Luxury sector set to contract by a fifth in 2020 as pandemic dents demand

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The coronavirus crisis has decimated demand for luxury goods and exposed the sector’s reliance on Chinese tourists, forcing high-end brands from Dior to Prada to find new ways to woo customers and accelerating a shift to ecommerce.

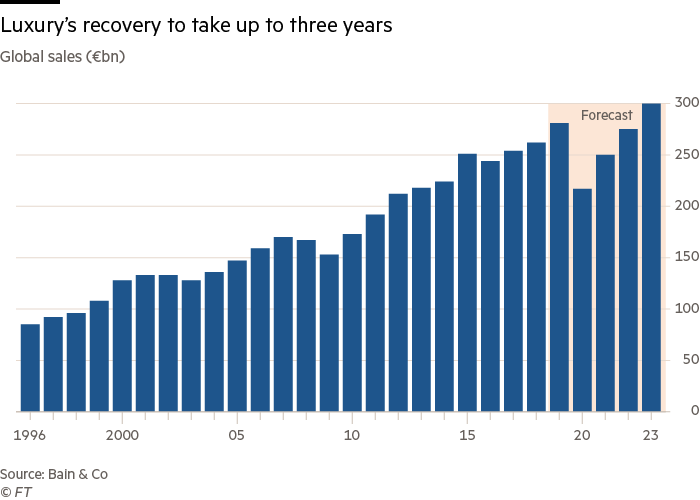

As a result, sales are set to contract 22 per cent this year to reach €217bn globally, representing a return to 2014 levels, and they will take up to three years to recover, according to a study by consultancy Bain and Altagamma, the Italian luxury association.

Claudia D’Arpizio, a partner at Bain, estimated that two-thirds of the sector’s operating profit “will disappear in 2020”, with variation between companies that cut costs quickly and those that did not.

“It is clear that this year will be the biggest drop ever for the industry, and some trends such as online commerce and reducing the reliance on tourists are fast forwarding versus what would have happened without the crisis,” she said. “A full recovery will happen between mid-2022 and 2023 depending on wider macroeconomic factors.”

After several months of lockdowns forced store closures in the spring, a recent surge of infections in the US and Europe has prompted further restrictions on retail in countries such as France, the UK, and Austria.

That has cast a shadow over the Christmas shopping season, which will have outsized impact on luxury companies since the fourth quarter typically generates about a third of annual sales. Bain said it was hard to predict the impact; it forecast a 5 per cent drop year-on-year in the fourth quarter as the best-case scenario, or a 20 per cent decline as the worst.

The curbs have prompted some brands to be more creative in how they target consumers. Louis Vuitton in France allows buyers to make an appointment with a sales clerk to purchase over the phone or via video chat, and then offers free delivery and returns. The industry’s focus on the most reliable, big-spending customers is becoming more pronounced in the current downturn.

The pandemic has also favoured industry leaders LVMH, Kering and Richemont, which bring many brands under one group and had already heavily invested in online selling and marketing. Meanwhile, smaller brands such as Salvatore Ferragamo and Tod’s that had less digital savvy and relied more on physical retail outlets have suffered.

A recovery is expected to be led by Chinese consumers, who will account for almost half of global spending on luxury goods by 2025, up from a third in 2019, according to Bain-Altagamma.

In anticipation of this, brands are rushing to open more stores in China and expand their online offering on platforms such as Alibaba’s T-Mall Luxury Pavilion. They are increasingly ramping up their presence in the domestic Chinese market to cater to consumers who are unable to visit flagship stores on Park Avenue in New York or the Champs Elysées in Paris amid travel restrictions.

A recent deal between Alibaba and Richemont to invest $1.1bn in online fashion platform Farfetch to expand in ecommerce in China shows how the pandemic is accelerating the shift of the industry’s centre of gravity to Asia and making digital selling much more important.

“Chinese consumption has been roaring across channels, categories and price points, driven largely by young people in Gen Z,” said Ms D’Arpizio. “They will drive the recovery next year mostly in China but also abroad if the vaccines help open up travel.”

Comments