Are trade rules stopping us from saving the planet?

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday to Thursday

Hello from Brussels. After a cold and rain-drenched summer and a September where the weather varied between the warm, dry season we’d missed and the tropical monsoons northern Europe isn’t supposed to have, the Brussels climate has now settled into its traditional pattern for the time of year, alternating “grey and raining” with “grey and about to rain”. Don’t expect too many updates with fresh developments over the next six months, much like negotiations at the WTO. With less than a month to go before the COP26 climate change summit in Glasgow, today’s main piece looks at the considerable potential for trade and climate to blow up into a big public fight between campaigners and governments.

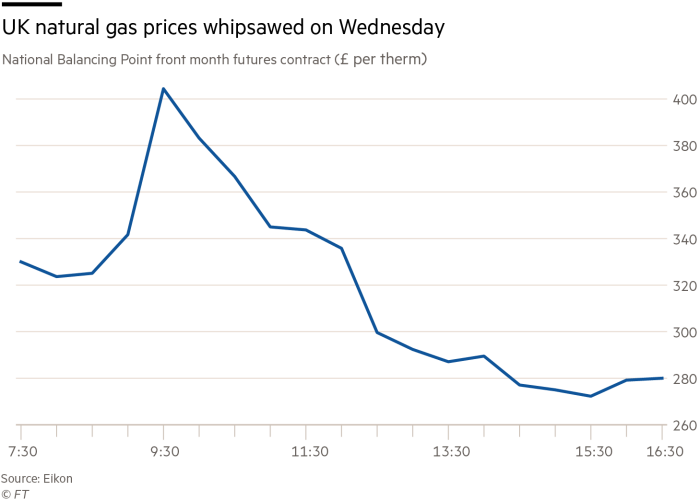

Charted waters looks at whipsawing prices for natural gas.

We want to hear from you. Send any thoughts to trade.secrets@ft.com or email me at alan.beattie@ft.com

Greens fought the law, and the law won

There’s a lot we need to say about the intersection of climate change issues with trade and globalisation, so we’re going to take it in pieces in the weeks coming. (Actually the months and years coming, come to think of it.)

Some parts are new policy measures and declarations, such as the EU’s carbon border adjustment mechanism or the collective statement that governments are trying to cobble together for the World Trade Organization ministerial in Geneva at the end of November. But there’s already plenty of tension in the system between government policies on climate change and existing trade rules. A lot of measures, such as the phasing out of fossil-fuel power generation, or government subsidies to encourage green technologies, are vulnerable to litigation at the WTO or, even more controversially, through investor-state dispute settlement (ISDS).

The expansion of new technologies often sets off a flurry of trade litigation as companies scramble to establish market dominance. This especially holds if someone can make a half-plausible argument that having domestic capacity in the new technology is a strategic asset and so governments start designing trade-distorting subsidies or procurement accordingly.

Green tech has created a lot of litigation — and high-profile arguments about trade defence measures — in the recent past. The manufacture of solar cells in particular provoked long and complicated struggles in the EU and US over antidumping and antisubsidy duties on imports from China, some of which ended up in litigation at the WTO which is still ongoing. Fees from cases on windpower equipment and e-bikes have also kept trade lawyers in the comfort to which they have become accustomed.

With issues like this you can, just about, argue either way from an environmentalist point of view. Chinese companies selling e-bikes into the EU said their products were cheaper and hence encouraged wider take-up, while European manufacturers (in our view mistakenly, but not absurdly so) said that having EU capacity in such a fast-expanding new field would be part of a transition to a green economy. Similarly, there was an important WTO case a decade ago where the EU and Japan won a ruling against Canada, specifically the province of Ontario, for requiring generators of renewable power to use a certain amount of locally made equipment to benefit from generous feed-in tariffs. Again: do we want the cheapest power generation right now or to create a critical mass of local technological capacity for the future? Debatable, just about.

More controversial, and in our view less defensible from the plaintiff’s point of view, is investor-state litigation. We’ve written before about the Energy Charter Treaty (ECT), an investment agreement with 54 signatories and contracting parties, including most EU member states individually and the EU collectively. Broadly drawn provisions on investor protection have encouraged volleys of litigation from companies that have lost out from governments phasing out fossil fuels and encouraging renewables. One of the latest and most controversial cases involves the German power companies RWE and Uniper suing the Netherlands over losses arising from its phaseout of coal-fired generation. Even those who generally support the principle of ISDS say the ECT embodies too crude and plaintiff-friendly a version of it.

But there’s been resistance to narrowing the ECT’s scope, particularly from Japan, which says that power generation is an investment like any other that needs protecting, and that policies involving renewable energy cannot simply be carved out entirely. Japan has for the first time itself become the target of an investor-state case on renewable energy, from a Hong Kong investor using a bilateral Japan-Hong Kong treaty, but that doesn’t seem to have changed its mind yet.

The European environmental and health campaigners who managed to make ISDS a public hate object during the Transatlantic Trade and Investment Partnership (TTIP) talks are trying similar tactics with the trading regime in the context of climate change. Ruth Bergan of the UK’s Trade Justice Movement, a campaign sharply critical of the current system of globalisation, says: “At minimum, we need to get rid of the investment court system that allows companies to sue countries for climate action and scrap the Energy Charter Treaty. But we also need to rethink other elements of the trade system.”

Campaigners inside the EU say similar. They want to protect climate change-related policies from litigation. But this creates tensions with other governments. A Japanese official told Trade Secrets that if the EU was going to make a case for a radical narrowing of the ECT’s scope based on positions determined by what the official termed “politically progressive” European campaigners, it seemed unlikely that Tokyo and EU governments would be able to agree on reform. “If the EU sticks to that idea, it will end up as a European treaty,” the official said.

That’s exactly the kind of tension between environmental policies and trade law that we’ve already seen. A previously obscure treaty is dragged out of anonymity into the brightly-lit path of a practised campaigning machine and trapped there by contrasts in approach between different governments. The interaction of climate change and trade rules is complex, varied and technical, but its serious potential to bring trade rules and ISDS under renewed public criticism seems pretty clear to us.

Charted waters

The threat of a natural gas shortage is looming across Europe and parts of Asia, with a cold winter expected to bring with it a surge in prices.

For anyone after a sense of just how spooked the industry’s getting, take a look at the chart. While this specific graphic shows what happened in the UK, the volatility was replicated across European markets.

Following a sharp rise early in the day, prices fell after Russian president Vladimir Putin signalled that he would be open to the idea of Gazprom raising supply.

Prices have fallen again this morning. However, we think there’s going to be plenty of volatility to come in the months ahead. Claire Jones

Trade links

A power crunch in India and China is threatening global growth.

Business organisations, think-tanks and trade unions all say UK prime minister Boris Johnson offered no real solution to Britain’s supply chain crisis when he spoke at his annual party conference yesterday.

Sixty-five of the WTO’s 164-member governments have concluded negotiations over a deal on regulation of domestic services ahead of the organisation’s ministerial conference at the end of November.

Japan’s Fair Trade Commission will investigate (Nikkei, $) whether Apple and Google are leveraging their dominance in the smartphone operating system market to eliminate competition and severely limit options for consumers.

Taiwan Semiconductor Manufacturing Co, better known as TSMC, said (Nikkei, $) it was working out how to protect sensitive client information while responding to a US request to disclose information on its supply chain. Alan Beattie and Francesca Regalado

Comments