Flood of bond sales pushes up UK borrowing costs

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A flood of gilt sales is driving up the UK government’s borrowing costs, investors say, as markets are asked to absorb record volumes of bonds without the Bank of England stepping in to hoover up supply.

Bond yields in most large economies have shot up over the past 18 months as soaring inflation drove a slew of aggressive interest rate rises, reflecting a decrease in prices. But they have remained stubbornly high in the UK even while dropping back elsewhere.

By November last year, gilt prices had recovered from the turmoil sparked by September’s disastrous “mini” Budget, but in recent months yields have drifted back up. Benchmark 10-year UK gilts currently yield 3.69 per cent, compared with 3.36 per cent on equivalent US Treasuries and 2.19 per cent on German Bunds. Until this year, US bonds typically traded with higher yields.

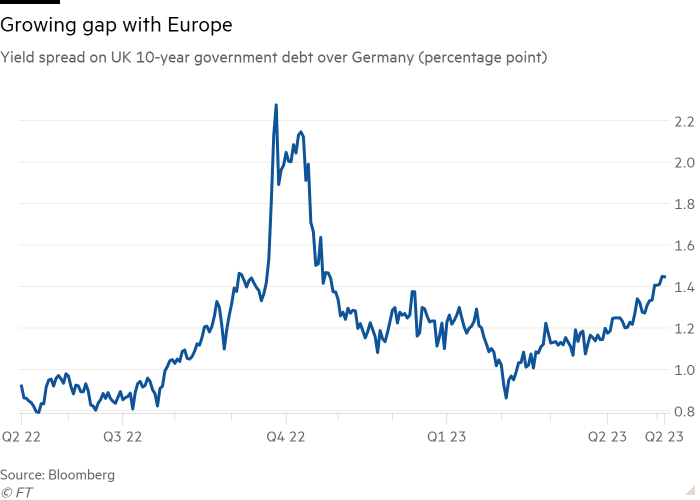

That relative shift reflects the outlook for the BoE, which is expected to lift interest rates by at least a further 0.5 percentage points this year as it battles stubbornly high inflation, unlike the US Federal Reserve, which is widely believed to have finished its tightening cycle with this week’s rate rise. However, gilts have underperformed recently even relative to German debt — the benchmark for the euro area, where further rate increases are anticipated.

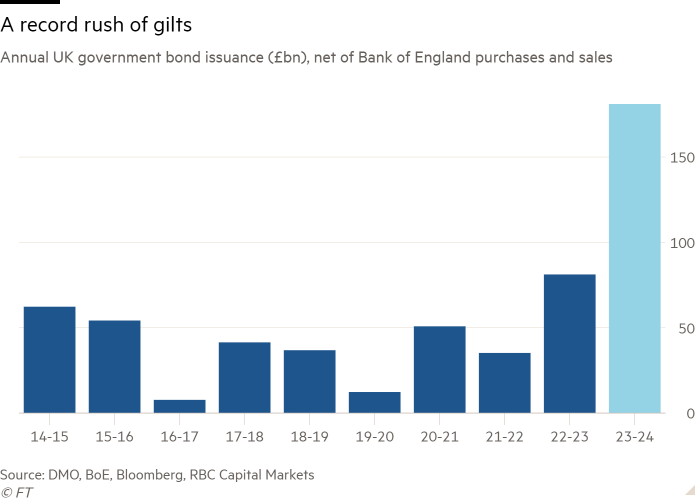

Many fund managers argue that the UK’s hefty borrowing needs, exacerbated by the BoE selling government bonds that it bought under its quantitative easing programme, are adding to the pressure on gilts.

“Undoubtedly, the surge in gilt supply along with quantitative tightening is weighing on prices,” said Matthew Amis, investment director at Abrdn. “It’s relentless and it will be for the next fiscal year.”

The government plans to sell £241bn of gilts in the current financial year, a sharp increase from £139.2bn issued in the last financial year, with issuance net of BoE purchases expected to be about three times more than the average over the past decade.

Investors say the impact of the government’s borrowing spree is starting to show up in the widening “spread” — or difference in yield — between the UK and other big bond markets, an important indicator that investors are starting to demand a premium for UK bonds.

“This year the enormity of gilt supply is weighing slowly on the spread with [German] Bunds,” said Mike Riddell, bond fund manager at Allianz Global Investors. He is buying up government bonds because he expects the global recession to be far worse than markets predict, but is opting for bonds in the US, Australia and Scandinavia over UK gilts.

“Everywhere there is a lot more net supply but it’s particularly pronounced in the UK. People will buy at a price but not where we are today — not at the long end.”

Economists at credit rating agency Fitch forecast that the combination of debt sales from the UK government and the BoE will be equivalent to 9 per cent of GDP this year. In the eurozone, the equivalent figure is just under 5 per cent.

Evidence of pricing pressure is also showing up in UK bond auctions, where the gap between the average price paid and the lowest bids accepted has been larger than usual, according to HSBC’s head of UK rates strategy Daniela Russell.

The gilt market’s biggest buyer has already turned to a seller since the BoE began to unload its massive portfolio of government debt last year. But there are signs that foreign investors, another traditional mainstay of demand, are also shying away from the market.

BoE data published this week showed that overseas investors were net sellers of gilts every month this year, totalling £36bn in the first quarter and reversing net purchases of £40bn in 2022.

“It’s really quite marked selling pressure that is broadly akin to a trend that we were already seeing . . . it’s part of this lack-of-demand story,” said Imogen Bachra, head of UK rates at NatWest.

Investors point out that the scale of bond issuance is far from the only factor propping up yields — a double-digit inflation rate that could prompt a hawkish message from the BoE at its meeting next week has also turned many investors off gilts.

But Quentin Fitzsimmons, a portfolio manager at T Rowe Price, said the recent weakness also betrays lingering concerns about borrowing following last year’s crisis, which was triggered by former chancellor Kwasi Kwarteng’s package of unfunded tax cuts. He said gilt yields would need to climb “considerably higher” than those on Treasuries in order to lure sufficient numbers of foreign investors back to the market.

“The fiscal stability of the UK is a very ephemeral and fragile creature,” he said.

Comments