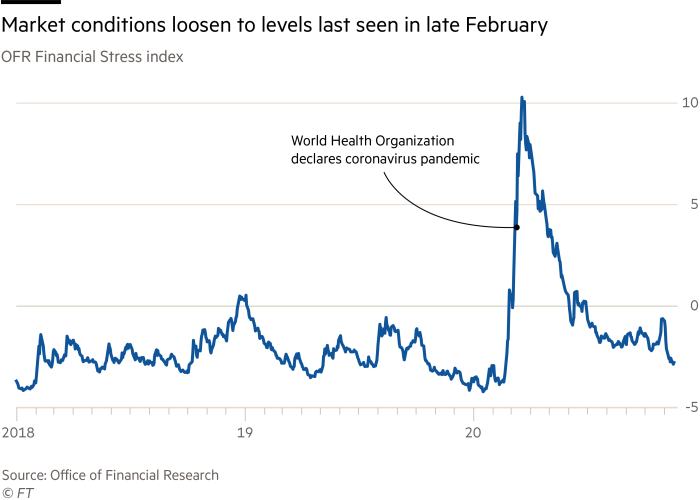

Financial conditions loosen to levels hit before Covid roiled markets

Simply sign up to the Capital markets myFT Digest -- delivered directly to your inbox.

Global financial conditions have eased to levels seen before the coronavirus crisis rocked markets in March, reflecting central banks’ success in soothing investor jitters.

A measure of financial stress compiled by the US Treasury department has dropped to roughly minus 3, the lowest level since late February. It peaked at 10 in the midst of March’s financial-market tumult. The ructions embroiled the US Treasury market, the world’s largest and most important bond market, and rippled across the globe.

Financial conditions are key for policymakers since markets provide essential lubrication for the broader economy. A sharp tightening, such as the one seen during the 2008-09 financial crisis, can chill business activity and ultimately contribute to declines in output.

Equity markets have bounded back since March, sending the S&P 500 to new highs in recent weeks, something that has helped to loosen conditions further. Investors have also clamoured to hold risky corporate debt, reducing borrowing costs, even as selling in Treasuries has pushed yields in that market higher.

The financial conditions index tracks corporate credit spreads, equity and safe haven valuations as well as measures of funding stress and volatility. A negative reading means financial stress levels are below average.

Investors have pointed to the US Federal Reserve, in particular, for engineering a robust recovery. Through a series of emergency interest rate cuts, a pledge to buy an unlimited quantity of government debt and the use of numerous lending facilities — among other measures — the Fed quickly stabilised the financial system in March and unfroze debt markets that businesses and state and local governments depend upon to meet their funding needs.

“It is all about the Fed,” said Patrick Leary, chief market strategist and senior trader at Incapital. “The Fed has been the main driver pushing [financial conditions] to these levels.”

Coronavirus business update

How is coronavirus taking its toll on markets, business, and our everyday lives and workplaces? Stay briefed with our coronavirus newsletter.

The Treasury department last week chose not to extend several emergency lending facilities that were put in place by the Fed this spring. The move prompted a rare public expression of disappointment from the Fed, which warned that the economy remained “strained and vulnerable”. It also unsettled some market analysts, who said the existence of the schemes provided important reassurance that policymakers were ready to intervene if markets became excessively unruly.

Still, some policymakers have raised concerns that in rescuing the financial system and propping up the recovery, the Fed may also be encouraging undue risk-taking.

“Aggressive policy actions may have changed private sector expectations of central bank actions in the future,” wrote members of the Financial Stability Board in a recent report. “This could lead to moral hazard issues in the future, to the extent that markets do not fully internalise their own liquidity risk in anticipation of future central bank interventions in times of stress.”

Latest coronavirus news

Follow FT's live coverage and analysis of the global pandemic and the rapidly evolving economic crisis here.

Comments