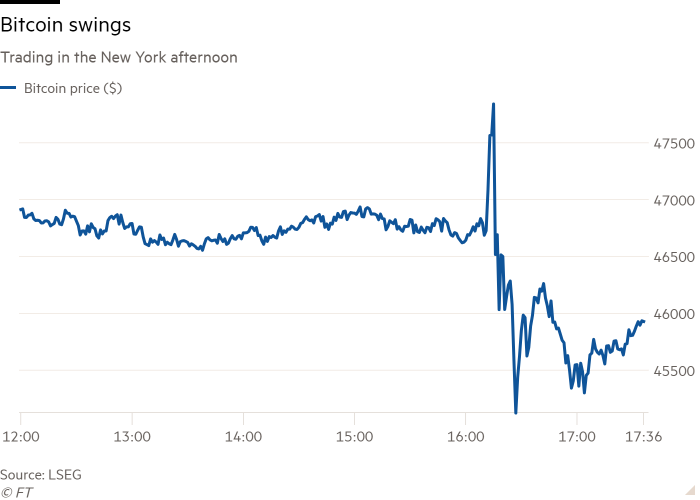

Bitcoin swings sharply after false claim that SEC approved ETFs

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Prices of cryptocurrencies swung sharply on Tuesday after a false post on the US Securities and Exchange Commission’s official X account claimed the regulator had approved the first-ever US spot bitcoin exchange traded funds.

The fake post declared just after 4pm Washington time that the SEC “grants approval for #Bitcoin ETFs for listing on all registered national securities exchanges”. It was picked up immediately on social media, business news websites and Bloomberg TV.

Just over 10 minutes later, the SEC chair poured cold water on the announcement. Gary Gensler posted on his personal account on X: “The @SECGov twitter account was compromised, and an unauthorized tweet was posted. The SEC has not approved the listing and trading of spot bitcoin exchange-traded products.”

An SEC spokeswoman said the original post “was not made by the SEC or its staff”. By 5pm SEC staff had regained control of the X account and the false post had been deleted.

“The SEC will work with law enforcement and our partners across government to investigate the matter and determine appropriate next steps relating to both the unauthorized access and any related misconduct,” the SEC said, attributing the unauthorised access to “an unknown party.”

In a post from an official account late Tuesday, X said its initial investigation indicated “the compromise was not due to any breach of X’s systems, but rather due to an unidentified individual obtaining control over a phone number associated with the @SECGov account through a third party.

“We can also confirm that the account did not have two-factor authentication enabled at the time the account was compromised,” the post stated, referring to an added layer of cyber security beyond a password. “We encourage all users to enable this extra layer of security.”

Bitcoin rallied immediately after the post, for a 1.5 per cent gain on the day, but swiftly reversed on confirmation that the news was fake and the price slid as much as 3.4 per cent.

Cryptocurrency enthusiasts are on tenterhooks as the SEC is expected to decide later this week whether to approve spot bitcoin ETFs, in what would be a watershed moment for the digital asset.

At least 11 asset managers have applications pending before the SEC to launch spot bitcoin ETFs. The SEC faces a deadline of Wednesday to approve some of the applications.

Although the watchdog has previously resisted such products, it now has less room for manoeuvre. A federal appeals court last year ruled that the SEC’s rejection of an application filed by Grayscale to convert its $29bn bitcoin trust into such an ETF was “arbitrary and capricious”.

So far this year, the volatile cryptocurrency has gained about 7 per cent on hopes the SEC would grant approval.

Several applicants have said they received feedback from commission staff indicating that approval was possible this week.

The applicants range from large asset managers BlackRock, Invesco and Franklin Templeton to smaller firms such as Ark Investment Management and Bitwise. Earlier this week, the firms disclosed fees for their prospective products, with several of the hopefuls either substantially cutting their fees or agreeing to waive them altogether shortly after inception.

The SEC has long argued that spot bitcoin ETFs cannot guarantee the same level of protection to investors as traditional investment products. Gensler on Monday posted a short thread on X outlining potential drawbacks to investing in cryptocurrency products, noting that issuers “may not be complying (with) applicable law” and that crypto investments “can be exceptionally risky (and) are often volatile”.

ETFs hold assets like mutual funds but trade on exchanges like stocks and usually enjoy preferential tax treatment in the US. Each of the pending ETFs are meant to invest solely in bitcoin, an evolution over previous products that invest in cryptocurrency futures or companies involved in the crypto industry.

Additional reporting by Hannah Murphy

Comments