First ETF zero-day options ETF launches in the US

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

The first exchange traded fund to trade in “zero-day-to-expiry” options, one of the hottest investment trends of the year, has launched in the US.

Zero day options — contracts with a maturity of 24 hours or less that allow the purchaser to buy or sell a security or asset at a specific price at a specific time — have exploded in popularity in the past year.

While the rise of zero-day options has led to concerns over their potential impact on market volatility, they have given ETFs another asset to trade. Almost inevitably, given the ETF market’s reputation as a hotbed of innovation, that opportunity has now been exploited.

Defiance ETFs, a small Miami-based thematic house with $860mn in five ETFs, has listed the Defiance Nasdaq Enhanced Option Income ETF (QQQY) on the Nasdaq stock exchange.

A sister product, the Defiance S&P 500 Enhanced Option Income ETF (JEPY) is due to follow on the Cboe BZX Exchange next week.

Although the ETFs will write and sell zero-day put options, they are designed to have similar pay-off structures to covered call ETFs — which sell call options — another of the hottest investment themes of the past year.

JEPY is a play on JEPI, the $29.5bn JPMorgan Equity Premium Income ETF, the posterchild of the covered call fund boom, which has not only attracted the largest inflows of any actively managed ETF this year, but also become the world’s largest active ETF.

Covered call funds and buy-write strategies such as JEPY and QQQY are both risk-averse equity market strategies. In both, some of the potential stock market upside is traded away in exchange for a steady stream of premium income, potentially tapping into demand for high-income investment strategies.

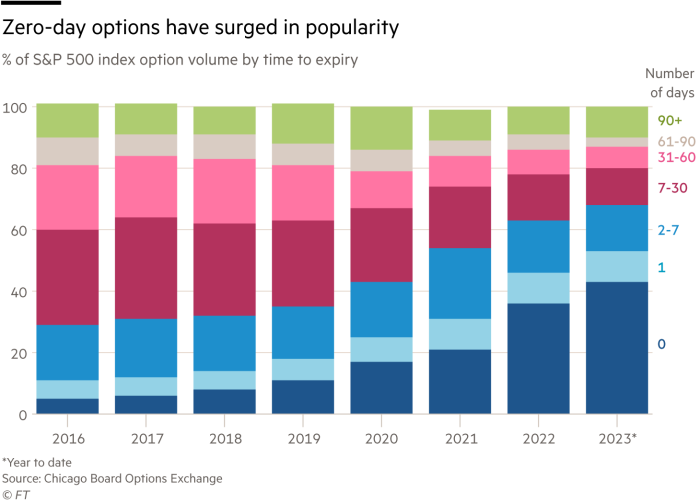

Ultra-short zero-day-to-expiry options have surged in popularity this year and now account for 43 per cent of overall S&P 500 options volume, up from 21 per cent in 2021 and just 5 per cent in 2016, according to Cboe Global Markets.

“The daily notional trading value of 0DTE options has skyrocketed to about $1tn,” said Sylvia Jablonski, chief executive of Defiance ETFs.

“These ETFs exemplify our commitment to innovation and to meeting the evolving needs of investors. With daily options at the core of these products, we’re unlocking a new dimension of income generation within the ETF space.”

JEPY and QQQY will sell “at-the-money” or “in-the-money” puts, ie where the option to sell is priced at or above the prevailing market price. They will seek to generate daily premium income equivalent to at least 0.25 per cent of their assets.

Unlike covered call funds, they do not hold the underlying equities, instead owning a portfolio of Treasury bonds that are used as collateral against the options they write. Both ETFs will charge annual management fees of 0.99 per cent, according to filings.

The ETFs bear some resemblance to the $94mn WisdomTree PutWrite Strategy Fund (PUTW), which sells put options written on the S&P 500, although that fund uses one-month, rather than zero-day, options.

WisdomTree says PUTW tends to underperform the S&P 500 in a rising market, while in a down market the premium income helps damp losses. Over the cycle, it should exhibit less volatility and smaller drawdowns than the underlying index. As of June 30, since its inception in 2016 it has generated average annual returns of 6.7 per cent, compared to 14.1 per cent for the S&P 500.

However, Jablonski said the “novel idea” of “selling short-term options multiple times generates higher yield than selling longer-dated options less frequently”.

She said the strategy has generated double-digit returns in back testing, where the concept has “been grossly outperforming covered call strategies, to the tune of 2.5 to 3 per cent a year”.

Since its inception in 2020, JPMorgan’s JEPI covered call ETF has delivered annual returns of 13.1 per cent, versus 15.7 per cent for the S&P.

Not everyone was convinced of the ETFs’ merits, though.

Nate Geraci, president of The ETF Store, a financial adviser, said that with the “massive success” of options-based strategies such as defined outcome ETFs, as well as JEPI, and the “recent surge” in popularity of zero-days option, “it’s absolutely no surprise to see ETF issuers looking for ways to capitalise”.

However, Geraci said: “My concern lies around the complexity of options-based strategies in general. Zero-day options are essentially daily bar bets. While longer-term strategies can certainly be constructed around these options, my fear is that investors might not fully appreciate the complexities and risks involved.”

Bryan Armour, a former options trader who is now director of passive strategies research, North America at Morningstar, said selling options tended to be profitable “most of the time”.

This is “premised on the fact that expected volatility usually ends up being higher than realised volatility”, meaning that the options sold by funds are exercised less often than might be expected, so the fund can just scoop up the premium income.

With zero-day-to-expiry options, though, Armour said it was “pretty much a casino”, given how close to their expiry they were written.

Todd Rosenbluth, head of research at VettaFi, said “options-based ETF strategies had gained in popularity as investors have sought enhanced income opportunities.

“Covered call strategies have provided more defensive equity exposure appealing to the more risk averse,” he added. “These newer ETFs are likely to appeal to a base more comfortable taking on risk through equities and seeking additional income.”

Comments