Investors look to exploit lucrative trade after US bitcoin ETF launch

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The launch of Wall Street’s first bitcoin exchange traded fund has created an opportunity for professional investors to make juicy profits on a simple bet, enabled by a lack of large players in the young crypto market.

The price of bitcoin powered to a new record this week as $1.2bn of new cash poured into the ProShares Bitcoin Strategy ETF in just three days, signalling voracious demand for the new investment fund that holds futures contracts that track the price of the cryptocurrency.

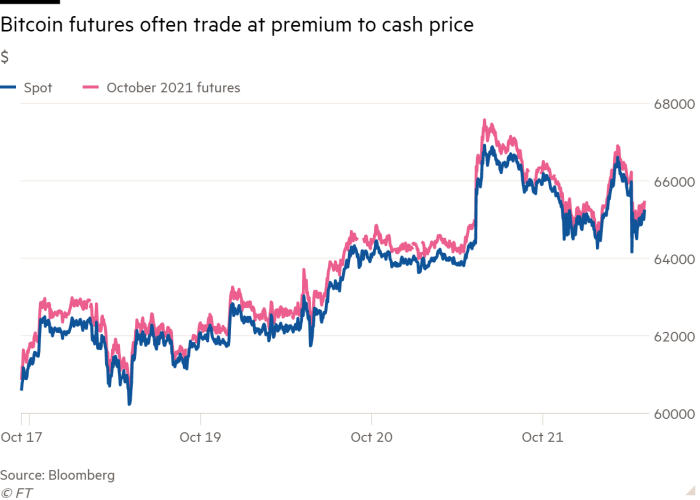

But those inflows and bitcoin’s new record price have also caught the eye of sophisticated traders looking to exploit the gap between the price of the coins themselves and that in futures markets.

The ProShares ETF is linked to the CME futures: as new money flows into the bitcoin ETF, the fund has to buy futures to gain exposure to the price of bitcoin. The futures contracts expire each month, meaning the fund must regularly “roll” its holdings into the next month’s contract.

The recent surge in demand has pushed up the price of near-term bitcoin futures, and nudged it out of sync with the underlying cash market — creating a gap between the two prices that trades can profit on.

“[The ETF] rolls the front month contract, so as flows come into the ETF, the contract is pushed higher, which widens the [difference between futures and cash prices],” said Michael Bucella, a partner at New York-based hedge fund BlockTower.

A “simple cash and carry trade” of buying bitcoin and selling futures that trade on the Chicago Mercantile Exchange provides an annualised return of about 30 per cent, said Stéphane Ouellette, chief executive and co-founder of Canadian hedge fund and broker FRNT.

In traditional markets, high-frequency traders move in quickly to close such price gaps for a profit, and the opportunity disappears. But a dearth of large players in the crypto industry means that there are few who are willing to deploy the additional capital required to erase pricing differences.

Trading on the CME is more expensive than other venues because the exchange has higher margin requirements.

“As is the thesis for many of the most successful trades in crypto, there are not enough sophisticated arb players to manage and police the spread,” said Ouellette, referring to arbitrage-focused trading strategies that take advantage of price differences across markets.

The opportunity to profit from this wager has been amplified by the fact that bitcoin is traded on a wide range of venues around the globe — meaning multiple prices are available to traders to buy coins in cash markets.

The knowledge that ProShares will roll its contracts means that traders reckon they can rely on a constant buyer in futures markets to push the price upwards.

Click here to visit the ETF Hub

Comments