CBDCs must be coupled with greater accountability

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Martina Fraschini, Luciano Somoza and Tammaro Terracciano are PhD candidates at the Swiss Finance Institute. Here they explain why the implications of central bank digital currencies on the balance sheets of monetary guardians warrant closer scrutiny.

Since the great financial crisis of 2008, central bankers have become reassuringly powerful technocrats. Whether it is market turmoil, a pandemic, or even climate change and inequality, they always seem try to do something about it.

This omnipotence is possible thanks to their special power to create money out of thin air.

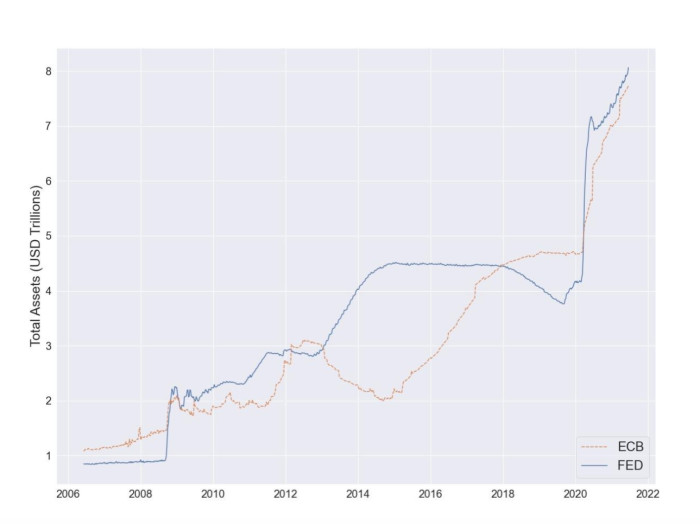

The effect of these interventions on the institutions themselves is quite evident from bloating of the European Central Bank’s and the Federal Reserve’s balance sheets over the past 15 years:

It’s not gone unnoticed. Questions are being asked. Who decides which assets to target? What do permanently low interest rates mean for public policy? Is the central bank monetising debt? It is difficult not to conclude then that, the bulkier balance sheet, the more politicised the central bank.

Soon, the size might increase even further.

The introduction of a central bank digital currency (CBDC) seems a matter of when not if. Its advocates highlight the technological advantages and argue that it could foster financial inclusion and smooth cross-border payments. While this is debatable, what we want to focus on here is what impact CBDCs would have on the balance sheet.

A CBDC would be the digital equivalent of cash, and it would function similarly from an accounting perspective. When a depositor withdraws $1,000 dollars in cash, her bank needs to purchase the banknotes from the central bank. To settle the transaction, the commercial bank pays the central bank with its reserves, which are reduced by $1,000 dollars. From the perspective of the central bank, this operation is neutral as one type of liability (reserves) is simply transformed into another (cash).

Things would be the same if, instead of cash, the depositor wanted to purchase CBDC. The bank would reduce its reserves, while the central bank would credit the depositor on their personal CBDC account. So far so good.

The key distinction between cash and CBDC is the size of your pockets. The demand for cash is hardly a concern; it is impractical and dangerous to hoard large amounts of banknotes. However, physical limits do not apply to digital dollars. If a significant fraction of deposits were converted into CBDC, and banks did not have enough reserves, any additional digital dollars created would imply an increase in the size of the central bank’s balance sheet.

Let’s make some back-of-the-envelope calculations.

In the US there are $17.2tn of bank deposits. The Fed, meanwhile, has $8tn-worth of liabilities, of which $3.9tn are bank reserves and $2.2tn are banknotes. It is reasonable to assume that banks would still want to keep hold of some reserves and that some cash would remain in circulation. So let’s say the system could handle up to $4.5tn of CBDC deposits (or a little over 25 per cent of bank deposits) without a major impact on the size of the balance sheet.

If the demand for CBDC is lower than 25 per cent of bank deposits, we would only see a transfer of bank reserves and banknotes into CBDC. Commercial banks might even welcome such a transfer, as deposits are costly to manage, and reserves pay very little interest. However, this changes the type and the number of counterparts the central bank would have to deal with, as millions of retailer depositors are rather different than a handful of banks. In case the central bank decided to revert its expansionary policies and taper its balance sheet, it would face millions of small inelastic retailers. This would complicate things quite a bit. The design of a CBDC could lessen, but not substantially change, the mechanism described. Even with commercial banks distributing the CBDC, there would be millions of retailers with a claim on the central bank.

If the demand for CBDC is higher than 25 per cent of bank deposits, the situation would be different. Once reserves and banknotes are absorbed, the banking sector would be under stress as it would have to liquidate other assets to transfer deposits. At this point, the Fed’s balance sheet size would increase with every additional unit of CBDC. In the extreme scenario where all deposits end up in CBDC, the Fed’s balance sheet would more than double its size. The central bank would also have to decide what to hold against these deposits. Treasuries and corporate bonds? That would push interest rates further down and make the government even more dependent on Fed funding. Bank debt? The idea of returning the money to the banks can be appealing, but who would decide which banks to fund? At which conditions? The central bank would inevitably end up picking winners and losers.

Either way, monetary policy would drastically change. The central bank would have a closer link to people’s wallets, with less intermediation by the private banking sector than there now is. It could easily implement all kind of monetary experiments, like helicopter money or deep negative rates direct to the people. In other words, the central bank would acquire even greater monetary superpowers.

And, like Spiderman, they must be aware that with great power, comes great responsibility.

CBDCs call for a deep rethinking of central bank’s mandates, independence and, ultimately, accountability. In his 1968 essay on central banks, The role of monetary policy, Milton Friedman pointed out the risks of splitting macroeconomic policy among multiple decision makers, as this would lead to a “dispersal of responsibility, which promotes shirking responsibility in times of uncertainty and difficulty…”. This concern is very real. It is perhaps no surprise that in this environment, the most recent former heads of the ECB and the Fed, Mario Draghi and Janet Yellen, now both hold political office. A strong, proactive central bank is the perfect alibi for the government. In bad times, the government can avoid taking responsibility, as the central bank steps in and saves the day. In good times, the government has no pressure for doing reforms, and nothing gets done. The long-run effect is arguably over-indebtedness, inequality, a dependence on asset prices and a constant quest for new and more powerful monetary tools.

With great power, should come great accountability. A central bank with monetary superpowers, that directly guarantees people’s savings, that targets climate change and social justice, and whose former heads are involved in active politics, is not a dull technocratic body any more. Enthusiasm for new technologies should not hijack the debate about CBDCs; there are serious implications for financial stability and social welfare from taking such a step. In such circumstances it is vital that we ask deeply whether launching officially-endorsed digital money is truly consistent with central bank independence and the public interest at large.

Comments