Shift in European equity market belies old economy tropes

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The writer is chief European equity strategist at Morgan Stanley

When the European equity market is compared with its US counterpart, an old trope of old vs new economy is often trotted out.

There is a common perception among equity investors that the European market has high exposure to financial and commodity sectors and a low weighting to technology and other, more vibrant, growth-oriented sectors.

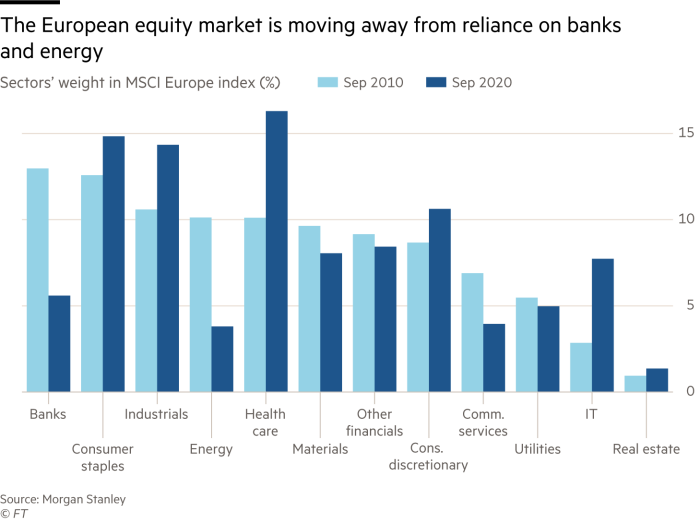

This viewpoint is increasingly outdated. Taking a closer look at the European equity market suggests that this leopard is indeed changing its spots. The sector often seen as synonymous with the European equity market is banks, even though healthcare is more than twice the size of the former.

Ten years ago, banks and energy were the two largest sectors in the MSCI Europe index by market capitalisation and accounted for 25 per cent of the entire index. Today, this figure is down to a record low of 10 per cent.

Even when we include the other unloved sectors that are perceived to be at the coal face of “disruption”, namely autos and telecoms, the overall weighting of this area of the market rises to just 15 per cent.

In contrast, 45 per cent of MSCI Europe can be accounted for by healthcare, consumer staples and industrials — sectors that offer a healthy mix of good, quality growth. When we compare the sector mix of the European equity market to its global peers, these same three areas are those where Europe is most “overweight”, while its exposure to banks is no greater than that found in the MSCI All Country World Index.

In this context, the key question to ask is why Europe continues to trade as a value stock, even though its “old economy” exposure is much reduced? The answer here is less about what Europe does have, but rather what it doesn’t.

Over the past decade, technology has seen the second-largest increase of any sector in MSCI Europe (after healthcare). However, given a low starting point, today’s exposure is still just 8 per cent. In contrast, 28 per cent of MSCI USA is listed as technology, which rises closer to 40 per cent once we adjust for related names that are listed in other sectors.

Faced with such a divergence, it is very challenging for headline European indices to keep pace with some of their regional peers while the tech sector is in the ascendancy.

It’s not all doom and gloom on this front, however; while the broad MSCI Europe index is light on technology, this is not true across all regional or country indices.

Although Germany is viewed as the industrial heartland of Europe, the largest sector in MSCI there is not capital goods or autos, but rather technology, followed by healthcare.

We can observe a similar trend for the Euro Stoxx 50, which is arguably the most important index for top-down macro investors in Europe because of the level of futures trading activity linked to it. The largest sector in this (admittedly concentrated) index is technology, followed by personal and household goods and healthcare. Banks languish down in eighth place, a shadow of their former selves (a decade ago, they were twice the size of the next largest sector).

In the short term, the outsized influence of technology shares on global equity markets means that it is easy to overlook the improving sector composition of the European equity market. In turn, this should justify a higher valuation range for European indices than in the past. And this is not just for the simple rationale that better growth should warrant higher valuations.

Inside ETFs

The FT has teamed up with ETF specialist TrackInsight to bring you independent and reliable data alongside our essential news and analysis of everything from market trends and new issues, to risk management and advice on constructing your portfolio. Find out more here

Over the past decade and more, we would argue low interest rates have boosted the relative attractiveness of equities in the US more than they have in Europe despite the latter seeing materially lower (and negative) bond yields. That is down to the perceived security of the respective corporate income streams, with US earnings seen as more stable and European profits viewed as more cyclical and volatile.

When bond yields are low, it is easier to place a higher valuation on a stable income stream than when low or negative rates may actually be signalling caution about the earnings outlook — or making it worse in the case of financials.

Consequently, Europe’s transition to a superior sector mix looks set to improve the longer-term growth and valuation outlook for the region. Coupled with an agreement on the EU Recovery Fund earlier this summer, this suggests that the investment case for Europe is improving.

Comments