Indonesia hopes global investors will follow the carmakers

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

With the world’s fourth largest population, a flourishing middle class, a digitalising economy and five of the seven critical minerals for making electric batteries, Indonesia has long been considered a sleeping giant of great potential.

At a conference held by UOB Asset Management in March, Colin Ng, head of Asia equities for the financial services group, called Indonesia, a “sitting jackpot”. “When you invest in Indonesia, you are basically investing in the future,” he said.

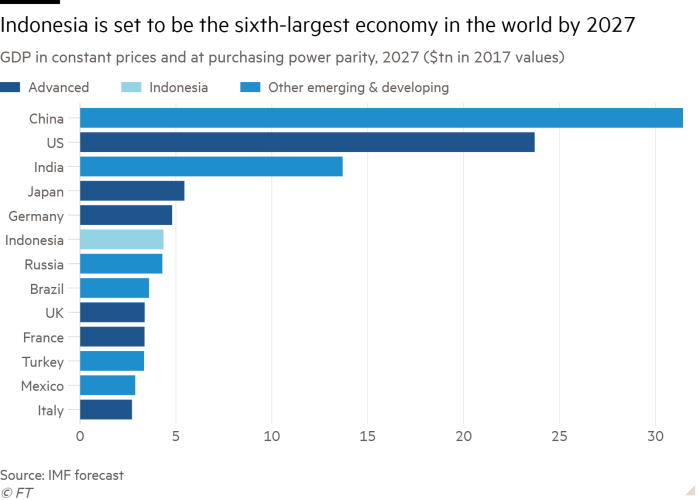

For Indonesia’s economy — the largest in south-east Asia — the global shift to producing electric vehicles has provided a strong tailwind. The country has abundant reserves of nickel — a key mineral for creating batteries — and is aiming to become a hub for the new energy supply chain.

Investor interest has followed that of the major carmakers. The number of investors in Indonesia’s capital markets has grown from 1.1mn at the end of 2017 to almost 12mn at the end of October 2023, according to Trimegah Asset Management, a major asset management business in Indonesia — a 10-fold increase in just six years.

“The majority of growth [was] driven by the availability of digital financial platforms that made it easy for people, especially the younger generation, to invest,” explains Antony Dirga, chief executive at Trimegah.

Among these investors are wealthy individuals from around the world, who have opened banking facilities in the country. According to government data, as of the quarter ended September 2023, total deposits in Indonesia had reached 8,203tn rupiah ($529bn) — a 35 per cent increase from the end of 2019. And the number of accounts increased by 77 per cent, from 301mn accounts to 535mn.

Vera Margaret, executive director and head of deposit and wealth management at UOB Indonesia says the number of customer information files — electronic records of bank customers — has grown fourfold in the past three years, after it launched digital banking in the country.

But she believes Indonesia must do more if it wants to lure more wealthy individual clients away from global family offices or big private banks in Hong Kong or Singapore. That will mean offering a greater variety of financial products, as well as making such services more accessible to middle-income clients, Margaret says.

So far, fund inflows have been disappointing. Although wealth managers and supply chain executives agree on the potential of Indonesia, the country of 277mn people has struggled to translate that interest into broader, international investment.

The local fund management industry had 508.19tn rupiah ($32.5bn) of assets under management (AUM) at the end of 2022, a 12.4 per cent decline from 579.93tn rupiah ($37.1bn) in 2021, according to figures from the Financial Services Authority of Indonesia. In addition, AUM stood at about 4 per cent of GDP, compared with 25 to 30 per cent in Malaysia and Thailand.

“The tax and administrative situation here is not at all conducive to the establishment of domestic family offices and wealth management infrastructure,” argues Eugene Galbraith, director at mobile phone tower company PT Protelindo, and a longtime observer of Indonesian business. However, the more mass affluent, that is to say high end-focused wealth management businesses have seen “some growth”, he adds.

Some of the problems holding back Indonesia’s manufacturing sector help to explain the difficulties that wealth managers encounter.

“Indonesia has been fantastic at attracting investment in tech start-ups, for example, thanks to its large domestic market,” says Steven Westervelt, Singapore head of global investigations firm Nardello & Co. “There are many businesses filling and creating the needs of Indonesian people. But, in terms of making products and selling them to the global market from the US to Europe, they have not been as successful.”

High costs, unclear tax regulations and opaque bureaucracy have dogged Indonesia’s attempts to persuade more multinationals to build domestic factories and provide a broad boost to its economy, beyond its mining sector, experts say.

High tech companies such as Apple, Sony and Samsung have picked neighbouring countries over Indonesia to expand in, and to manufacture their goods, as they diversify away from China.

Indonesia has not been able to compete effectively. At 22 per cent, its corporate tax rate is not much higher than Vietnam’s 20 per cent, notes Thomas Hansmann, head of operations practice for south-east Asia, at consultants McKinsey & Company. “But Vietnam offers tax breaks and incentives like tax free periods,” points out Hansmann. As a result, a company like Samsung, in effect, pays about 5 per cent in tax in Vietnam.

Even Indonesia’s individual taxes can be difficult to navigate — a factor that many high net worth individuals and wealthy investors take into account, says Galbraith.

Logistics and skilled labour are the other economic hurdles. Despite huge investment by the Joko Widodo government in upgrading ports, toll roads, airports and other infrastructure, logistics costs remain high.

“Logistics costs in Indonesia as a percentage of GDP are 26 per cent,” calculates Vivek Luthra, a managing director specialising in supply chain and operations at Accenture. “Most other south-east Asian countries are around 15 per cent.”

Qualified staff can be hard to find, too. Much of Indonesia’s large labour force lacks the skills that international corporations need. There is an “education gap” compared with countries such as Vietnam and Malaysia, says Westervelt, which is why so many high-tech companies have gone elsewhere.

Such entrenched problems have held back the development of the financial services sector in Indonesia’s economy — such as capital markets and wealth management — experts conclude.

But improvements in per capita income offer some hope. The World Bank estimated that Indonesia’s gross national income (GNI) per capita was $4,580 in 2022 — higher than India but lower than Malaysia or Thailand. Cleaning up Indonesia’s economy and becoming more attractive to foreign groups could help lift the country out of this so termed middle-income trap in which it has been stuck for years.

“When the country’s GDP per capita exceeds $5,000, people tend to have excess savings available for investments after paying for basic necessities such as food, clothings, mortgages and auto loans,” explains Dirga.

This year, Indonesia’s GDP per capita is predicted to finally reach $5,000 — which Dirga thinks could give the wealth management industry the potential to reach $150bn to $200bn AUM within the five to seven years.

“[This is] still small in a global context, but Indonesia will probably be among the few countries whose wealth management sector will achieve high double-digit growth in the coming years,” he predicts.

Comments