Japanese investors buy UK government bonds at record rate in early 2021

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Japanese investors snapped up UK government bonds at the quickest pace on record at the start of 2021 as fading Brexit risks removed a barrier to investment in British assets.

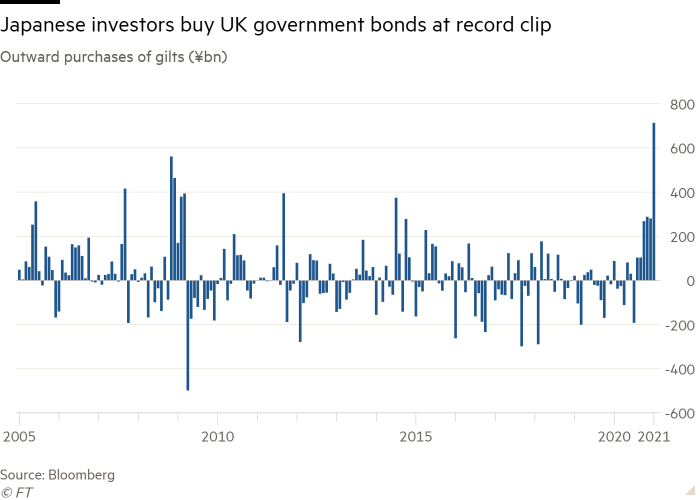

Data from Japan’s ministry of finance released this week showed investors purchased ¥714bn (£5bn) of UK gilts on a net basis in January, the biggest monthly figure in Bloomberg records dating back to 2005.

The buying spree reflects investment managers boosting the share of UK gilts in their portfolios following the UK-EU trade agreement struck on Christmas Eve, after shying away from British bonds throughout the turbulent Brexit process over fears of sharp moves in sterling.

“Confidence rose that Brexit uncertainty was behind us,” said Derek Halpenny, head of research for global markets at Japanese bank MUFG. He said the large inflows showed investors returning to a “more normal balance” of gilts after a “long period of under investment”.

Japanese investors were net sellers of gilts during the period from the Brexit referendum in 2016 through to the end of 2020, which Halpenny said was “very unusual”.

Hideki Kishida, senior economist at Nomura, said Japanese investors had been underweight gilts because they did not want to take on currency risk. The pound moved dramatically in wake of the 2016 referendum and endured numerous bouts of volatility around UK-EU negotiations in the years that followed.

Kishida said the January purchases probably showed pension funds and life insurers were expecting the pound to strengthen.

Rising gilt yields, prompted in part by diminishing expectations the Bank of England will deploy negative interest rates, may now provide another boost. While higher yields are negative for current holders of UK sovereign bonds because they indicate prices have fallen, they mean new investors are able to garner juicier returns from holding the debt.

Foreign government debt is a popular choice for Japan’s vast life insurance and pensions sector, since many international jurisdictions offer higher returns relative to low or even negative yielding Japanese sovereign bonds.

Japan’s foreign investment report is closely followed as it is one of few countries that provides detailed and timely indications of where its savers have placed their money.

“The Brexit deal at the end of last year has likely boosted foreign investor confidence in UK assets,” said Imogen Bachra, European rates strategist at NatWest Markets, adding that the sudden rise in Japanese purchases pointed to Brexit being “quite a strong” driver the inflows.

Adam Cole, chief currency strategist at RBC Capital Markets, added the surge of buying in January partly reflected “pent-up demand being released after the UK-EU trade deal”.

The inflows came shortly before February’s sharp sell-off in global government bond markets, including in gilts, where 10-year British bonds suffered their biggest decline since 2016. MUFG’s Halpenny said investors who bought in January were likely to hold on for the longer term. “I’d be surprised if this was reversed in February,” he said.

UK gilts have seen strong demand from overseas buyers throughout the pandemic, according to Daniela Russell, head of UK rates strategy at HSBC, who cautioned against drawing conclusions from one month’s data. She said political risk is a factor in international flows alongside currency and yields.

Overseas investors hold just over a quarter of UK gilts and are expected to remain a key source of financing for the country as it aims to raise £296bn in the financial year beginning next month.

Traders unwind negative interest rate bets

Expectations that the Bank of England will need to deploy negative interest rates to prop up the UK economy have evaporated as the country’s economic outlook has brightened.

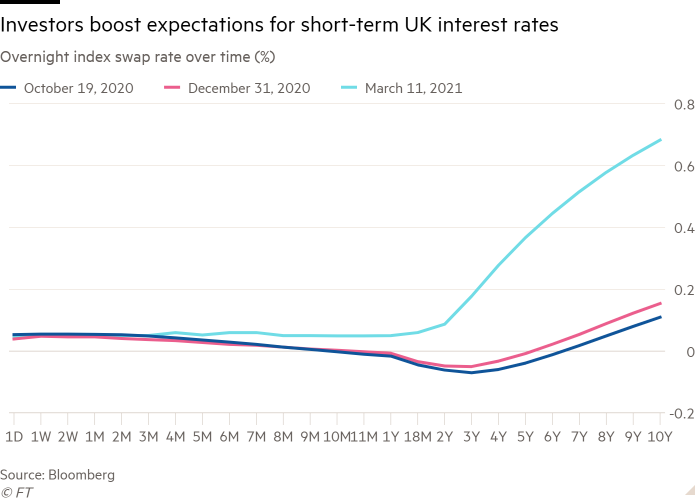

Overnight index swaps, a key proxy for the market outlook for the BoE’s main interest rate, are now in positive territory for the next several months and years.

Last autumn, when Brexit and coronavirus worries were swirling, these financial instruments suggested traders were bracing themselves for the chance that policymakers would reduce interest rates below zero for the first time in the bank’s history.

Analysts and investors say the UK-EU trade deal reached late last year and the quick progress the UK is making on vaccinations has helped bolster the outlook for Britain’s economy.

Goldman Sachs recently increased its expectations for long-term UK interest rates as well, citing the “expansionary nature” of the Budget announced earlier this month by chancellor Rishi Sunak. Barclays economists similarly upgraded their near-term UK economic forecasts following the Budget, pointing to projections for a “faster and more convincing recovery” from the pandemic.

The $1.9tn US stimulus package has provided a further boon to the outlook since a quicker recovery in the American economy is expected to ripple out to trading partners across the world.

Adam Samson

Comments