Investors ask if the price is right for buying into India’s growth story

The superlatives roll off the tongue when it comes to India: the world’s most populous nation; the world’s fastest-growing large economy, and the third-largest of all by 2027 (when the IMF expects it to overtake Japan and Germany); the pivotal Asian nation amid an ever growing Sino-American rivalry.

India also lays claim to the world’s fifth-largest stock market — behind only the US, China, Japan and Hong Kong — and, in August, it became just the fourth country to land a spacecraft on the moon.

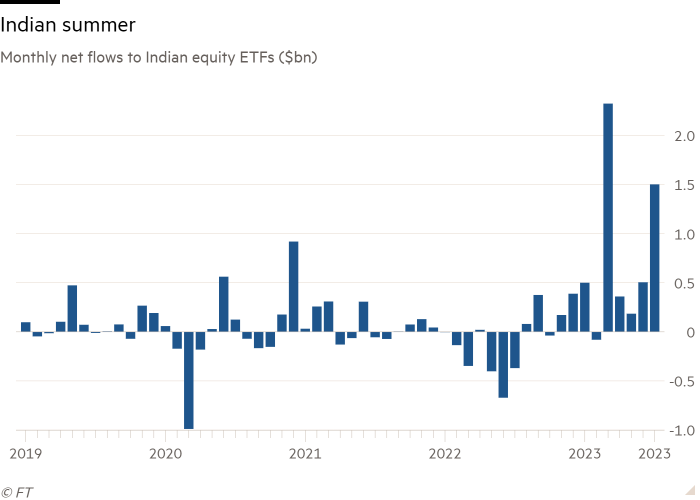

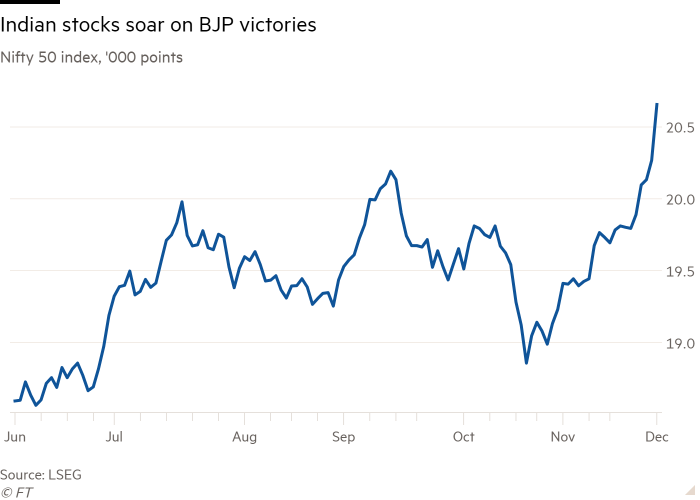

In response to this growth story, the outside world has responded by pumping a net $12.2bn into the Indian equity market so far this year, according to Bloomberg data. These inflows, and the success of Prime Minister Narendra Modi’s Bharatiya Janata party in state elections, have helped to push the NSE Nifty 50 and S&P BSE Sensex stock market indices to new record highs in recent days.

“The strength of the Indian economy has taken centre stage for those investing in Asia and emerging markets,” says Henry Ince, investment analyst at funds supermarket Hargreaves Lansdown.

“[Economic] growth is underpinned by favourable demographics, with nearly 70 per cent of India’s 1.4bn population in the working-age bracket,” Ince points out. “Consumption, particularly among the middle class, will be a significant theme for investors. By 2050, India is projected to contribute approximately 40 per cent to global middle-class consumption, a substantial increase from the current 5 per cent.”

“Some of the statistics are difficult to ignore,” agrees Dzmitry Lipski, head of funds research at retail investment platform Interactive Investor. Where China once held this mantle, “India is now undeniably the leader in emerging markets. India is almost stepping on [China’s] toes,” he argues.

Dina Ting, head of global index portfolio management at Franklin Templeton, says: “People are recognising that this is a market they can’t ignore.” She suggests that India is benefiting both from its own reform agenda and from broader global trends.

Domestically, she points to a range of growth-boosting reforms, such as the rollout of the nationwide goods and services tax, which replaced a multitude of local taxes; as well as infrastructure development with, for example, plans to build 80 airports in the next five years.

“The reforms and building the infrastructure are the key,” Ting says. “In many cases, India is well behind in terms of infrastructure,” but she believes the government is now focusing on “moving people around with their huge investment in airports and planes”.

This is likely to result in more foreign direct investment as Asia-oriented global companies learn lessons from the Covid pandemic and Russia’s invasion of Ukraine. They will be “simplifying their supply chain to where it’s closer to where it needs to be,” predicts Ting — potentially doing more in India, given that Asia accounts for 60 per cent of the global population.

Overall, though, India remains a “private consumption-driven economy [accounting for 60 per cent of gross domestic product],” explains Lipski, “which gives the economy a lot of immunity from external forces” — more than would be the case for a more export-driven country.

He also stresses India’s strength in information technology which, domestically, has powered the rise of Infosys, Wipro, and Tata Consultancy Services. Further afield, “the largest companies in the world are run by Indian nationals and that will continue,” Lipsky adds.

Ting believes all of these strengths merit a higher prominence for India in investors’ portfolios than its 15.3 per cent weight in the MSCI Emerging Markets Index. This could be achieved by investing in a single country exchange traded fund.

Not everyone is convinced, however.

Despite his enthusiasm about India as a long-term investment, Ince cautions that “now is not the time to be overweighting India in your portfolio, given how well it’s done relative to other Asian and emerging market countries”.

He flags that, since the start of 2020, the Sensex index has risen more than 60 per cent, even as the broader MSCI EM index has fallen 12 per cent. As a result, equity valuations are now rich.

Companies in the Sensex index are trading at an average of 21.4 times their earnings last year — similar to the price-earnings ratios in the US but approaching twice the 11.9 times ratio of the MSCI EM index and the 12.5 times of the Stoxx Europe 600.

Anuj Arora, chief investment officer of the emerging markets and Asia-Pacific team at JPMorgan Asset Management, warns that Indian equities have traded at similar valuations on four occasions in the past 30 years “and each time they resulted in a five-year period of stagnation”.

Lipski agrees that valuations are currently higher than in other EMs “and relative to [India’s] history”, but reckons this should not be a deal-breaker — unless someone is investing purely for the short term.

Ting is less concerned, too, arguing that valuation metrics are likely to fall as a result of strong earnings growth, rather than due to a slide in share prices.

However, any stock market gains will be diluted for foreign investors, who are subject to capital gains tax of 15 per cent on Indian equities held for less than a year, or 10 per cent CGT for positions held for longer.

India also maintains an array of foreign ownership limits on many stocks, potentially complicating the ability of passive fund managers to construct well-diversified indices to track, and of active managers to build positions in their favourite companies.

Ting adds that foreign ownership limits are not unusual in emerging markets and that, at the margin, India does seem to be liberalising its regime. She also points out that investors will typically have to pay capital gains tax when they sell investments, anyway.

Nevertheless, some seem to believe that the timing is not quite right yet. Despite the strong fund inflows year-to-date, foreign investors have pulled a net $2.6bn from the Indian equity market since the start of October.

Comments