How to get shoppers excited about clothes again

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Since fashion weeks went mostly online a year ago, some brands have hosted shows on their own schedules. At times, this has been driven by necessity — lockdowns often meant that fabric mills were closed and studios were running on skeleton staffs, which caused delays. At others, it has been guided by the realities of retail: it’s easier to sell a collection that still has a whiff of newness about it, and thus brands are now opting to show new designs closer to the date they land in stores (a trend that may continue even as fashion weeks return to physical form).

Hence the smattering of autumn/winter 2021 collections that appeared in recent weeks from Gucci, Burberry, Celine and Michael Kors — designers who, in normal circumstances, would have unveiled their collections in September.

These were collections designed to get their viewers — which, more than ever, includes their customers, and not just a few hundred members of the industry — re-enthused about luxury after a year of mostly dressing down.

A new energy at Gucci

Since chief executive Marco Bizzarri and creative director Alessandro Michele took the helm of Gucci in early 2015, the brand’s revenues have nearly trebled, from €3.5bn in 2014 to €9.6bn at the end of 2019. Young consumers, particularly in China and south-east Asia, have taken to Michele’s joyous, 1970s-inflected, geek-chic aesthetic. Ever since the question has been: how long can the pair maintain it?

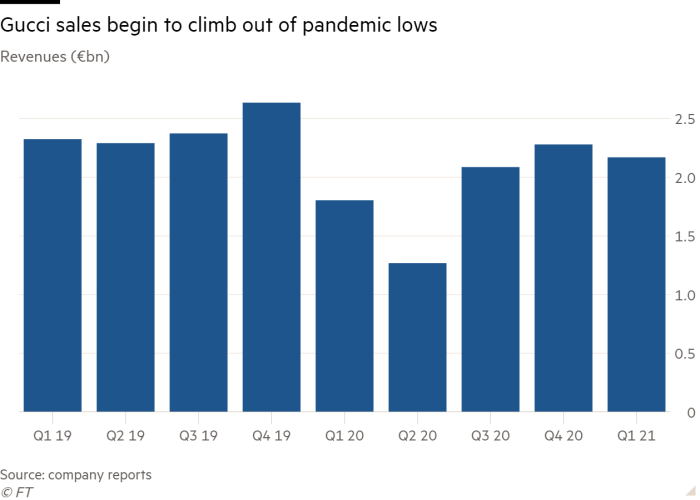

Apparently some time yet. On Tuesday, parent company Kering posted better-than-expected results for the first quarter, with Gucci recording €2.2bn in sales. That’s nearly in line with pre-pandemic levels of €2.3bn, which the company credits to a ramping-up of fashion events in China, a strong recovery in the US, and a raft of new product launches (including a much-lauded tie-up with outerwear purveyor The North Face).

The report came on the heels of Michele’s latest collection unveiling, set among the polished surfaces and flashing lightbulbs of an imaginary nightclub in the bowels of The Savoy (where founder Guccio Gucci once worked as a lobby boy, surveying the luggage of the rich). Described by Michele as a “hymn to life”, it was also a celebration of the 100th year since the brand’s birth as a leather goods shop in Florence.

That made Michele want to throw “an unmissable party” and also to re-examine the brand DNA. Thus he mixed the Gucci monogram and signature horsebit with velvet trouser suits that riffed off Tom Ford’s designs for the house in the mid-1990s; equestrian with fetish; supersized sequins with silk and velvet; lingerie with Marilyn Monroe.

Unusually, it also featured coats, blazers and vertiginous heel shapes lifted directly from Demna Gvasalia’s designs for Balenciaga, another house owned by Kering, and plastered with both brands’ logos. Though the borrowing was done with Gvasalia’s blessing, Michele called it a “hacking” rather than a “collaboration”. “I think it is possible now to have a dialogue between ivory towers, between couture workshops,” he observed in a post-show press conference. Mainly, it was fun.

Though Michele indicated that the idea was his, the “hacking” makes a certain amount of commercial sense — a way to inject newness into Gucci while exposing its substantially larger client network to one of the fastest-growing brands in the Kering portfolio. Analysts were pleased: “This is exactly the kind of thing Gucci should do to reignite young Chinese consumer interest for the brand,” wrote Bernstein analyst Luca Solca.

Glamour and timelessness at Michael Kors

If the mood among European designers has been jubilant, the American fashion industry’s approach to post-pandemic dressing has been a bit more subdued. Designers speak less of a return to dressing up and more about designing only what is necessary and the importance of making things that last.

Michael Kors, a rare American designer who has worked on both sides of the Atlantic (he was creative director of LVMH-owned Celine from 1997 to 2004), is somewhere in the middle. He is also celebrating an anniversary this year, his 40th, which gave him occasion to double down on his style signatures (camel coats in double-faced cashmere, suits in Prince of Wales check, head-to-toe leopard) and revisit some of his greatest hits, including a red patent leather Balmacan coat that looks as good on Bella Hadid now as it must have on Cindy Crawford when she originally modelled it in 1991.

These were polished, glamorous looks for being alive again: for sipping cool martinis in Midtown, or (as Kors loves to do) attending opening night on Broadway. They also underlined Kors’ knack for designing clothes that stand the test of time. “It’s just the opposite of this messy, slouchy, undone look that I think that we’ve all gotten very used to,” he observed.

What that means for the Kors business, where sales are still down about $600m from their 2016 peak of $4.7bn, is another matter. Although the Kors brand is classified as “luxury”, its bread and butter are tote bags priced at £250, not £2,000. That category is under heavy pressure at the moment, and a solid catwalk collection from Kors is unlikely to mitigate it.

Burberry

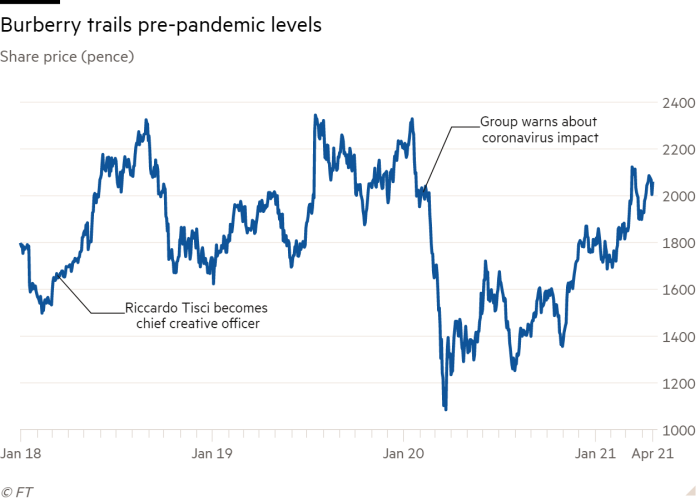

“I don’t believe people want to go simple,” says Riccardo Tisci, Burberry’s chief creative officer, of how we’ll want to dress post-pandemic. “People now have time to understand what they want, and what they want is to have things that are very special, that have emotion behind them, and quality . . . that make them look unique.”

For the first time since he joined the house in 2018, Tisci showed his women’s collection separately from men’s. And so his autumn/winter 2021 digital show was a full-blown celebration of femininity, opening with a close-up pan of the voluptuous British music artist Blane Muise, aka Shygirl, who had been transformed into a fertility goddess measuring several stories tall.

From between her legs (yup) walked models in clothes that riffed on archetypal images of femininity: woman as divine symbol, in fluid silk dresses printed with stars; woman as warrior, in glittering gold chainmail and boxy outerwear accented with regimental braid; and woman as “glamazon”, in cloud-like shearlings and lush striped furs that turned out to be faux. (Then there was the medieval headgear, which incongruously called to mind both nuns’ wimples and Crusaders’ helmets.)

While the deconstructed outerwear was thoughtful and well-executed — particularly a pair of knee-length black capes neatly fused to blazer fronts — the other looks, particularly the dresses, seemed to be lacking finesse and that “special” quality Tisci spoke of (at least from the limited view afforded from my laptop screen).

And so Burberry keeps chugging along, more than three years into a five-year turnaround that has been sorely disrupted by the pandemic. While shares in rivals LVMH, Kering and Hermès are trading at all-time highs, Burberry’s shares are still 11 per cent off their pre-pandemic peak. If investors were hoping for a creative boost to Burberry’s fortunes, this was not it.

Follow @financialtimesfashion on Instagram to find out about our latest stories first

Comments