ETF costs: what is an OCF or TER and why is it important to know?

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Owners of all funds, including exchange traded funds, have to pay ongoing fees just for owning them. It is important to know how much they are because research has shown that fees can significantly reduce returns over time.

This is the main reason regulators are keen for fund providers to be transparent about fees and to ensure they are comparable so investors can make informed choices about the funds they buy.

Charges are often referred to by their initials on fund information details. So investors should look out for figures such as the annual management charge (AMC), the ongoing charge figure (OCF), which is favoured in Europe, or the total expense ratio (TER).

What should investors look out for?

Regulators, such as the UK’s Financial Conduct Authority, have in the past drawn attention to poor marketing practices by some companies.

“Using the annual management charge in some marketing material and the ongoing charges figure in other documents may confuse investors and hinder their ability to compare charges,” it said in a 2014 review of practices.

The OCF includes the AMC, registration fee, custody safekeeping and transaction fees, audit fees and regulatory fees. Even this list of costs is not exhaustive. In addition to the OCF investors might also be charged other incidental costs.

Calculate the cost of hidden fees

Our calculator helps you work out how much difference fees can make to your returns

The TER is almost the same as the OCF and is the favoured measure for trying to express the costs investors will encounter in non-Ucits funds. The TER is calculated by dividing the total fund costs over a year by the total fund assets. The TER is also imperfect for representing the total costs an investor might face in that it might not include one-off charges or annual adviser fees.

How are the costs expressed?

The costs typically are expressed as a percentage of the assets invested. For example, an annual management charge of 0.5 per cent would mean an investor would pay $50 on a $10,000 investment each year. The charges are levied daily on a pro-rata basis.

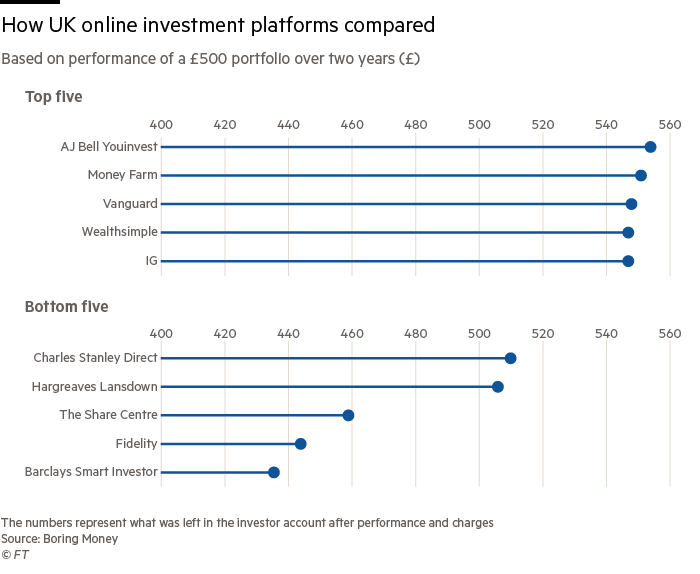

A Financial Times investigation a year ago showed how investing £500 over the previous two years in “medium risk” passive funds produced radically very different returns across a range of providers — costs were a factor. The chart below shows the returns.

There has been criticism by regulators of how costs are disclosed. The UK’s Financial Conduct Authority has implemented rules designed to improve transparency by requiring companies to publish costs and charges as cash amounts, as well as percentage figures.

Findings from an FCA investigation into investment charges, published in 2019, suggested these rules were not always being followed, however.

“In the first half of 2018, we found several examples of firms failing to incorporate cash equivalents in their [charges] disclosures. The situation improved in the second half of the year, but some firms still do not consistently include charges as both cash amounts and percentages,” the FCA wrote.

The regulator also criticised the practice of including cash equivalents of charges over short time periods and instead recommended that examples of what charges could amount to over longer time periods should be published.

The FCA also found examples of companies being inconsistent with cost disclosures depending on the stage of the “customer journey”.

“Some firms’ generic presale disclosure figures differed significantly from their tailored point-of-sale disclosures. This was particularly the case when they had left out investment product transaction costs from presale disclosures,” the report stated. “Firms must ensure information in marketing is consistent with any separate information they give customers”.

What other costs should ETF investors look out for?

There is much talk of a fees war in the world of ETFs and some ETFs even charge no management fees at all, but that does not mean that the investor will not incur some costs.

As well as keeping their eye on the OCF or TER, ETF investors need to keep an eye on the tracking difference of their ETF because the fund needs to buy and sell securities to maintain accurate replication of the underlying index.

In addition, ETF investors should look out for tax costs and the potential cost burden if investments are in another currency and its value moves in the wrong direction.

Click here to visit the ETF Hub

Comments