Mistry’s Tata allegations spark official probe of AirAsia India

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

India’s Enforcement Directorate is scrutinising allegedly “questionable” payments made by AirAsia India, a joint venture between the Tata Group and Malaysian airline AirAsia.

The probe — confirmed by an official at the directorate and by a document separately seen by the Financial Times — is the latest aftershock to follow the dramatic upheaval at Tata’s holding company, Tata Sons. The saga was triggered by the October 24 dismissal of Cyrus Mistry as chairman and the return of his predecessor Ratan Tata.

Mr Mistry, who remains a director of several Tata operating companies, has embarked on a campaign to expose what he alleges are ethical and governance breaches at India’s largest conglomerate.

This has drawn strong denials from Tata Sons, which accuses him of damaging the group and its shareholders’ interests through a “smokescreen of baseless allegations”. Tata Sons is also seeking to remove Mr Mistry from six listed operating companies where he is a director, with the first shareholder vote due to be held on Tuesday.

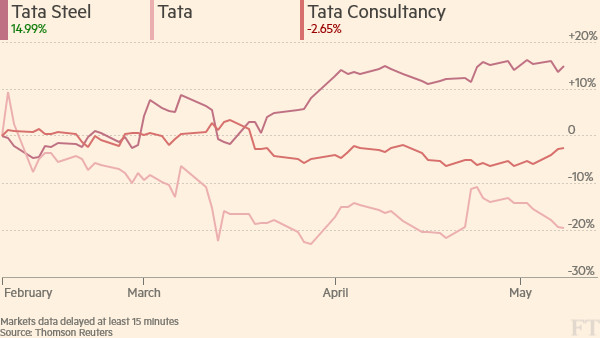

The combined market capitalisation of listed Tata companies has declined by Rs896bn ($13bn), or 11 per cent, since Mr Mistry’s removal from the Tata Sons chairmanship.

——————

Tata’s forthcoming EGMs

——————

The Enforcement Directorate started its probe of AirAsia India after the public leak of an email sent by Mr Mistry to Tata Sons directors on the day following his dismissal. In it, he mentioned a special audit by Deloitte that identified Rs223m ($3.3m) of “dubious” or “questionable” payments by the AirAsia India.

The Deloitte report, which has been seen by the Financial Times, was on the agenda for discussion at Mr Mistry’s final board meeting, and people close to him say he had planned to push at the meeting for further action on the matter.

Tata Sons said that AirAsia India had taken action over the concerns raised in the report, and said that the joint venture could provide further details. AirAsia India and AirAsia declined to comment.

Meanwhile the audit committee of Tata Power is looking into contracts issued before Mr Mistry took charge of the group, following concerns raised by him, according to a director of the company.

Mr Mistry is also using his position as chairman of Tata Teleservices to seek information about transactions between that business and companies owned by Chinnakannan Sivasankaran, a Chennai-based businessman who has claimed a close association with Mr Tata.

A lawyer for Mr Sivasankaran declined to comment. Tata Power did not respond to a request for comment. Tata Teleservices said that its board had not yet reached a decision on whether to provide Mr Mistry with the information he has requested.

Mr Mistry’s campaign has alarmed some senior figures in Mumbai’s business community, who worry that he could do permanent damage to the group’s longstanding reputation for ethical conduct and stable management. “It’s like Samson pulling down the temple to kill the Philistines,” says one.

But Mr Mistry — whose family controls 18 per cent of the shares in Tata Sons — has presented his claims as part of an effort to push for improved governance at the group.

Over the next two weeks, shareholders in listed Tata companies will have an opportunity to give their verdict on the competing arguments, as Mr Tata moves into the next stage of his effort to remove Mr Mistry.

Tata Consultancy Services, by far the group’s most profitable unit, will be the first to vote on whether to eject Mr Mistry at a meeting scheduled on Tuesday. Tata Sons’ 73 per cent stake in TCS means its victory is assured.

But overseas funds account for 18 of TCS’s next 19 shareholders, according to S&P Capital IQ data. And Institutional Shareholder Services, a proxy advisory firm widely followed by global investors, has recommended voting against removing Mr Mistry from TCS, saying that insufficient grounds have been given.

“We’ve just been presented with this motion, with a nudge and a wink that it’s the right thing to do,” says one top-10 shareholder in TCS, who will nonetheless support the motion in the interests of stability.

Mr Mistry is hoping for more support at the other five shareholder meetings later in the month, where Tata Sons’ lack of a majority stake means it must rely on other shareholders to secure his removal.

The boards of Tata Chemicals and Indian Hotels have publicly affirmed their backing of Mr Mistry. One of the most prominent independent directors to have endorsed Mr Mistry, the industrialist Nusli Wadia, now faces a Tata Sons motion to remove him from the boards of Tata’s chemicals, steel and automotive companies at their forthcoming meetings.

Tata Sons claims that Mr Wadia — a longstanding Tata family friend who has sat on boards within the group for nearly four decades — acted against the companies’ interests by “galvanising” board-level support for Mr Mistry. Mr Wadia contests the allegations and has threatened a defamation lawsuit.

Analysts at Institutional Investor Advisory Services, a Mumbai-based proxy advisory firm, say that it would set a chilling corporate governance precedent if the action against Mr Wadia were seen as punishment for his support of Mr Mistry.

They warn that outside directors at Indian companies have rarely been found to be sufficiently independent, and add: “Hanging the Damocles sword of eviction over their heads will be a great disservice to the minority shareholders.”

Mr Mistry is seeking to capitalise on such concerns to push for sweeping reform of the group’s unusual governance structure. The charitable Tata Trusts — which were endowed by the Tata family in the early 20th century and chaired by Mr Tata throughout Mr Mistry’s tenure — own 66 per cent of Tata Sons, which in turn holds large stakes in the operating companies.

In a letter to shareholders in Tata companies last week, Mr Mistry accused Mr Tata and other trustees of interfering in the day-to-day business of listed Tata companies. He alleges that his resistance of such conduct was another key reason for his dismissal.

Mr Mistry called for the government to step in to ensure transparent governance at the Tata Trusts — which are public charities — and the removal of people “who have demonstrated a blatant disregard for good governance”.

Mr Tata responded with a shareholder letter of his own in which he insisted that operating company managers had “enjoyed the operational freedom to develop and execute the right strategy as guided by their respective boards”.

He urged investors to back the removal of Mr Mistry, whom he labelled a “serious disruptive influence . . . which can make the company dysfunctional”.

The table in this article has been amended since original publication to reflect Tata Motors’ board position on Mr Mistry

——————–

Further reading

● News: Rift deepens between Cyrus Mistry and Ratan Tata

● Analysis: Boardroom divide in Mumbai

● Letter: ‘Shocked beyond words’: Mistry’s reaction to dismissal

Comments