Italy’s bond rally forces key measure of risk to lowest since 2018

Simply sign up to the Sovereign bonds myFT Digest -- delivered directly to your inbox.

A rally in Italian debt has pushed the perceived risk of holding it to the lowest level in two-and-a-half years, as investors bet on further bond buying from the European Central Bank.

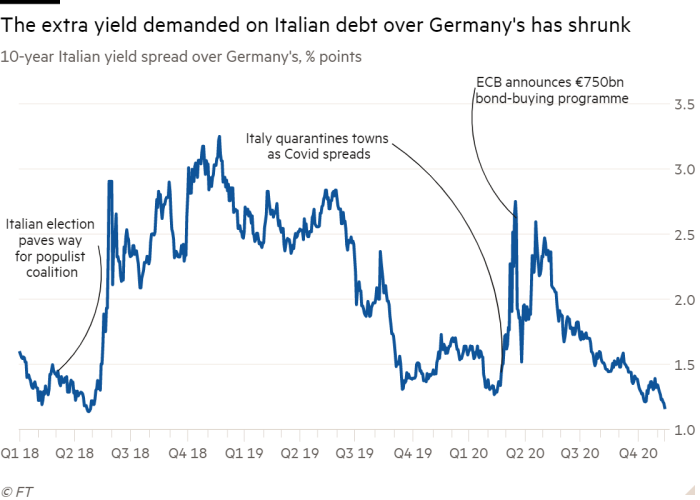

Investors see the gap between Italy’s borrowing costs and those on super-safe German debt as a barometer for political tensions both in Italy and the euro area as a whole.

Last week, the extra yield demanded by investors to hold 10-year Italian bonds rather than their German equivalents shrank to less than 1.2 percentage points — the tightest since April 2018.

The latest catalyst came from ECB chief Christine Lagarde, who dropped a strong hint in a speech on Wednesday that the ECB was preparing to scale up its bond purchases and cheap loans to banks next month, in an effort to keep a lid on borrowing costs. It was the job of monetary policy, she said, to ensure “favourable financing for the whole economy: private and public sectors alike”.

The spread ballooned after a March 2018 general election in Italy paved the way for a populist coalition that repeatedly clashed with Brussels over EU budget rules. That government collapsed the following year.

The risk measure spiked again in March this year as the economic impact of the Covid-19 pandemic hit Rome’s public finances, reawakening doubts over the sustainability of its vast public debt. Ms Lagarde added fuel to the sell-off when she said the ECB was not there “to close spreads”.

Later that month, the central bank repaired the damage by announcing a €750bn bond purchase programme, which was scaled up to €1.35tn in June. The ECB is widely expected to deliver a further expansion next month to bolster an economy struggling with a second wave of the Covid-19 pandemic.

Italian spreads have tightened further in recent weeks, and more so after last week’s apparent vaccine breakthrough dented demand for haven German Bunds.

“It’s ‘heads I win, tails you lose’ for peripheral bonds,” said Rabobank strategist Richard McGuire, referring to the euro area’s riskier borrowers. “A second wave of the virus has been supportive for the likes of Italy because it implies additional stimulus from the ECB, but a vaccine has helped too because it means less damage to the economy.”

Comments