Commodities explained: Iran’s return to the global oil market

Simply sign up to the Oil myFT Digest -- delivered directly to your inbox.

The prospect of Iranian crude oil returning to the market has heaped further pressure on prices this week. Brent, the international oil benchmark, sank to 2003 lows of less than $28 a barrel. But just how quickly can these additional Iranian barrels make their way to customers?

Production promises

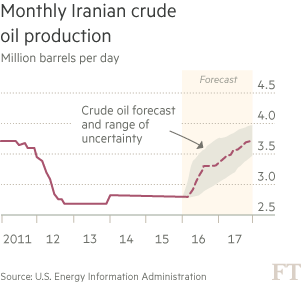

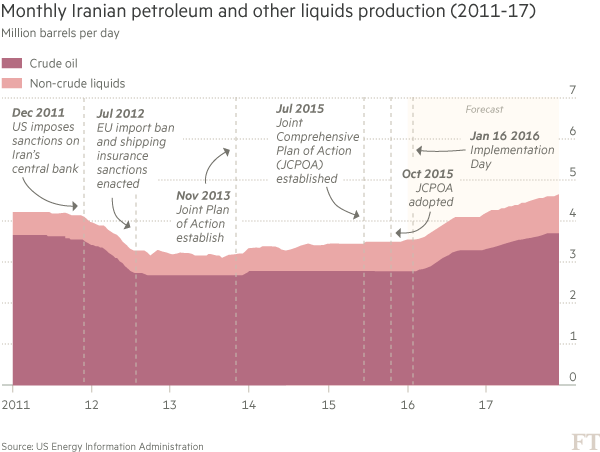

Once the second-largest producer in Opec, Iran’s output has averaged 2.8m barrels a day — from 3.6m b/d in 2011 — as a result of the western sanctions aimed at reining in the country’s nuclear activities. Iranian officials have vowed in recent months to increase output by 500,000b/d immediately after the lifting of restrictions and a further 500,000b/d within seven months. They reiterated this promise in recent days. But analysts have said this is still an ambitious task given the investment needed to expand production capacity, the technical difficulties to overcome and banking limitations that are still in place.

Michael Wittner, analyst at Société Générale, said: “[Iran’s] ability to increase quickly is questioned by most in the market, as the amount of investment and engineering preparation is a huge unknown. However, Iran may surprise the markets by coming closer to their aggressive targets than expected.”

Emphasis on exports

Exports stand at about 1.1m b/d, which is half their pre-sanctions level. Iran is keen to sell as much of the additional oil it produces to foreign buyers. David Hufton at oil broker PVM said: “The big unknown now …is the timing and size of additional Iranian supply on to the market.”

The International Energy Agency, the wealthy nations’ energy watchdog, estimates that 300,000b/d could flow to world markets by March. While Iran has been testing its export infrastructure for an acceleration in foreign sales, the rate is likely to fluctuate. Those closest to Bijan Zanganeh, Iran’s oil minister, have tempered their rhetoric in recent weeks, keen to show the country does not want to flood the market amid growing fears of a swelling glut.

Cargo overhang

Shipbrokers say at least 20 tankers hold Iranian oil — mainly an ultralight oil known as condensate — off Iran. With names such as Serena, Amber, Destiny and Argo, industry analysts say they could hold as much as 50m barrels. Tehran needs to sell this oil in storage to free up its tanker fleet to make subsequent crude oil deliveries. “Everyone is waiting to see who will lift the first cargo,” said one London-based shipbroker.

Global market

In spite of sanctions, Iran was able to sell specific quantities of its crude to India, China, Japan, South Korea and Turkey. Since the lifting of restrictions over the weekend Iran can market its oil worldwide. Iran plans to sell extra output to existing customers, as well as former buyers in Europe such as Greece, Spain and Italy and others such as Sri Lanka and South Africa. Iranian heavy and light grades will make up the vast bulk of exports with a small amount of the heavy West of Karun crude due to make its debut this year.

Sweeteners on the cards

Iran does not want to lose out on price but at the same time it wants to limit discounts. As such, it may offer sweeteners as it goes head-to-head with Saudi Arabia, Russia and other big producers that have taken its market share during sanctions years. Oil-for-goods deals, crude-for-product swaps, deferred payment or pledges to make investments in foreign refineries are all tactics that could be deployed to make Iranian crude attractive. It could also show flexibility on crude quality and timing, particularly in a low oil price environment.

Legal ambiguity and timing

Podcast

Lifting of sanctions offers hope to Iran’s ailing economy

The lifting of UN sanctions on Iran reconnects a potentially vibrant emerging economy to world markets, with the allure of a bonanza for international and local investors and a brighter future for a restive young population.

Those looking to participate in Iranian oil sales, however, are waiting for the ambiguity around executing transactions to be removed — from banking and payment systems to insurance for cargoes. “We are currently monitoring the problems and obstacles our banks are facing,” said Rokneddin Javadi, head of Iran’s national oil company, according to state news agencies. “It will take [a] few weeks to be solved.”

Ground work

Iran has sought to prepare its fields for a rapid increase in production, particularly the supergiant Marun, Ahwaz and Gachsaran. “Most of Iran’s forecast production growth comes from Iran’s pre-existing crude oil production capacity that is currently shut in, while the remainder comes from newly developed fields,” said Asmeret Asghedom at the Energy Information Administration.

Some industry analysts have said the shutdown of large oil volumes under sanctions have allowed pressure to rise, leaving the fields capable of a swift production boost. But other industry observers believe more investment is necessary to drive up and sustain production at pre-sanctions levels. One Iranian official has said current production capacity allows for a 500,000 b/d increase.

Surface-level capacity issues exist along with more complex infrastructure problems, requiring foreign cash and cutting-edge technology quickly from international oil and services companies and costing hundreds of billions of dollars.

Comments