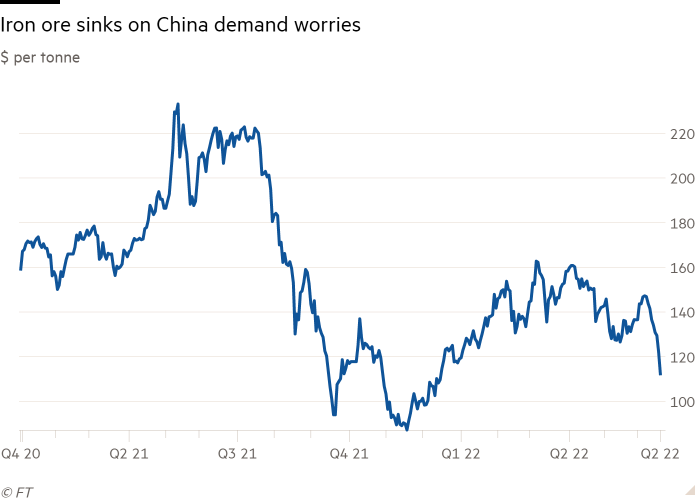

Iron ore price surrenders gains for the year as Chinese demand cools

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The price of iron ore, a key source of profit for some of the world’s biggest mining companies, has surrendered all of its gains for the year as investors become fearful about waning Chinese demand.

Iron ore slumped 8 per cent on Monday to a six-month low of $111.35 a tonne, according Platts, part of S&P Global Commodity Insights, following reports of steel mills in China cutting production. The move reflected a ninth straight session of declines.

Analysts have warned that it could now fall to as low as $100 a tonne for the first time since November if China’s flagging property market remains in the doldrums. The country accounts for around half of global steel output and iron ore is the key material needed to make the metal.

“Construction starts have not been strong and finally the orders have stopped,” said Colin Hamilton, head of commodities research at BMO Capital Markets. “Steel mills are now having to cut production.”

Traders said videos on WeChat, China’s popular social media app, allegedly showing huge stockpiles of steel had spooked the market.

The property sector accounts for up to 40 per cent of Chinese steel demand, but new home starts have tumbled this year as Beijing has moved to bring prices under control and rein in debt levels at big developers.

“May was particularly bad, down somewhere between 30 and 40 per cent year on year on new starts,” said Hamilton.

At the same time, the country’s vast steel industry has continued to hold production steady, with output in May annualising at more than 1.1bn tonnes.

That in turn has weighed on the steel market. The price of reinforcement bars, a product widely used in the construction industry, is down 20 per cent since the start of May, which has hit corporate profitability.

“It is all about the margin picture . . . and they are very weak to negative right now,” said Peter Hannah, index manager at Fastmarkets, referring to the profitability of Chinese steel mills. “Something has got to give.”

A year ago, iron ore hit a record high of above $230 a tonne, as demand surged in line with the global recovery from the pandemic. Prices then fell sharply in the second half of the year after Beijing ordered its vast steel industry to rein in production in an effort to cool its economy. The commodity traded at $119 at the end of 2021.

That volatility has alarmed Chinese policymakers who are now moving to consolidate the country’s iron ore imports through a new centrally controlled group by the end of this year. The biggest suppliers to China are Brazil’s Vale and Australian groups BHP, Rio Tinto and Fortescue Metals Group.

Hannah said the fear stalking the market now was whether Chinese steel production could remain at an annualised rate of above 1bn tonnes “when margins are so pressured”.

Hamilton said he expected to see iron ore at $100 a tonne “sooner rather than later”.

Yet others were more sanguine about the outlook. JPMorgan said the latest weekly data from the property sector were the strongest so far in 2022, boosted by pent-up demand from cities emerging from Covid lockdowns and developers looking to hit half-year targets.

“A sustained improvement in China property activity, coupled with accelerating infrastructure investment, could provide a boost to . . . steel and demand and iron ore prices in the second half of 2022,” the US bank said in a report.

Analysts at JPMorgan expect prices to average $140 a tonne in the third quarter of 2022 and $125 in the fourth quarter.

Comments