Stocks outperform bonds by less than you think

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is an FT contributing editor

The belief that stocks outperform bonds over the long run sits behind almost every strategic asset allocation process and is backed by centuries of empirical data.

The longest series of American financial asset returns in general circulation stretches back to 1871. In this account, stocks’ median outperformance of bonds over a 10-year holding period has been 3.7 percentage points a year, rising to 4.6 percentage points per annum over 50-year holding periods. The chance of underperformance over relatively long periods has been low. And importantly, incidence of stocks being trumped by bonds become vanishingly rare as your holding period lengthens.

This degree of persistent outperformance has delighted shareholders but puzzled academics. The result has been a vast array of finance literature on the equity risk premium puzzle — the inability of standard models to explain the degree of historical equity outperformance versus risk-free debt.

Outside the US there has been less of a puzzle. Elroy Dimson, professor of finance at Cambridge university’s Judge Business School, has for several years co-authored the finance industry’s definitive almanac of global long-run asset return data, stretching it back to the start of the 20th century. This work has provided a quantitative check to universalist beliefs in the dependability of equity outperformance.

Instances of 20-year holding periods in which equities have been beaten by bonds or even cash are not uncommon across developed markets. In the 50 years ending 2019, the Dimson team reported that returns from world ex-US equities and government bonds were approximately equal at 5.0 per cent and 5.1 per cent, respectively. Still, the US has been exceptional. Or at least that is what the data has told us so far.

While some people take up gardening or golf in retirement, Edward McQuarrie, an emeritus marketing professor, has spent the past seven years taking a closer look at US exceptionalism. His conclusion, published in the Financial Analyst Journal this month, is that the data is dud. Building on bond figures assembled by financial historian Richard Sylla, McQuarrie conducted city-by-city searches of digitised archives for details of dividends and share counts to expand the American historical financial record. The result is a new resource containing more than three times as many stocks and five times as many bonds. His account captures many more failures, reducing survivorship bias, and a stunningly different long-term story.

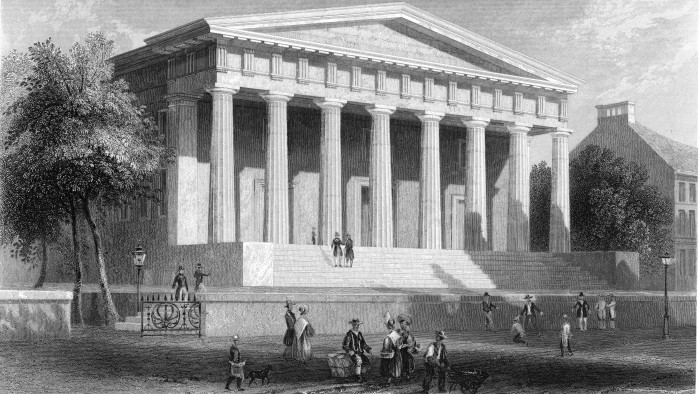

The impact of survivorship is no small detail. The old history, McQuarrie tells me, had some glaring omissions. The biggest omission from previous data, the Second Bank of the United States, accounted at its peak for almost 30 per cent of total US market capitalisation, around the combined weight of the Magnificent Seven in today’s S&P 500. The bank failed in a financial panic in 1837. Despite the inclusion of such epic fails, the new historical record still favours equities, but less so. This downward re-evaluation of old American financial returns has form.

In 2002, Research Affiliates founder Rob Arnott co-authored a paper with Peter Bernstein concluding that the historical average equity risk premium was about half of what most investors believed and stood at only 2.4 percentage points a year. The quantum of stocks’ median outperformance over long-term holding periods is roughly halved again in the new data. And the incidence of equity underperformance over fifteen-year holding periods more than triple.

Why should we care about new estimates of frankly ancient asset returns? In part because they push back on the idea there is some enduring lawful regularity to long-run US equity outperformance. “What has astonished me is how myths in our industry linger in the face of compelling evidence that they’re wrong,” Arnott tells me. “It’s marvellous to have company in the quixotic task of debunking them.”

Asset prices are a descriptive account of economic conditions, policy choices, entrepreneurial successes – and of course their failures. Investors holding Russian financial assets in 1917 or Chinese ones in 1949 were expropriated by policy choices. Holders of Japanese index-trackers in 1989 are still waiting to be made good on their initial investments. Dimson’s work on 20th century returns has long found US equity market performance to be exceptional. The new data does not diminish the exceptionalism of postwar American equity performance but suggests it could be an exceptional episode.

Investors find it hard to escape the framing that historical returns provide. But extrapolation carries dangers. “Stocks today are poised to offer long-term patient investors a risk premium of 1-2 per cent,” Arnott tells me. “This could be easily wiped out by poor policy choices.”

This article has been corrected to state that in the dataset challenged by new research, stocks’ median outperformance of bonds over a 10-year holding period has been 3.7 percentage points a year, rising to 4.6 percentage points per annum over 50-year holding periods. And to state that the incidence of equity underperformance over fifteen-year holding periods under the new dataset is more than triple than in the older one.

Comments