Investors flee hedge fund Pelham Capital after losses

Simply sign up to the Hedge funds myFT Digest -- delivered directly to your inbox.

Pelham Capital, once one of the biggest names in London’s equity hedge fund sector, has lost more than three-quarters of its assets in the past three years amid poor performance, investor withdrawals and team departures.

Assets at equities specialist Pelham, which was founded by former Lansdowne Partners fund manager Ross Turner and is backed by Goldman Sachs’s publicly listed Petershill fund, have dropped from $4.5bn in October 2020 to about $1bn today, according to people familiar with the situation.

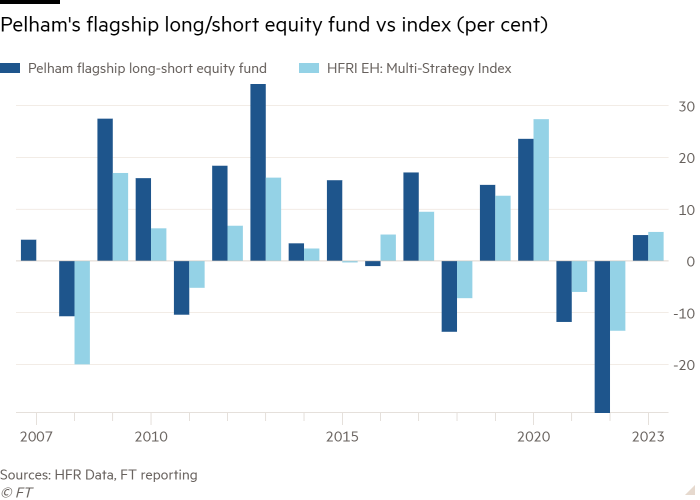

The flagship fund was down 11.8 per cent in 2021 and dropped 29 per cent last year, investors said. This year it has recovered by about 5 per cent, leaving it far off its so-called high-water mark, the level at which it can start charging performance fees.

“Assets leave when performance is bad,” said one investor. “Clients lose patience.”

Pelham’s declining fortunes reflect how “long/short” equity hedge funds — a strategy betting on rises or falls in individual stocks — have fallen out of favour with investors. Many of these funds struggled to earn returns comparable with blue-chip equity indices during the long bull market that followed the 2008-09 financial crisis.

Last year’s downturn in stock markets as global interest rates sharply climbed brought only a minor reprieve, with long/short equity funds falling 13.5 per cent, 6 percentage points less than the decline suffered by the S&P 500 index. This year, an index tracking such funds is up 5.58 per cent, while the main US equity benchmark has gained 12.5 per cent.

Some of Pelham’s peers, including Adelphi Capital and Sloane Robinson, have closed in the past few years, while others such as Lansdowne and Egerton Capital are running smaller hedge fund businesses than before.

Turner, a prominent European stock picker and the largest single investor in the firm’s funds, enjoyed a decade of strong returns after launching Pelham in 2007. Petershill Partners, which buys minority equity stakes in alternative asset companies, invested in Pelham in January 2014.

But big losses in 2018, 2021 and 2022 have dragged down the hedge fund’s overall returns. Pelham’s annualised return since inception to August of this year is about 5 per cent, according to Financial Times calculations applied to historical data. Turner declined to comment.

Pelham paid out a total of £340mn in dividends to a company “controlled by one of the directors” between 2015 and last year, company filings show. Pelham Capital had just three directors, including Turner, during that period, according to the filings.

Separately, since 2015 Pelham has paid £82mn in dividends to company directors. Turner is the sole “person of significant control” who “has voting rights of over 75 per cent”, the filings said.

As assets have dwindled, Pelham has suffered a number of departures.

Stephen Kirk, a portfolio manager who also worked at Lansdowne and later ran a global financials fund at Pelham, left for hedge fund Caxton Associates at the end of last year and the financials fund was closed.

Chief operating officer Hamant Lad resigned in September and has been replaced by Jonathan Shorrock, a former fund executive and bank prime broker. William Haslam, the fund’s chief technology officer, left in May to help set up a new fund called Pardinus Capital, according to his LinkedIn profile.

Pelham is one of the smaller holdings in Petershill’s portfolio, which includes investments in Andrew Law’s macro hedge fund Caxton and private equity firms Harvest and ACP.

Comments