The resilient mechanics within ARK ETFs

Simply sign up to the Exchange traded funds myFT Digest -- delivered directly to your inbox.

ARK is the investment fund and ETF provider that wants to believe in larger than life techno disruptive dreamscaping while ending up on the right side of change. (If not a Martian mount.)

Cynics, however, often dub it a bet on perpetual zero rates disguised as a fund management business.

In either guise, ARK’s founder Cathie Wood has become a prominent voice on financial TV networks, where she is often seen talking up the futuristic visions of enigmatic CEOs like Elon Musk while making off the chart projections for high-potential disruption stocks and bitcoin. All this is part of a global thematic investing strategy she herself pioneered.

Her ballsy take on the future has however also turned her into a favourite with Redditor meme-investing types. The fad famously shocked old time pros on Wall Street when it managed to take down GameStop shorts while simultaneously launching a thousand “who the hell are these punks?” editorials in the financial press and beyond.

But ARK’s bigger claim to fame these days is its role in popularising active ETF investing with retail investors on platforms like Robinhood.

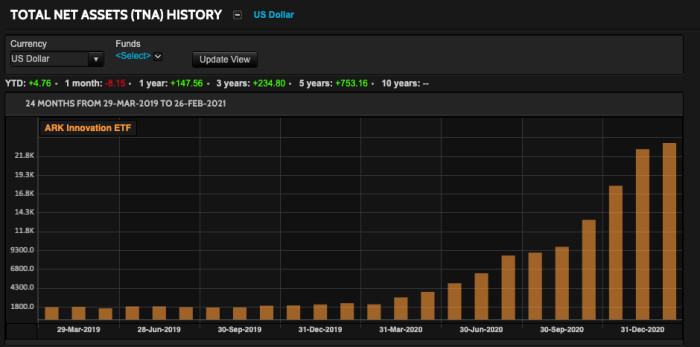

Among its best known products, most of which were launched in 2014, is the ARK Innovation Fund, whose assets under management broke out last May before going fully steroid in the fourth quarter of 2020. In recent weeks volumes have completely exploded, echoing a similar expansion in the trade of Tesla shares (which just happens to be one of the fund’s primary constituents).

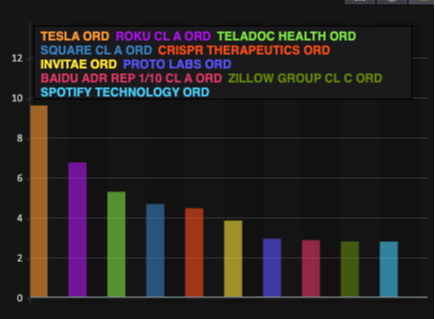

Here are its top holdings, via Reuters:

It’s worth noting that in January, inflows into the combined ARK funds tallied $8.2bn, outstripping flows into equivalent big name players like BlackRock and State Street.

Then came Tuesday last week, when for the first time in recent months the fund unexpectedly clocked a major reversal and a net redemption. Again, via Reuters:

Here, via Neil Campling at Mirabaud, was the damage done to the holdings the firm has more than a 10 per cent stake in on the following Thursday:

So what’s going on? Where is all the drama coming from? And how is it connected to meme investing, if at all?

A good place to start is with what the GameStop saga really taught us: if you’re short-in-size of an illiquid name in the market and everyone knows your position, a pile on by even small pocketed investors (if they can organise and gain momentum) can become a self-fulfilling circle of doom.

None of this is profoundly surprising.

What happened with GameStop, if you dissect it properly, is really not all that different to what happened with the USO oil fund ETF in the spring of 2020. In a similar vein, everyone knew USO’s position but also its limitations (in their case, it was the CFTC’s rules on position limits in futures contracts). The market piled in and pushed the fund to those limits, and in so doing exacerbated forces that were already sending crude to crazy sub-zero rates. And this was in oil futures. An exceptionally deep and liquid market.

But consider the risks in play when you combine meme-based investing, negative feedback loops and the transparency of active ETFs invested in illiquid names?

An obvious irony is revealed. While Redditors were busy congratulating themselves over their amazing discoveries about GameStop shorts, they may have completely missed the exposed structural shorts baked into some of their own favourite innovation ETFs.

Structural shorts in the ETF business

The key here is the fact that every ETF, passive or active, is dependent on entities known as Authorised Participants (APs) for its ability to keep its net asset value tracking its listed price on an exchange. These guys operate as dedicated arbitrageurs continuously buying and selling ETF units and the underlying stocks until the two markets coincide with each other.

In the course of providing these activities (and profiting from them), such entities also take on large amounts of intraday market risk. To offset that risk they will often engage in operational shorting or hedging, utilising either options and futures or de facto naked shorts facilitated by the market-making process. Much of this process is opaque and commercially sensitive.

What we do know is that with conventional ETFs, the passive nature of the funds often heightens the risk for ETF owners if unexpected constraints in the arbitrage system pop up. This is because it’s largely a forgone conclusion as to how a fund will respond to any pile-in exploiting the constraint. Such funds have clearly defined and predictable objectives — like an index — which must be tracked.

Even if a fund needs to change the make-up of its constituent basket in response to an issue, it must pre-warn the market it is about to do so. Since there are no surprises, APs and market makers who have not understood their risk (both in terms of price and liquidity) can on occasion find themselves in distress or, more frequently, in a position where they have to pass on the distress to the fund investors. This can happen directly in the form of deviations between the NAV and ETF’s price, and under or over performance versus their respective benchmark.

One of the interesting aspects of the USO saga, however, was that as the fund’s position limits kicked in, its fund managers were — in the face of continuing inflows — forced to become ever more active in terms of how they allocated those funds, pushing the ETF to the limits of its acceptable (and predictable) investing options and into ever less liquid securities. But even then, the objective of the fund was to track the oil index and all changes had to be pre-announced. (Although there is an inquiry into whether USO did in fact give enough warning.)

But active ETFs are different. They don’t track predictable indices. Nor do they pre-warn about their position changes in the same way. What’s more, the broader market is even less familiar with how such APs go about hedging or mitigating their intraday risk exposures.

What we do know is that a lot of ETFs, such as the ARK suite, are obliged to disclose their portfolio holdings on a daily basis. This transparency requirement has in previous years kept some big fund managers like Vanguard fearful of issuing equivalents due to concerns over how the visibility might encourage front-running.

But ARK’s COO, Tom Staudt, told FT Alphaville on Friday that he believed active ETFs may be better protected from pre-positioning and front-running risk, because unlike mutual funds, they benefit from APs’ capacity to absorb a lot of the risk.

“We don't bear the same execution requirement that you have with mutual funds. They hit the sell button that day in order to have the cash to meet the redemption,” he noted.

With APs present in the ETF redemption process, however, there are more mechanisms to absorb big one-sided flows. Authorised participants, Staudt noted, are often large broker-dealer banks who understand the mechanism of the ETF and have multiple options to work that flow into the market. The redemptions don’t have to happen all at once.

“They have the ability to hedge their book, they can close short positions that they themselves have on as market makers and they can close securities lending outstandings. Typically these are large banks. So they have large security lending books that they can use to cover those, they can work the trades over a number of days,” he said.

For context, here’s a little more from our conversation with Staudt on Friday (with our emphasis):

Because there are more participants, there are more options, relative to liquidating those shares back into the market, then a mutual fund, which has really one option. And that's to sell. Mutual funds that got in the most trouble, got in the most trouble because they unwound their most liquid positions first. Because they were having trouble with their illiquid stock. And they got to a point where their entire fund was the illiquid and that could not be redeemed. That does not happen here. This is very different. Partly because the redemptions are in kind. And partly because they're pro rata. So there's no unwinding of only the liquid part of the book first. And so, you know, some of the comparisons that have been drawn are really not fair. And they're not fair because they're not apples to apples. In the case of the ARK suite, there are 21 such APs contracted to providing creation and redemption services. Many are quite active and some are more strategic. And just like with passive ETFs, these APs are focused on pocketing arbitrage either from closing the differential between the ETF price and the underlying net asset value of the fund by delivering or redeeming component stocks in kind to the issuer, or by servicing market makers who wish to do so themselves.

One less talked about component of the arbitrage process is the data APs rely on to profitably execute their trades. These come in the shape of the basket composition files that ARKK is obliged to submit to the National Securities Clearing Composition (NSCC) on a daily basis to aid the arbitrage process. Usually these files, which are far more granular in detail than the conventional website holding disclosures, are submitted at the end of trade so that they are available to the AP’s for the next morning’s session. Staudt says there really is not a lot of lag between when the baskets are published and when the data is released publicly.

The important point is that APs will use hedging mechanisms (both operational shorts from market-making activities, balance sheet or derivatives) to manage their risk based on that data.

And certainly, in terms of NAV/price tightness on Tuesday, February 23, the process worked just as designed, says Staudt. There was no apparent distress. The ETF remained liquid at all times and there were no panic-stricken requests from APs for redemptions in cash instead of in kind.

To all extent and purposes, it seems, the APs absorbed the flows, either by passing them on direct to the market or by internalising them on to their own balance sheets, or offsetting them against broader hedges or alternative liquidations.

The bigger question is to what degree were APs compelled to keep providing liquidity to the ARK ETFs and absorbing their flows because of related hedging exposures which may or may not have been easy to close out. Such hedges, whether written as options or enacted as shorts, are much harder to detect through the system.

What we do know however is that according to S3 partners — a firm that tracks short positions in US equities — is that on February 17 total short interest in ARK ETFs had grown to $1.79bn in 2021 having previously averaged just $131m in 2020.

As S3 noted at the time, such shorts were badly hit in the rampant price run up at the beginning of the year possibly indicating exposure to some sort of negative feedback loop or squeeze-type phenomenon:

While there are technical trading reasons to short ETFs with such AUM and stock price growth in expectation of a price retracement, the reality is that by shorting into this ARK rally short sellers were down -94% of mark-to-market losses in 2020 and are already down -16.4% in 2021.

One last point to consider is the potential risk associated with the same institutions operating as ETF authorised participants and writing options on ARKK (and related stock constituents) to the big retail trading platforms. As this Twitter thread recounts there are some circular exposures that may have been under appreciated in such practice.

Related Links:

ARK Invest's effective Tesla model — FT Alphaville

Why chartcrime has destroyed the blockchain — FT Alphaville

Ark's Cathie Wood dismisses bubble talk and Tesla doubters — FT

Investors increase bets on Ark fund losing value — FT

Interested in ETFs?

Visit our ETF Hub for investor news and education, market updates and analysis and easy-to-use tools to help you select the right ETFs.

Comments