lawsuits against Coinbase and Binance are still open too, so it remains to be seen how successful the SEC’s offensive will be.

Up until this week, it also staunchly opposed bitcoin spot ETFs, earning praise from crypto’s plentiful naysayers in the process.

But to paraphrase a famous saying: it takes decades to build a reputation and seconds to destroy one.

“This decision is unfortunately not just going to undermine Gensler’s record, but even worse, I am concerned it’s going to undermine the SEC’s credibility more broadly,” Dennis Kelleher, chief executive of non-profit Better Markets, told me.

The SEC’s fundamental point against spot bitcoin ETFs has long been that the cryptocurrency trades on largely unregulated markets and thus its price is prone to manipulation. Straightforward, right?

That view came under scrutiny last year after a judge in Washington DC found the regulator to be “arbitrary and capricious” when it rejected asset manager Grayscale’s attempt to launch a spot bitcoin ETF, claiming it failed to justify treating bitcoin spot and future products so differently.

The problem was that the SEC had already given the green light to bitcoin futures ETFs — similar products that track the price of futures traded on the CME in Chicago rather than the price of the underlying asset, which are traded on unregulated exchanges.

In Gensler’s defence, if a regulated entity like the CME and a federal agency like the Commodity Futures Trading Commission are satisfied that it’s not a manipulated market, then it’s hard for the SEC to turn down a bitcoin futures ETF.

So once the court ruled that the SEC needed to more clearly distinguish between bitcoin futures and spot products, it was likely that Gensler would eventually have to yield.

“We are now faced with a new set of filings similar to those we have disapproved in the past. Circumstances, however, have changed,” the chair said in defence of his agency’s decision.

But some argue that the arrival of bitcoin ETFs changes little. “Bitcoin in an ETF is still bitcoin, with all of its Ponzi-like nature and all of its manipulability,” said Hilary Allen, professor of financial regulation at American University, adding “for the uninitiated, seeing it in an ETF might seem to convey a sense of legitimacy, they might not realise that it’s just lipstick on a pig”.

It’s worth reminding ourselves just how disorderly those unregulated exchanges — which have been bitcoin’s most natural home since its inception — have been.

Since the SEC approved bitcoin futures ETFs, FTX has gone down as one of the largest frauds in American history, and Binance paid a whopping $4.3bn fine to settle criminal charges.

“Well-known financial firms getting involved gives Main Street Americans a false comfort,” added Kelleher, saying the fact the SEC will oversee issuers is “completely meaningless because the price of the ETF is based on the price of the bitcoin spot market, and there is no cop on the beat there”.

And when Gensler’s time as chair is all said and done, he may not have even brought the crypto crowd onside, despite having ushered in a potentially revolutionary wave of new money for the sector.

“I don’t know if anyone in crypto is going to be praising Gensler,” Jeremy Senderowicz of law firm Vedder Price, told me, adding: “If only because he was forced to approve these at the point of further court battling. So, in that respect, crypto will probably be more appreciative to the courts than to Gensler.”

What’s your take on Gary Gensler’s crypto record after this week? As always, email me at scott.chipolina@ft.com.

Christmas highlights

We were off for Christmas but crypto never stops. Here’s some highlights from the holiday period.

Crypto’s latest market frenzy prompted bitcoin mining firms such as CleanSpark and Bitfarms to splash more than half a billion dollars on new equipment in December in a bid for a bigger share of the bitcoin mining market.

Bitcoin miners weren’t the only ones splurging: the world’s largest crypto companies such as Coinbase, Circle and a16z, the crypto investing arm of venture capitalists Andreessen Horowitz, have started pouring funds towards electing pro-crypto politicians in election year.

The Department of Justice stole headlines last month after successfully prosecuting FTX’s former chief executive Sam Bankman-Fried and Binance’s former chief executive Changpeng Zhao, a one-two blow that I’m sure was the envy of Securities and Exchange Commission chair Gary Gensler. Catch up on how the DoJ became crypto’s top cop here.

And finally, to bring you up to speed this week: stablecoin operator Circle confidentially filed for an IPO, just one day after the SEC controversially approved spot bitcoin ETFs.

Soundbite of the week: Bitcoin ETFs are no endorsement of bitcoin

Gary Gensler’s reluctance to approve spot bitcoin ETFs couldn’t have been much clearer, as his statement accompanying the decision laid out.

That said, its chair did not shy away from sharing his view on the merit — or lack thereof — behind America’s latest ETF products.

I’d note that the underlying assets in the metals [exchange traded products] have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing.

While we approved the listing and trading of certain spot bitcoin [exchange traded product] shares today, we did not approve or endorse bitcoin.”

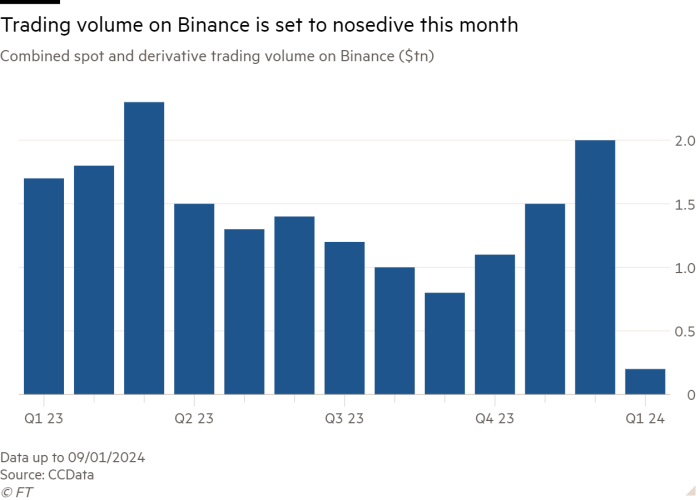

Data mining: Binance’s uncertain future

The advent of spot bitcoin ETFs not only marks a new era, it also spells potential trouble for the existing crypto market.

At Binance, the world’s largest exchange, combined monthly spot and derivatives volume have dropped sharply. In January last year it recorded total volumes of $1.7tn, according to CCData. By January 9 this year the exchange had traded roughly $200bn.

Of course, Binance’s multiple run-ins with US authorities since then should be taken into account, but it traded $2tn only in December.

An anomaly or the start of things to come? We shall see.

FT Cryptofinance is edited by Philip Stafford. Please send any thoughts and feedback to cryptofinance@ft.com.

Comments